Huaming Power Equipment Co.,Ltd (SZSE:002270) Stock Rockets 28% As Investors Are Less Pessimistic Than Expected

Huaming Power Equipment Co.,Ltd (SZSE:002270) shares have continued their recent momentum with a 28% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 96% in the last year.

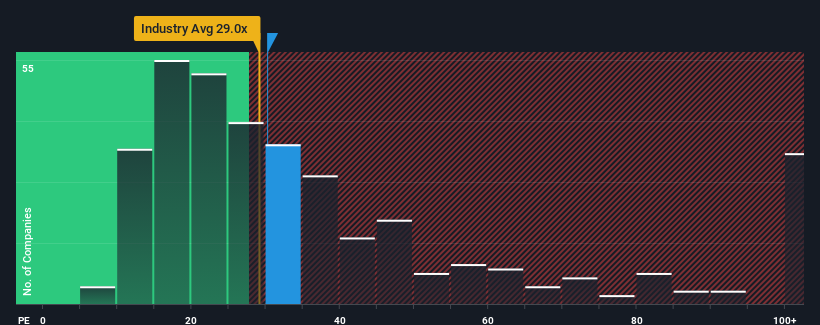

Even after such a large jump in price, it's still not a stretch to say that Huaming Power EquipmentLtd's price-to-earnings (or "P/E") ratio of 30.2x right now seems quite "middle-of-the-road" compared to the market in China, where the median P/E ratio is around 30x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Huaming Power EquipmentLtd certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. One possibility is that the P/E is moderate because investors think the company's earnings will be less resilient moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

See our latest analysis for Huaming Power EquipmentLtd

Is There Some Growth For Huaming Power EquipmentLtd?

The only time you'd be comfortable seeing a P/E like Huaming Power EquipmentLtd's is when the company's growth is tracking the market closely.

Taking a look back first, we see that the company grew earnings per share by an impressive 54% last year. Pleasingly, EPS has also lifted 44% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the seven analysts covering the company suggest earnings should grow by 21% over the next year. With the market predicted to deliver 42% growth , the company is positioned for a weaker earnings result.

In light of this, it's curious that Huaming Power EquipmentLtd's P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Key Takeaway

Its shares have lifted substantially and now Huaming Power EquipmentLtd's P/E is also back up to the market median. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Huaming Power EquipmentLtd currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Before you settle on your opinion, we've discovered 1 warning sign for Huaming Power EquipmentLtd that you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Huaming Power EquipmentLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002270

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives