- Japan

- /

- Auto Components

- /

- TSE:7229

3 Leading Dividend Stocks Yielding Up To 7.5%

Reviewed by Simply Wall St

As global markets navigate a mixed economic landscape, with U.S. consumer confidence declining and European stocks experiencing modest gains, investors are increasingly turning their attention to stable income-generating opportunities like dividend stocks. In this environment of fluctuating indices and economic indicators, identifying leading dividend stocks that offer attractive yields can provide a reliable source of returns while potentially mitigating some market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.02% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.31% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.61% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.42% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.83% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.68% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.08% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.82% | ★★★★★★ |

Click here to see the full list of 1943 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

illimity Bank (BIT:ILTY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: illimity Bank S.p.A. operates in Italy, offering private banking, investment, and trading services with a market cap of €272.95 million.

Operations: illimity Bank S.p.A. generates revenue through its Corporate Banking (€82.60 million), Specialised Credit (€62.20 million), Investment Banking (€15.70 million), and B-Ilty (€15.60 million) segments, while its Digital segment reported a negative contribution of -€44.20 million.

Dividend Yield: 7.6%

illimity Bank's dividend yield is among the top 25% in Italy, with a payout ratio of 34.5%, indicating well-covered dividends. However, it has only paid dividends for two years, raising concerns about long-term reliability. The bank's high level of non-performing loans (13.9%) and recent decline in net income may impact future payouts despite current coverage forecasts being favorable at a 19.8% payout ratio in three years.

- Get an in-depth perspective on illimity Bank's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that illimity Bank is trading behind its estimated value.

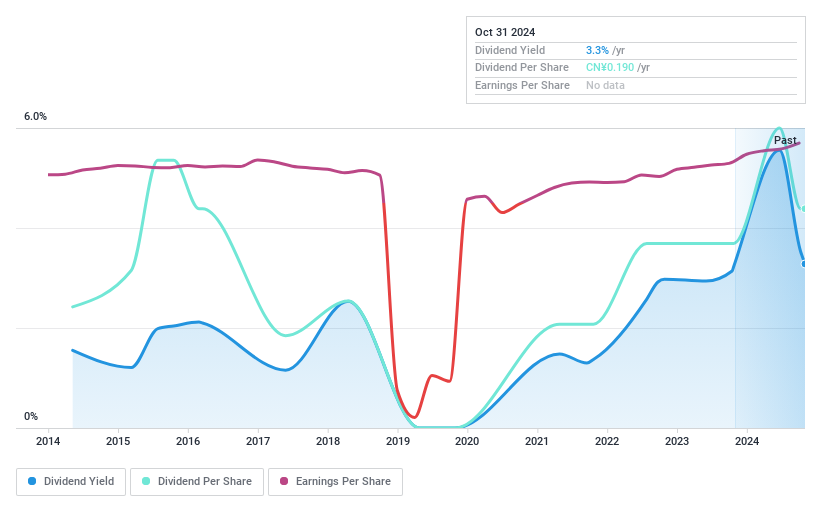

Zhongshan Broad-Ocean Motor (SZSE:002249)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Zhongshan Broad-Ocean Motor Co., Ltd. operates in the motor systems business in China and has a market capitalization of CN¥14.69 billion.

Operations: Zhongshan Broad-Ocean Motor Co., Ltd. generates revenue through its motor systems business in China.

Dividend Yield: 3.1%

Zhongshan Broad-Ocean Motor's dividends are well-covered by earnings and cash flows, with a payout ratio of 59.5% and a cash payout ratio of 30.3%. Despite trading at 47.4% below estimated fair value, its dividend history is marked by volatility over the past decade. Recent earnings growth of CNY 670.59 million for the first nine months suggests financial stability, though dividend reliability remains questionable due to historical inconsistency in payments.

- Delve into the full analysis dividend report here for a deeper understanding of Zhongshan Broad-Ocean Motor.

- Our valuation report here indicates Zhongshan Broad-Ocean Motor may be undervalued.

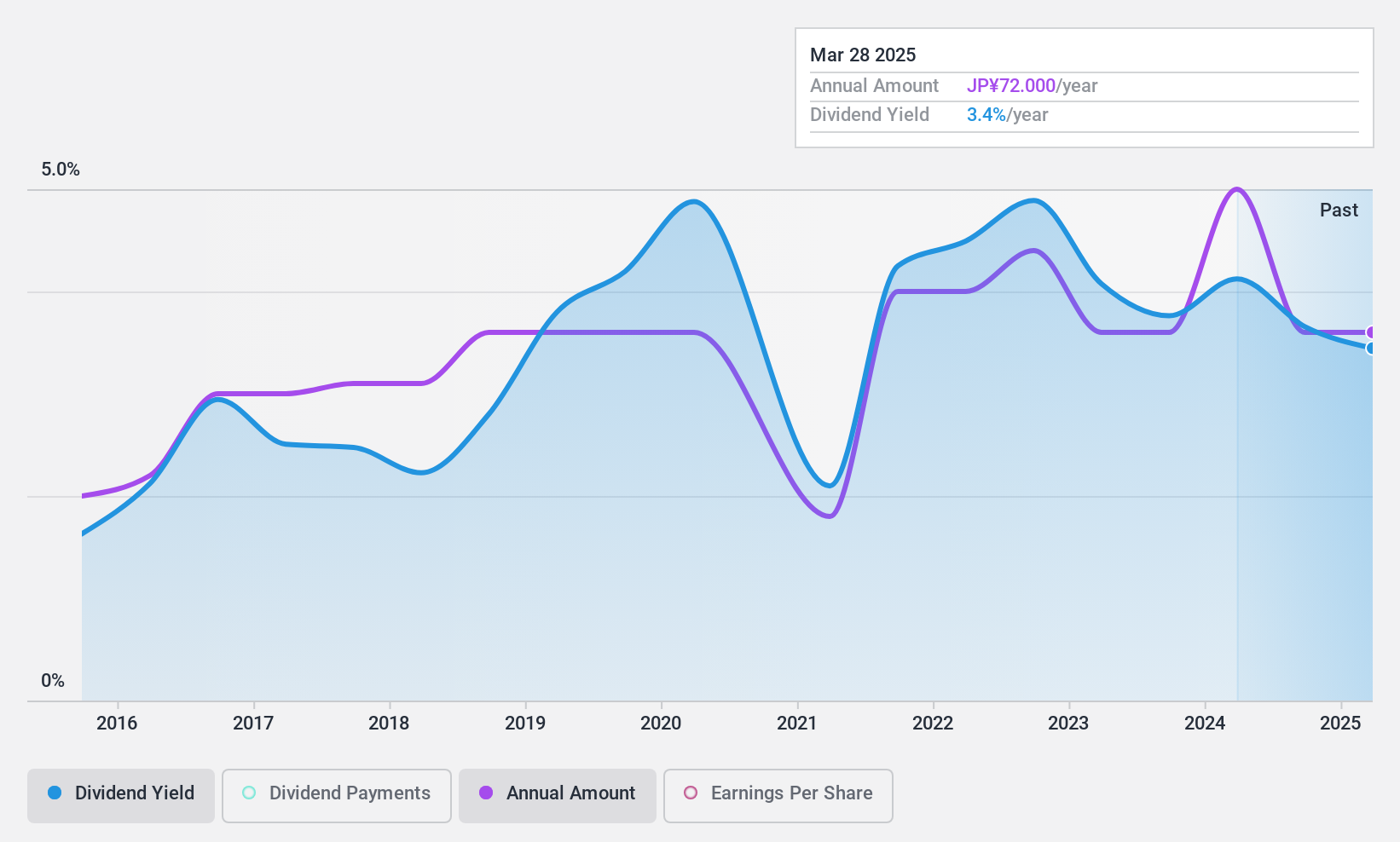

Yutaka GikenLtd (TSE:7229)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yutaka Giken Co., Ltd. manufactures and sells automobile parts across Japan, North America, China, Asia, and internationally with a market cap of ¥30.96 billion.

Operations: Yutaka Giken Co., Ltd.'s revenue is primarily derived from its operations in North America (¥71.10 billion), China (¥65.04 billion), Asia (¥36.30 billion), and Japan (¥43.07 billion).

Dividend Yield: 3.4%

Yutaka Giken Ltd.'s dividends are securely covered by earnings and cash flows, with a payout ratio of 19.7% and a cash payout ratio of 13.1%. Trading at 51.2% below estimated fair value, the stock presents potential value for investors. However, its dividend history is marked by volatility and unreliability over the past decade, despite an increase in payments during this period. The upcoming Q2 2025 results may provide further insights into its financial health.

- Click here to discover the nuances of Yutaka GikenLtd with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Yutaka GikenLtd shares in the market.

Key Takeaways

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 1940 more companies for you to explore.Click here to unveil our expertly curated list of 1943 Top Dividend Stocks.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7229

Yutaka GikenLtd

Manufactures and sells automobile parts in Japan, North America, China, Asia, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives