As global markets navigate a landscape marked by geopolitical tensions, tariff concerns, and fluctuating consumer sentiment, major indices have experienced volatility with the S&P 500 reaching record highs before retreating due to economic uncertainties. In this environment of shifting market dynamics, identifying stocks with strong fundamentals and resilience to external pressures can be key for investors seeking potential opportunities in lesser-known companies.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Goldiam International | 0.67% | 12.04% | 14.02% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Force Motors | 8.95% | 26.62% | 61.62% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| Bharat Rasayan | 5.93% | -0.16% | -5.78% | ★★★★★★ |

| Rir Power Electronics | 21.19% | 21.54% | 38.94% | ★★★★★☆ |

| Jamuna Bank | 85.07% | 7.37% | -3.87% | ★★★★☆☆ |

| Nibe | 30.41% | 78.22% | 83.19% | ★★★★☆☆ |

| Western Carriers (India) | 34.72% | 9.79% | 14.42% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

NICE Information Service (KOSE:A030190)

Simply Wall St Value Rating: ★★★★★☆

Overview: NICE Information Service Co., Ltd. operates in South Korea, offering credit evaluation, inquiries, investigations, and debt collection services with a market capitalization of approximately ₩725.95 billion.

Operations: The company generates revenue primarily from corporate and personal credit information services, which contribute ₩432.83 billion, and debt collection services, adding ₩71.50 billion.

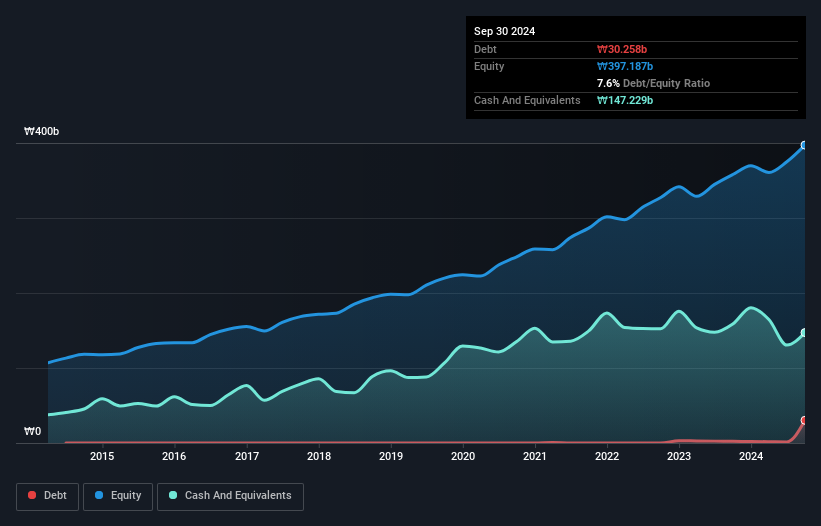

NICE Information Service, a smaller player in the financial landscape, has demonstrated notable earnings growth of 30.5% over the past year, outpacing the Professional Services industry's -8.7%. Trading at 30.1% below its estimated fair value suggests it offers good relative value compared to peers and industry standards. The company maintains a healthy balance sheet with more cash than total debt and a manageable debt-to-equity ratio increase from 0% to 7.6% over five years. Recent share repurchases totaling KRW 5,947 million indicate strategic capital management aimed at enhancing shareholder value without straining resources.

Zhejiang grandwall electric science&technologyltd (SHSE:603897)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Zhejiang Grandwall Electric Science & Technology Co., Ltd. engages in the research, development, production, and sale of electromagnetic wire products both domestically in China and internationally, with a market capitalization of CN¥4.86 billion.

Operations: The company generates revenue primarily through its manufacturing segment, which brought in CN¥12.39 billion. It has a market capitalization of CN¥4.86 billion.

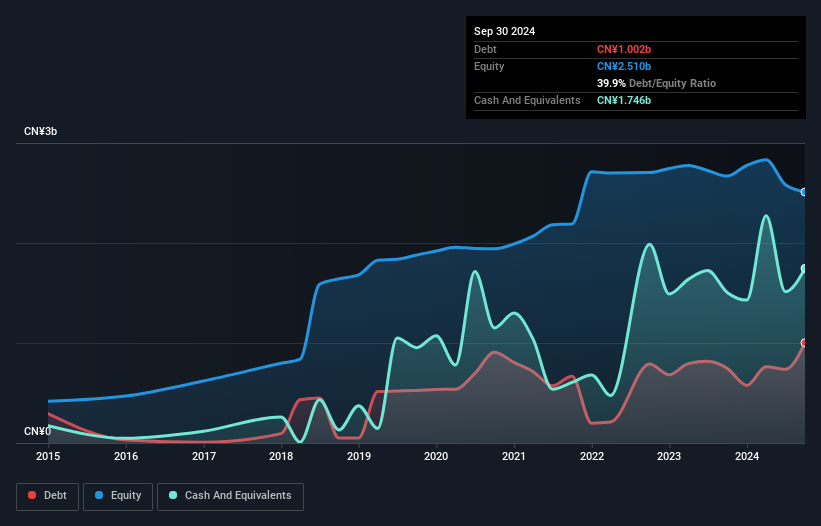

Zhejiang Grandwall Electric, a smaller player in the electrical sector, has shown impressive growth with earnings surging by 97% over the past year, outpacing the industry's modest 0.8% rise. The company trades at roughly 5.4% below its fair value estimate, indicating potential undervaluation. Despite an increase in its debt to equity ratio from 28% to nearly 40% over five years, it holds more cash than total debt and boasts strong interest coverage at 14 times EBIT. Non-cash earnings are high quality, suggesting robust underlying performance despite fluctuating free cash flow figures recently reaching US$729 million positive as of March 2024.

Guangzhou Tech-Long Packaging MachineryLtd (SZSE:002209)

Simply Wall St Value Rating: ★★★★★★

Overview: Guangzhou Tech-Long Packaging Machinery Co., Ltd. specializes in the manufacturing of packaging machinery and has a market capitalization of CN¥2.18 billion.

Operations: Tech-Long generates revenue primarily from the sale of packaging machinery. The company reported a gross profit margin of 28.5% in the latest period, reflecting its pricing strategy and cost management within its manufacturing operations.

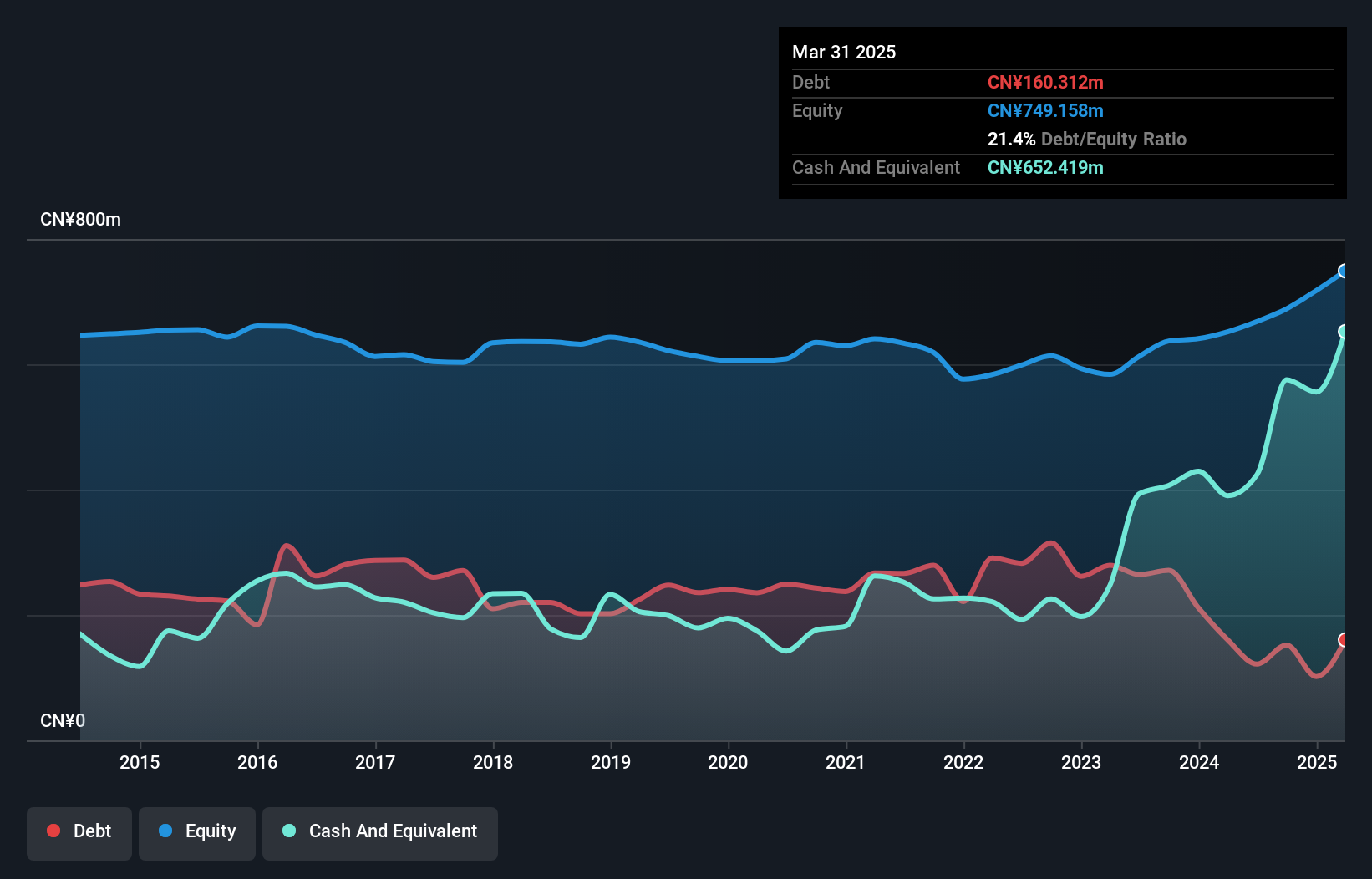

Guangzhou Tech-Long, a compact player in the packaging machinery sector, showcases notable financial health with earnings growth of 15.9% last year, outpacing the industry average of -0.4%. Its debt to equity ratio has impressively decreased from 38.5% to 22.1% over five years, reflecting prudent financial management. The company's interest payments are comfortably covered by EBIT at a multiple of 359 times, indicating strong operational performance and stability in meeting obligations. Trading at a significant discount of 57% below estimated fair value suggests potential upside for investors seeking undervalued opportunities within this niche market segment.

- Take a closer look at Guangzhou Tech-Long Packaging MachineryLtd's potential here in our health report.

Learn about Guangzhou Tech-Long Packaging MachineryLtd's historical performance.

Next Steps

- Explore the 4758 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002209

Guangzhou Tech-Long Packaging MachineryLtd

Guangzhou Tech-Long Packaging Machinery Co.,Ltd.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives