Zhang Jia Gang Freetrade Science&Technology GroupLtd And 2 Other Undiscovered Gems In Asia With Strong Fundamentals

Reviewed by Simply Wall St

As global markets navigate a landscape marked by trade uncertainties and mixed performances across major indices, smaller-cap stocks have shown resilience, with indexes like the S&P MidCap 400 and Russell 2000 posting gains despite broader market challenges. In this context, identifying stocks with strong fundamentals becomes crucial for investors seeking stability and potential growth in the Asian market.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 9.41% | 15.39% | 13.20% | ★★★★★★ |

| Central Forest Group | NA | 5.93% | 20.71% | ★★★★★★ |

| Wuxi Chemical Equipment | NA | 12.65% | 0.91% | ★★★★★★ |

| Namuga | 14.80% | -3.26% | 30.46% | ★★★★★★ |

| YagiLtd | 38.98% | -8.93% | 16.36% | ★★★★★☆ |

| Chongqing Machinery & Electric | 25.60% | 7.97% | 18.73% | ★★★★★☆ |

| Shanghai Chlor-Alkali Chemical | 9.56% | 7.12% | 1.55% | ★★★★★☆ |

| Shanghai Pioneer Holding | 5.59% | 4.81% | 18.86% | ★★★★★☆ |

| Pizu Group Holdings | 48.10% | -4.86% | -19.23% | ★★★★☆☆ |

| Fengyinhe Holdings | 0.60% | 38.63% | 65.41% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Zhang Jia Gang Freetrade Science&Technology GroupLtd (SHSE:600794)

Simply Wall St Value Rating: ★★★★★★

Overview: Zhang Jia Gang Freetrade Science & Technology Group Co., Ltd. operates through its subsidiaries in the loading, unloading, and storage of petrochemical products in China, with a market capitalization of approximately CN¥6.05 billion.

Operations: The company's primary revenue streams include Supply Chain Services (CN¥381.44 million) and Liquefied Storage (CN¥232.25 million), with significant contributions from Smart Logistics (CN¥218.51 million). The diverse service offerings highlight its focus on logistics and storage solutions within the petrochemical sector.

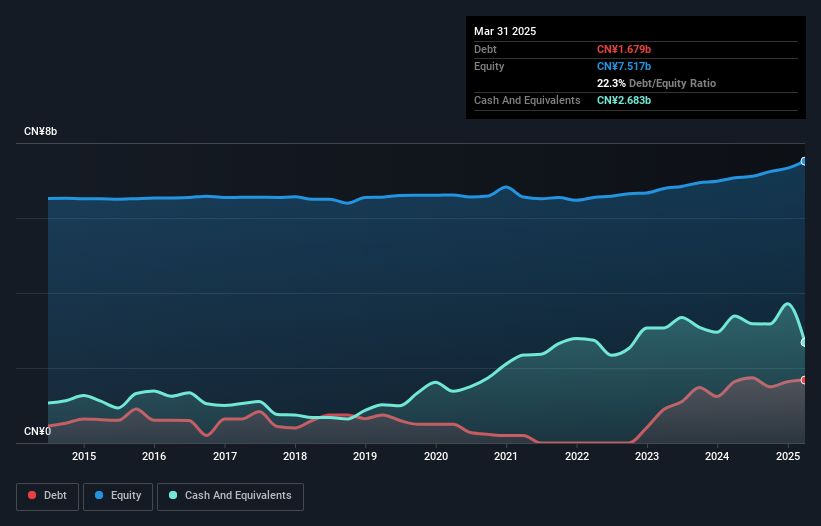

Zhang Jia Gang Freetrade Science & Technology Group, a smaller player in the market, has demonstrated impressive financial discipline with its debt to equity ratio dropping from 17.3% to 0.2% over five years and more cash than total debt. Despite a challenging year with earnings falling by 16.8%, it still outperformed the industry average decline of 28.2%. The company reported annual sales of CNY 893 million and net income of CNY 209 million for 2024, reflecting a dip from the previous year but remaining profitable with high-quality earnings and positive free cash flow, suggesting potential for future growth at an estimated rate of 7.53% annually.

Dalian Huarui Heavy Industry Group (SZSE:002204)

Simply Wall St Value Rating: ★★★★★☆

Overview: Dalian Huarui Heavy Industry Group Co., Ltd. operates as a major player in the heavy machinery industry, with a market capitalization of CN¥12.07 billion.

Operations: Dalian Huarui Heavy Industry Group generates revenue primarily from its heavy machinery products and services. The company focuses on optimizing its cost structure to enhance profitability, reflected in a net profit margin trend that provides insights into its financial health.

Dalian Huarui Heavy Industry Group, a smaller player in the machinery sector, has shown impressive earnings growth of 37.1% over the past year, outpacing the industry's 1.4%. Despite a volatile share price recently, its P/E ratio of 24.2x suggests it offers better value compared to the broader CN market at 35.8x. The company reported sales of CNY 14.28 billion for 2024, up from CNY 12 billion in the previous year, with net income rising to CNY 501 million from CNY 363 million. A recent dividend increase further underscores its robust financial health and commitment to shareholder returns.

Sanhe Tongfei Refrigeration (SZSE:300990)

Simply Wall St Value Rating: ★★★★★★

Overview: Sanhe Tongfei Refrigeration Co., Ltd. specializes in the manufacturing and sale of industrial temperature control products in China, with a market cap of CN¥7.59 billion.

Operations: Sanhe Tongfei generates revenue primarily through the sale of industrial temperature control products. The company's financial performance is highlighted by a net profit margin of 10.5%, reflecting its ability to convert sales into profit efficiently.

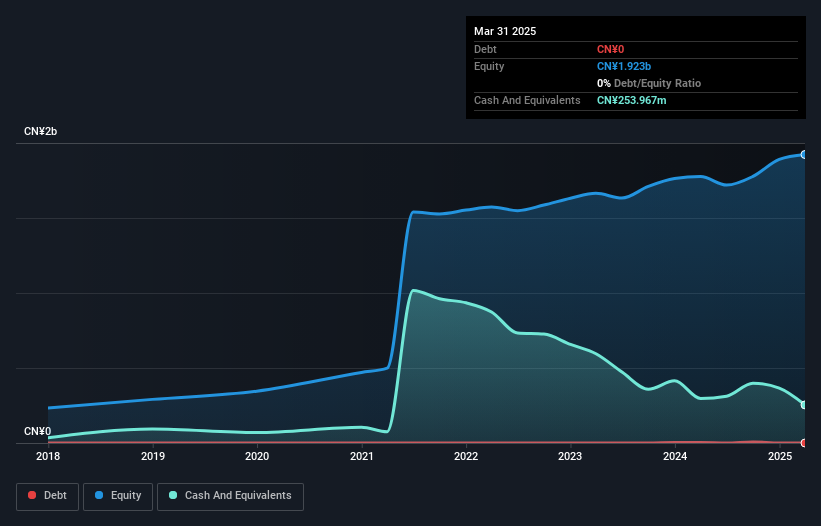

Sanhe Tongfei Refrigeration, a nimble player in the machinery sector, recently announced a CNY 3.00 dividend per 10 shares for 2024. The company's Q1 2025 results show impressive growth with sales jumping to CNY 573.62 million from last year's CNY 274.43 million, and net income soaring to CNY 61.91 million from CNY 5.14 million. With no debt on its books compared to five years ago when it had a debt-to-equity ratio of just over zero, Sanhe Tongfei appears financially sound and poised for continued expansion in earnings, projected at an annual growth rate of over thirty-five percent.

- Click here and access our complete health analysis report to understand the dynamics of Sanhe Tongfei Refrigeration.

Learn about Sanhe Tongfei Refrigeration's historical performance.

Turning Ideas Into Actions

- Click this link to deep-dive into the 2652 companies within our Asian Undiscovered Gems With Strong Fundamentals screener.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002204

Dalian Huarui Heavy Industry Group

Dalian Huarui Heavy Industry Group Co., Ltd.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives