- China

- /

- Electrical

- /

- SHSE:601700

Uncovering Opportunities: Changshu Fengfan Power Equipment And 2 Other Global Penny Stocks

Reviewed by Simply Wall St

As global markets navigate a landscape of economic uncertainty and mixed performance across major indices, investors are increasingly seeking opportunities that lie beyond the traditional blue-chip stocks. Penny stocks, though often considered a relic of past market eras, continue to offer intriguing possibilities for those willing to explore smaller or newer companies. These stocks can present underappreciated growth potential at lower price points, especially when they possess strong balance sheets and solid fundamentals.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.40 | SGD9.48B | ✅ 5 ⚠️ 0 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.72 | SEK278.94M | ✅ 4 ⚠️ 3 View Analysis > |

| NEXG Berhad (KLSE:DSONIC) | MYR0.26 | MYR723.36M | ✅ 4 ⚠️ 2 View Analysis > |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.51 | MYR2.54B | ✅ 5 ⚠️ 0 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$3.88 | HK$45.04B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.31 | HK$807.62M | ✅ 3 ⚠️ 1 View Analysis > |

| Next 15 Group (AIM:NFG) | £3.005 | £298.87M | ✅ 4 ⚠️ 5 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.63 | £412.89M | ✅ 4 ⚠️ 1 View Analysis > |

| QinetiQ Group (LSE:QQ.) | £3.784 | £2.1B | ✅ 5 ⚠️ 1 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.12 | A$146.15M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 5,714 stocks from our Global Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Changshu Fengfan Power Equipment (SHSE:601700)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Changshu Fengfan Power Equipment Co., Ltd., with a market cap of CN¥5.35 billion, operates in the power equipment industry.

Operations: Revenue Segments: No specific revenue segments have been reported for this company.

Market Cap: CN¥5.35B

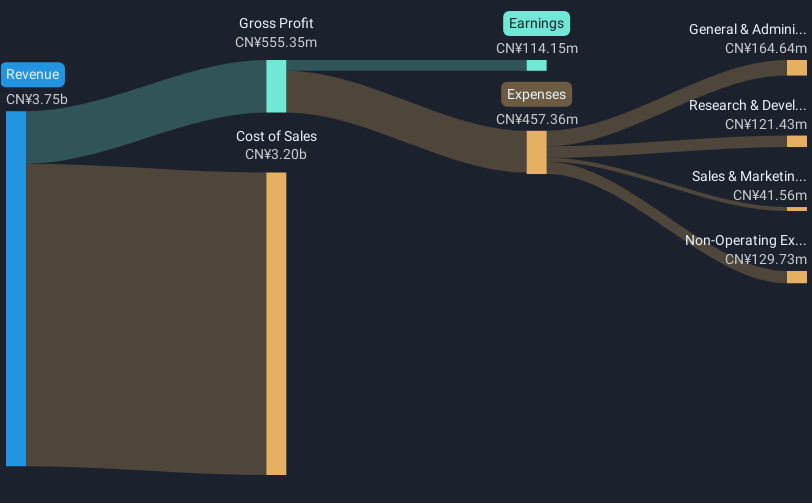

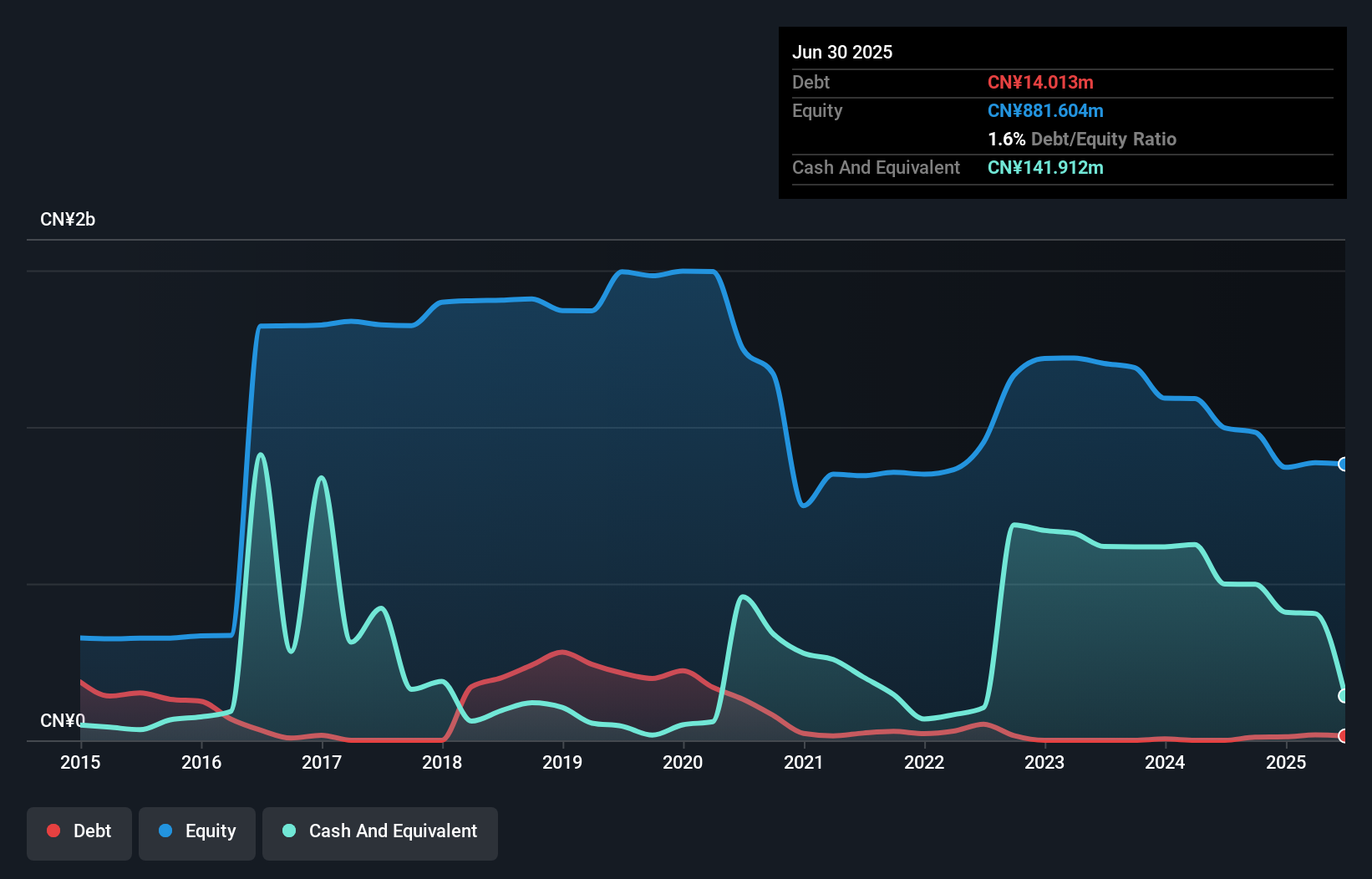

Changshu Fengfan Power Equipment, with a market cap of CN¥5.35 billion, presents a mixed picture for investors interested in penny stocks. The company has demonstrated robust earnings growth, significantly outpacing the industry average over the past year. Its short-term assets comfortably cover both short and long-term liabilities, indicating solid financial footing. However, an increased debt-to-equity ratio suggests rising leverage concerns. Despite high-quality earnings and well-covered interest payments by EBIT, negative operating cash flow raises questions about debt sustainability. Additionally, low return on equity and insufficient dividend coverage highlight areas needing improvement for long-term stability.

- Jump into the full analysis health report here for a deeper understanding of Changshu Fengfan Power Equipment.

- Learn about Changshu Fengfan Power Equipment's historical performance here.

Topscore Fashion (SHSE:603608)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Topscore Fashion Co., Ltd. operates in the fashion shoes and apparel sector, as well as mobile Internet marketing in China, with a market cap of CN¥1.71 billion.

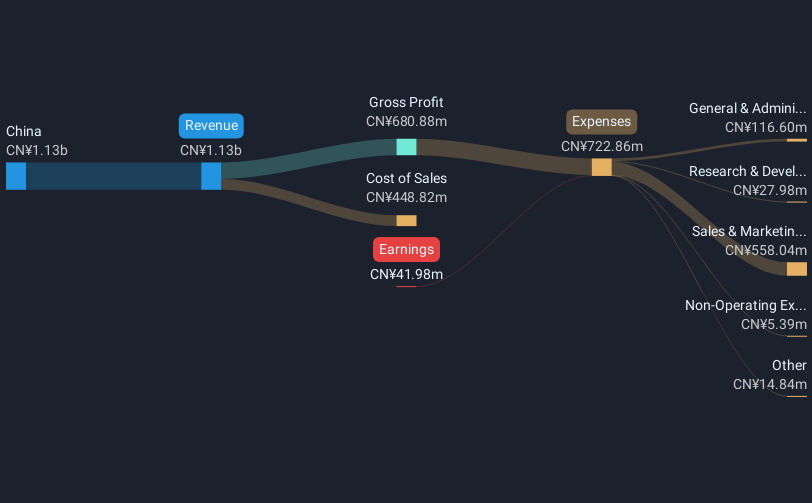

Operations: The company's revenue is primarily generated from its operations in China, amounting to CN¥1.13 billion.

Market Cap: CN¥1.71B

Topscore Fashion Co., Ltd., with a market cap of CN¥1.71 billion, operates primarily in China, generating CN¥1.13 billion in revenue. Despite trading at 32.2% below its estimated fair value, the company remains unprofitable with increasing losses over the past five years. Its short-term assets exceed both short and long-term liabilities, suggesting a stable financial position despite an increased debt-to-equity ratio from 3.6% to 32.1%. The company's board is experienced with an average tenure of 6.8 years, and shareholders have not faced significant dilution recently, but negative return on equity reflects ongoing profitability challenges.

- Navigate through the intricacies of Topscore Fashion with our comprehensive balance sheet health report here.

- Gain insights into Topscore Fashion's historical outcomes by reviewing our past performance report.

Infund Holding (SZSE:002141)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Infund Holding Co., Ltd. operates in the micro enameled wire and veterinary vaccine sectors in China with a market capitalization of CN¥1.59 billion.

Operations: Infund Holding Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥1.59B

Infund Holding Co., Ltd., with a market cap of CN¥1.59 billion, operates in the micro enameled wire and veterinary vaccine sectors in China but remains pre-revenue. Despite its unprofitable status, it has managed to reduce losses by 24.2% annually over five years and maintains a strong financial position with short-term assets exceeding both short- and long-term liabilities. The company holds more cash than debt, offering a cash runway exceeding three years if free cash flow continues to grow historically. Recently, Jiangxi Xinyu Environmental Technology Co., Ltd. acquired a 2.42% stake for CN¥34.11 million, reflecting investor interest amidst ongoing challenges.

- Click here and access our complete financial health analysis report to understand the dynamics of Infund Holding.

- Evaluate Infund Holding's historical performance by accessing our past performance report.

Taking Advantage

- Embark on your investment journey to our 5,714 Global Penny Stocks selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601700

Changshu Fengfan Power Equipment

Changshu Fengfan Power Equipment Co., Ltd.

Low risk with imperfect balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion