Is It Too Late To Consider Buying Zhejiang Sanhua Intelligent Controls Co.,Ltd (SZSE:002050)?

Today we're going to take a look at the well-established Zhejiang Sanhua Intelligent Controls Co.,Ltd (SZSE:002050). The company's stock led the SZSE gainers with a relatively large price hike in the past couple of weeks. Shareholders may appreciate the recent price jump, but the company still has a way to go before reaching its yearly highs again. With many analysts covering the large-cap stock, we may expect any price-sensitive announcements have already been factored into the stock’s share price. However, what if the stock is still a bargain? Let’s take a look at Zhejiang Sanhua Intelligent ControlsLtd’s outlook and value based on the most recent financial data to see if the opportunity still exists.

View our latest analysis for Zhejiang Sanhua Intelligent ControlsLtd

Is Zhejiang Sanhua Intelligent ControlsLtd Still Cheap?

According to our valuation model, Zhejiang Sanhua Intelligent ControlsLtd seems to be fairly priced at around 8.28% above our intrinsic value, which means if you buy Zhejiang Sanhua Intelligent ControlsLtd today, you’d be paying a relatively reasonable price for it. And if you believe that the stock is really worth CN¥22.82, then there isn’t really any room for the share price grow beyond what it’s currently trading. Furthermore, Zhejiang Sanhua Intelligent ControlsLtd’s low beta implies that the stock is less volatile than the wider market.

Can we expect growth from Zhejiang Sanhua Intelligent ControlsLtd?

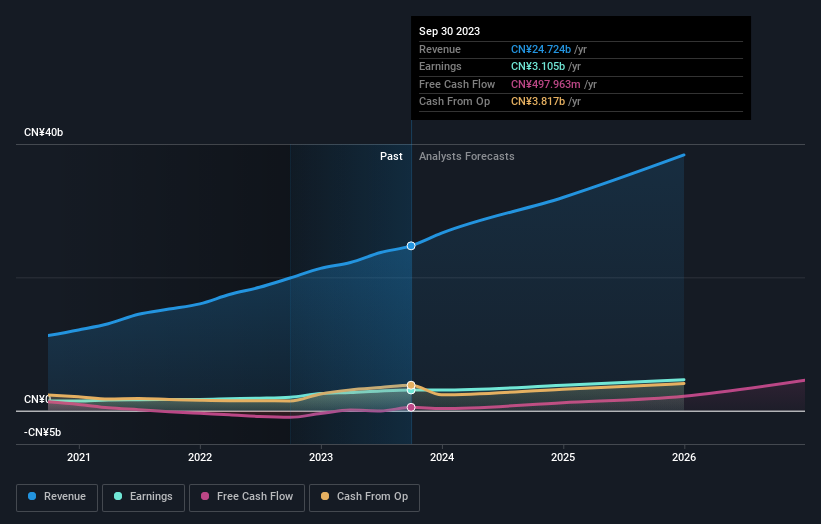

Investors looking for growth in their portfolio may want to consider the prospects of a company before buying its shares. Although value investors would argue that it’s the intrinsic value relative to the price that matter the most, a more compelling investment thesis would be high growth potential at a cheap price. With profit expected to grow by 42% over the next couple of years, the future seems bright for Zhejiang Sanhua Intelligent ControlsLtd. It looks like higher cash flow is on the cards for the stock, which should feed into a higher share valuation.

What This Means For You

Are you a shareholder? It seems like the market has already priced in 002050’s positive outlook, with shares trading around its fair value. However, there are also other important factors which we haven’t considered today, such as the financial strength of the company. Have these factors changed since the last time you looked at the stock? Will you have enough confidence to invest in the company should the price drop below its fair value?

Are you a potential investor? If you’ve been keeping tabs on 002050, now may not be the most optimal time to buy, given it is trading around its fair value. However, the optimistic prospect is encouraging for the company, which means it’s worth further examining other factors such as the strength of its balance sheet, in order to take advantage of the next price drop.

If you'd like to know more about Zhejiang Sanhua Intelligent ControlsLtd as a business, it's important to be aware of any risks it's facing. For example, we've discovered 1 warning sign that you should run your eye over to get a better picture of Zhejiang Sanhua Intelligent ControlsLtd.

If you are no longer interested in Zhejiang Sanhua Intelligent ControlsLtd, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

If you're looking to trade Zhejiang Sanhua Intelligent ControlsLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Zhejiang Sanhua Intelligent ControlsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002050

Zhejiang Sanhua Intelligent ControlsLtd

Engages in the research, manufacture, and sale of refrigeration and air-conditioning electrical parts, and auto parts in China and internationally.

Excellent balance sheet second-rate dividend payer.