- Japan

- /

- Commercial Services

- /

- TSE:6564

Undiscovered Gems Three Promising Small Caps with Strong Potential

Reviewed by Simply Wall St

In the current global market landscape, small-cap stocks have faced challenges, underperforming their large-cap counterparts as evidenced by the Russell 2000 Index dipping into correction territory. Despite this volatility and concerns over inflation and interest rates, these conditions can create opportunities for discerning investors to identify promising small-cap companies with strong fundamentals that may be overlooked by the broader market.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| NJS | NA | 5.31% | 7.12% | ★★★★★★ |

| GakkyushaLtd | 19.76% | 4.94% | 18.11% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Chuo WarehouseLtd | 12.36% | 0.35% | 9.16% | ★★★★★★ |

| MIRARTH HOLDINGSInc | 261.26% | 3.32% | 0.93% | ★★★★★☆ |

| Hayleys | 140.54% | 19.07% | 20.35% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Hwaway Technology (SZSE:001380)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hwaway Technology Corporation Limited focuses on the research, development, production, and sale of elastic components both in China and internationally, with a market cap of CN¥3.96 billion.

Operations: Hwaway Technology generates revenue primarily through the sale of elastic components in both domestic and international markets. The company's net profit margin has shown a fluctuating trend over recent periods, highlighting variability in profitability.

Hwaway Technology, a promising player in the machinery sector, has shown notable progress with earnings growth of 31.8% over the past year, outpacing industry averages. Its price-to-earnings ratio stands attractively at 19x compared to the broader CN market's 31.8x, suggesting potential undervaluation. The company reported sales of CNY 1.23 billion for the first nine months of 2024, up from CNY 846 million last year, while net income rose to CNY 153 million from CNY 110 million a year ago. Despite not being free cash flow positive recently, Hwaway's profitability and strong earnings forecast indicate robust future prospects.

Brilliance Technology (SZSE:300542)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Brilliance Technology Co., Ltd., along with its subsidiaries, offers information solutions and services in China, with a market cap of CN¥5.61 billion.

Operations: Brilliance Technology generates revenue primarily from its information solutions and services in China. The company has a market capitalization of CN¥5.61 billion.

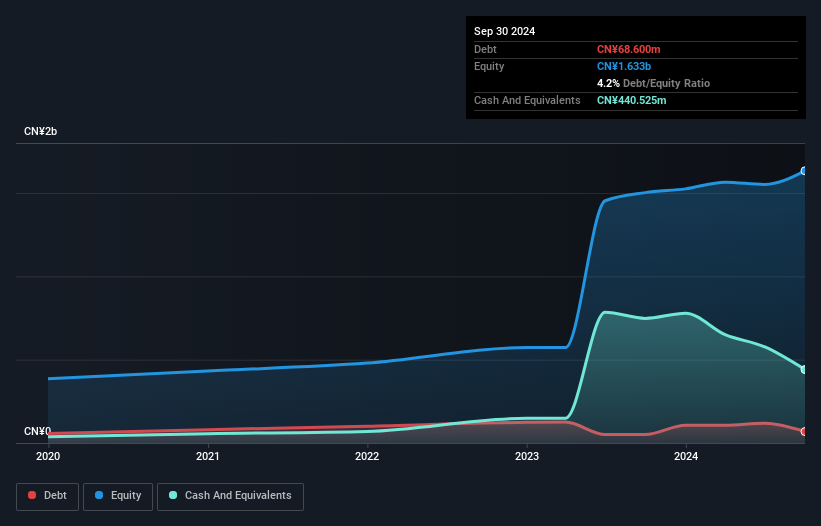

Brilliance Technology, a small player in the tech space, has seen its earnings surge by 65% over the past year, significantly outpacing the IT industry's -11% trend. However, this growth is overshadowed by a five-year earnings decline of 11% annually. The company's debt-to-equity ratio has risen from 13% to 62%, although interest payments are well-covered with EBIT at 3.5 times interest expenses. Despite reporting a net loss of CN¥17.74 million for nine months ending September 2024, Brilliance remains free cash flow positive and maintains satisfactory net debt levels at 25%.

- Click to explore a detailed breakdown of our findings in Brilliance Technology's health report.

Understand Brilliance Technology's track record by examining our Past report.

Midac Holdings (TSE:6564)

Simply Wall St Value Rating: ★★★★★★

Overview: Midac Holdings Co., Ltd. operates in Japan focusing on the collection, transportation, cleaning, treatment, and disposal of industrial waste with a market capitalization of ¥44.47 billion.

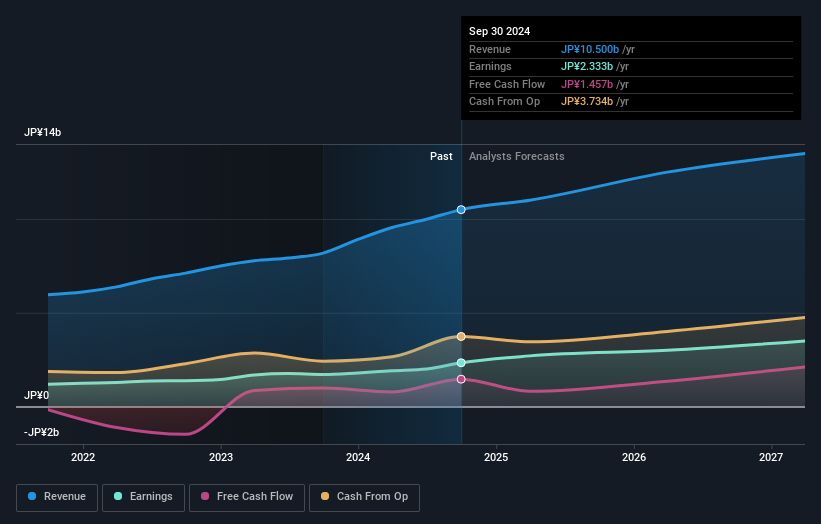

Operations: Midac Holdings generates revenue primarily from waste treatment and collection and transportation services, with waste treatment contributing ¥8.65 billion and collection and transportation adding ¥1.91 billion. The brokerage management segment also provides additional revenue of ¥160.09 million.

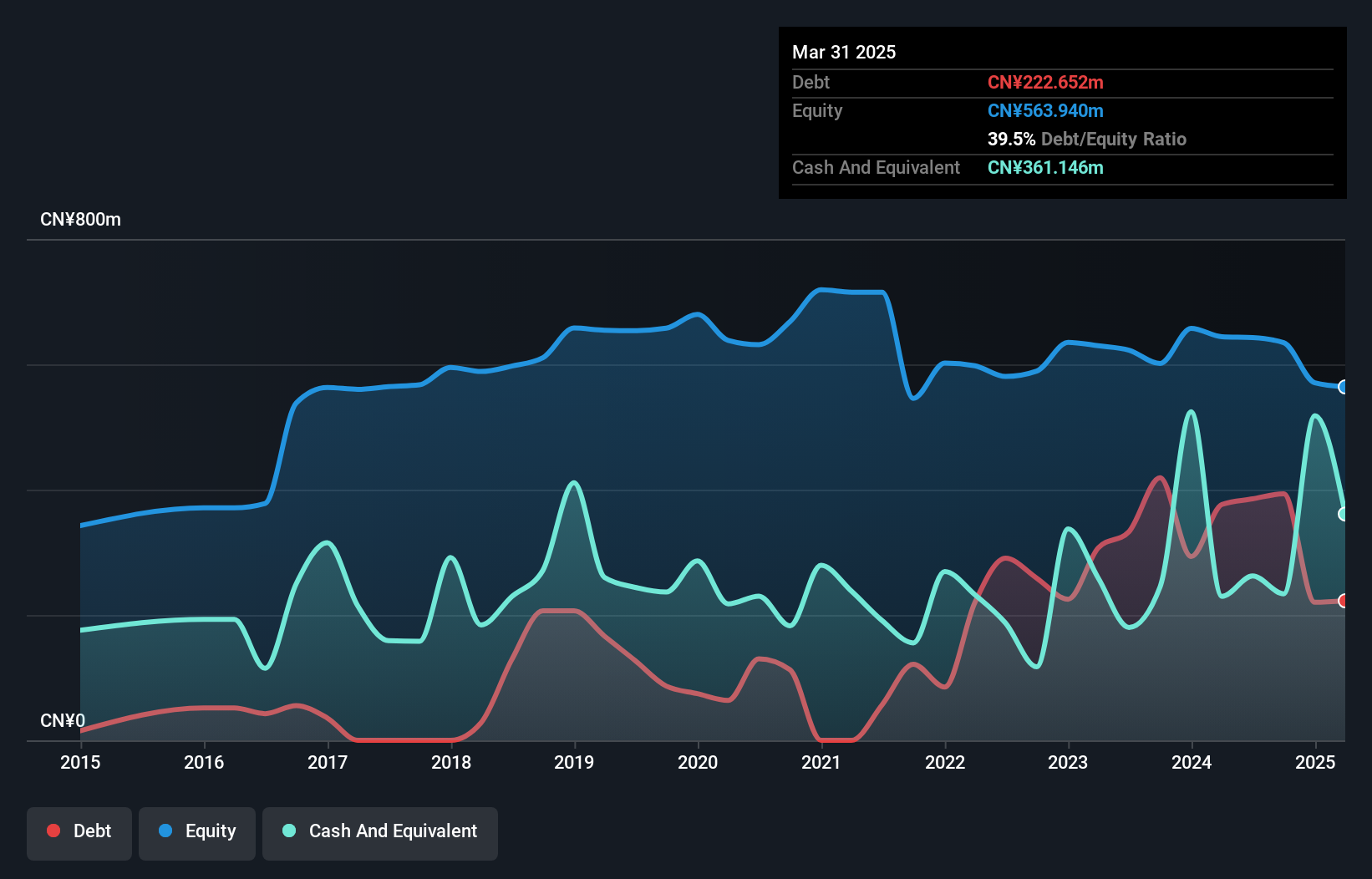

Midac Holdings, a small cap player in the industry, has seen its debt to equity ratio significantly improve from 190.5% to 72.1% over the past five years, indicating stronger financial health. The company boasts high-quality earnings and reported a robust earnings growth of 36.8% last year, outpacing the Commercial Services sector's average of 7.4%. Trading at a substantial discount of 54.1% below its estimated fair value suggests potential upside for investors seeking undervalued opportunities. With EBIT covering interest payments by an impressive margin of 39.8 times, Midac's financial footing appears solid moving forward into projected growth phases.

- Unlock comprehensive insights into our analysis of Midac Holdings stock in this health report.

Assess Midac Holdings' past performance with our detailed historical performance reports.

Key Takeaways

- Get an in-depth perspective on all 4536 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6564

Midac Holdings

Engages in the collection, transportation, cleaning, treatment, and disposal of industrial waste in Japan.

Flawless balance sheet with solid track record.