Global markets have recently experienced fluctuations due to tariff uncertainties and mixed economic signals, with U.S. job growth falling short of expectations and manufacturing activity showing signs of recovery. Amidst these shifting conditions, investors often seek opportunities in lesser-known segments like penny stocks, which represent smaller or newer companies that can offer unique growth potential at lower price points. While the term "penny stocks" might seem outdated, these investments remain relevant for those looking to discover promising companies with strong fundamentals that could deliver impressive returns over time.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Bosideng International Holdings (SEHK:3998) | HK$3.87 | HK$44.43B | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.545 | MYR2.71B | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.705 | MYR417.12M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.405 | MYR1.13B | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.93 | £148.21M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.85 | MYR282.15M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.785 | A$144.95M | ★★★★☆☆ |

| Warpaint London (AIM:W7L) | £4.00 | £322.74M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.14 | HK$723.66M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.26 | £161.24M | ★★★★★☆ |

Click here to see the full list of 5,702 stocks from our Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Suzhou Institute of Building Science GroupLtd (SHSE:603183)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Suzhou Institute of Building Science Group Co., Ltd operates in the construction industry in China with a market cap of CN¥1.95 billion.

Operations: The company generates its revenue primarily from operations within China, totaling CN¥929.16 million.

Market Cap: CN¥1.95B

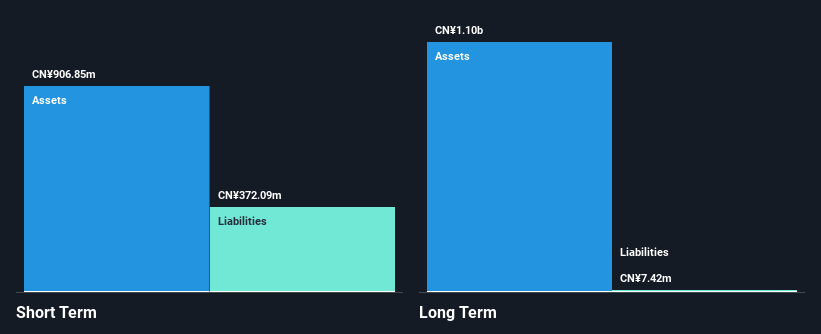

Suzhou Institute of Building Science Group Co., Ltd, with a market cap of CN¥1.95 billion, operates in China's construction industry and reported revenues of CN¥929.16 million. The company has not diluted shareholder value over the past year and holds a favorable price-to-earnings ratio (18.4x) compared to the Chinese market average (36.3x). Its short-term assets significantly surpass both short-term and long-term liabilities, ensuring financial stability. However, recent negative earnings growth (-16.9%) contrasts with its historical 5-year growth trend of 4.6% annually, while its dividend coverage remains weak due to insufficient free cash flows.

- Get an in-depth perspective on Suzhou Institute of Building Science GroupLtd's performance by reading our balance sheet health report here.

- Evaluate Suzhou Institute of Building Science GroupLtd's prospects by accessing our earnings growth report.

Infore Environment Technology Group (SZSE:000967)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Infore Environment Technology Group Co., Ltd. operates in the environmental technology sector and has a market cap of CN¥15.17 billion.

Operations: Infore Environment Technology Group Co., Ltd. does not report specific revenue segments.

Market Cap: CN¥15.17B

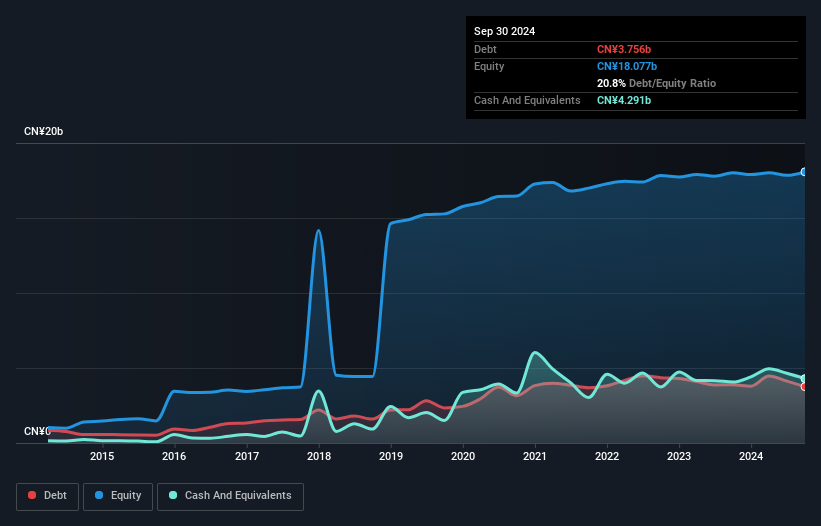

Infore Environment Technology Group Co., Ltd., with a market cap of CN¥15.17 billion, demonstrates financial resilience with short-term assets (CN¥13.5 billion) exceeding both short-term (CN¥7.0 billion) and long-term liabilities (CN¥4.0 billion). The company maintains more cash than total debt, ensuring robust liquidity, while its interest payments are well-covered by EBIT at 10.9x coverage. Despite a low return on equity (2.8%) and declining earnings over the past five years (-26.1% annually), the stock's price-to-earnings ratio of 30.4x remains below the Chinese market average, suggesting potential value for investors mindful of volatility risks and negative recent earnings growth trends.

- Unlock comprehensive insights into our analysis of Infore Environment Technology Group stock in this financial health report.

- Assess Infore Environment Technology Group's future earnings estimates with our detailed growth reports.

Tong Petrotech (SZSE:300164)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tong Petrotech Corp. provides perforation technology services to oilfield customers both in China and internationally, with a market cap of CN¥2.55 billion.

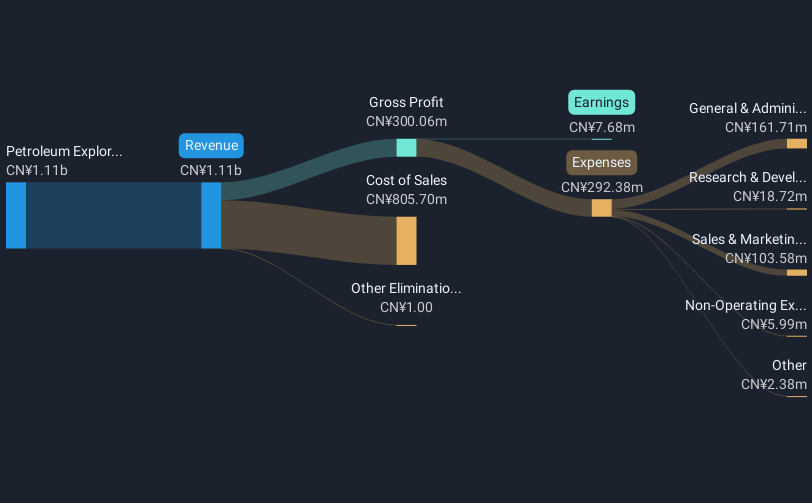

Operations: The company generates revenue of CN¥1.11 billion from its Petroleum Exploration Development segment.

Market Cap: CN¥2.55B

Tong Petrotech Corp., with a market cap of CN¥2.55 billion, generates CN¥1.11 billion in revenue from its Petroleum Exploration Development segment. The company has seen a significant decline in profit margins to 0.7% from 9.2% last year, despite having more cash than total debt and strong interest coverage at 12.4x EBIT. Short-term assets (CN¥1 billion) comfortably cover both short-term and long-term liabilities, indicating solid liquidity management. However, negative earnings growth (-92.1%) poses challenges against industry averages, while the board's relatively new tenure suggests potential for strategic shifts moving forward.

- Click here and access our complete financial health analysis report to understand the dynamics of Tong Petrotech.

- Gain insights into Tong Petrotech's past trends and performance with our report on the company's historical track record.

Where To Now?

- Dive into all 5,702 of the Penny Stocks we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000967

Infore Environment Technology Group

Infore Environment Technology Group Co., Ltd.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives