- China

- /

- Trade Distributors

- /

- SZSE:000632

Fujian Sanmu Group Co., Ltd. (SZSE:000632) Held Back By Insufficient Growth Even After Shares Climb 28%

Despite an already strong run, Fujian Sanmu Group Co., Ltd. (SZSE:000632) shares have been powering on, with a gain of 28% in the last thirty days. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 7.6% over the last year.

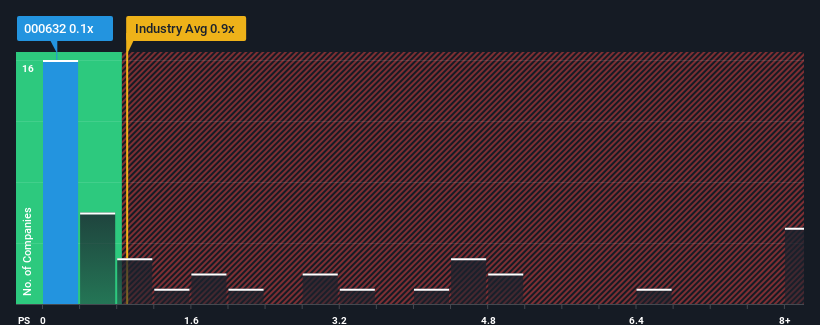

In spite of the firm bounce in price, Fujian Sanmu Group may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.1x, considering almost half of all companies in the Trade Distributors industry in China have P/S ratios greater than 0.9x and even P/S higher than 5x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Fujian Sanmu Group

What Does Fujian Sanmu Group's P/S Mean For Shareholders?

For instance, Fujian Sanmu Group's receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Although there are no analyst estimates available for Fujian Sanmu Group, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as Fujian Sanmu Group's is when the company's growth is on track to lag the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 15%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 29% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 16% shows it's noticeably less attractive.

In light of this, it's understandable that Fujian Sanmu Group's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

The Bottom Line On Fujian Sanmu Group's P/S

Fujian Sanmu Group's stock price has surged recently, but its but its P/S still remains modest. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Fujian Sanmu Group confirms that the company's revenue trends over the past three-year years are a key factor in its low price-to-sales ratio, as we suspected, given they fall short of current industry expectations. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Fujian Sanmu Group you should know about.

If you're unsure about the strength of Fujian Sanmu Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade Fujian Sanmu Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000632

Fujian Sanmu Group

Engages in the import and export trading business in China.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives