- Hong Kong

- /

- Entertainment

- /

- SEHK:434

Penny Stocks To Watch This November 2024

Reviewed by Simply Wall St

As global markets experience broad-based gains and U.S. indexes approach record highs, investors are showing renewed interest in smaller-cap stocks. Penny stocks, though often considered a relic from earlier market days, remain an intriguing investment area due to their potential for growth at lower price points. By focusing on companies with strong financials and clear growth prospects, investors can uncover hidden gems that offer both stability and upside potential.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.48 | MYR2.39B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$146.79M | ★★★★☆☆ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.565 | A$66.23M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.89 | MYR295.43M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.22 | £836.42M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.20 | £417.71M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.92 | £74.76M | ★★★★☆☆ |

| United U-LI Corporation Berhad (KLSE:ULICORP) | MYR1.55 | MYR337.59M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.79 | A$231.32M | ★★★★★★ |

Click here to see the full list of 5,756 stocks from our Penny Stocks screener.

We'll examine a selection from our screener results.

Boyaa Interactive International (SEHK:434)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Boyaa Interactive International Limited is an investment holding company that develops and operates online card and board games in China and internationally, with a market cap of HK$3.18 billion.

Operations: No specific revenue segments are reported for Boyaa Interactive International Limited.

Market Cap: HK$3.18B

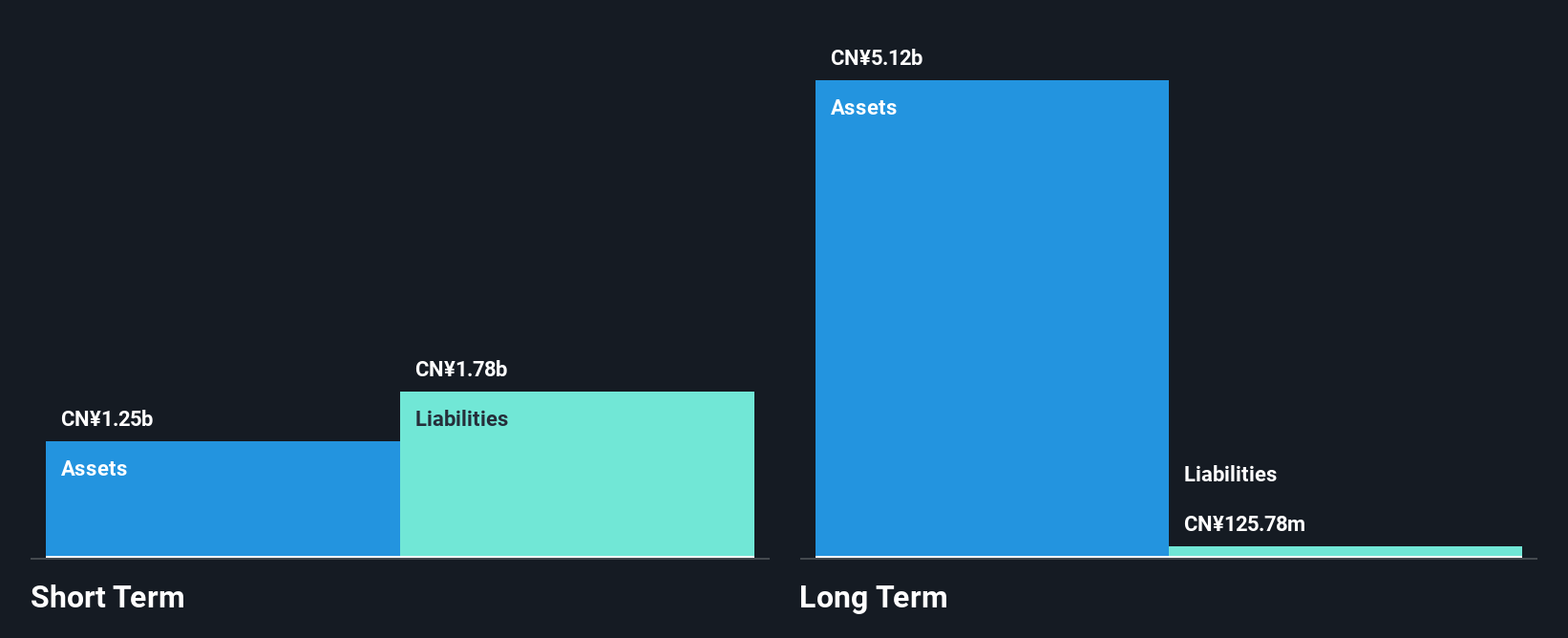

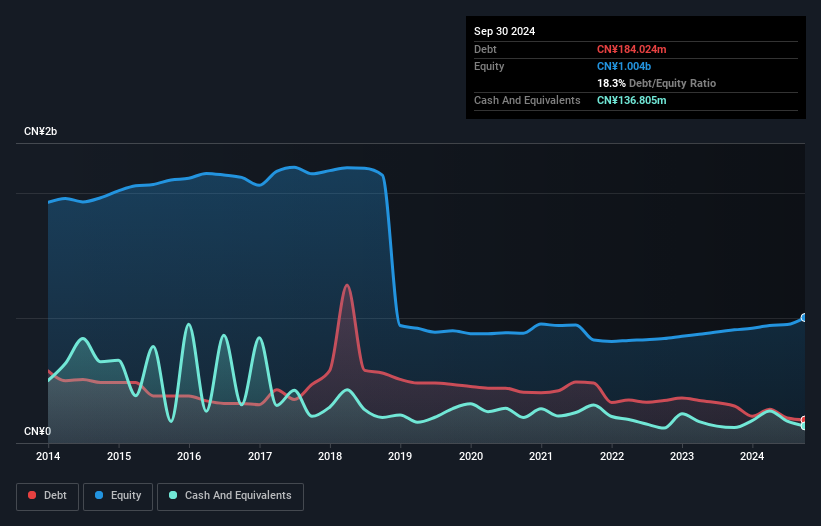

Boyaa Interactive International, with a market cap of HK$3.18 billion, has demonstrated significant earnings growth over the past year, outpacing its five-year average. The company is debt-free and has stable short-term assets exceeding liabilities. Despite high-quality earnings and improved profit margins, recent results show a net loss for Q3 2024 due to non-operating factors like digital asset valuation changes. However, revenue for the nine months ended September 30 increased by approximately 5% to 10%, driven by gains in digital assets and enhanced gaming operations. The board is experienced with an average tenure of over a decade.

- Click to explore a detailed breakdown of our findings in Boyaa Interactive International's financial health report.

- Assess Boyaa Interactive International's previous results with our detailed historical performance reports.

Wenfeng Great World Chain Development (SHSE:601010)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Wenfeng Great World Chain Development Corporation operates a commercial retail chain in China with a market cap of CN¥4.22 billion.

Operations: The company's revenue segment is derived entirely from China, totaling CN¥1.93 billion.

Market Cap: CN¥4.22B

Wenfeng Great World Chain Development, with a market cap of CN¥4.22 billion, recently saw a 5.41% stake acquisition by Jiahong Tianfu No.1 Private Securities Investment Fund for CN¥150 million, indicating investor interest despite challenges. The company reported declining revenue of CN¥1.39 billion for the nine months ended September 2024, down from CN¥1.62 billion the previous year, alongside reduced net income and profit margins. While its price-to-earnings ratio is below industry average and debt is well-covered by cash flow, short-term liabilities exceed assets and earnings growth has been negative over five years with a low return on equity of 2.6%.

- Jump into the full analysis health report here for a deeper understanding of Wenfeng Great World Chain Development.

- Evaluate Wenfeng Great World Chain Development's historical performance by accessing our past performance report.

Guangdong Shunna Electric (SZSE:000533)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Guangdong Shunna Electric Co., Ltd. specializes in providing power transmission and distribution equipment in China, with a market cap of CN¥3.11 billion.

Operations: The company has not reported any specific revenue segments.

Market Cap: CN¥3.11B

Guangdong Shunna Electric, with a market cap of CN¥3.11 billion, shows promising financial health for a company in its category. Trading at 38.5% below estimated fair value and with no significant shareholder dilution recently, the firm benefits from an experienced management team averaging 3.6 years in tenure. Its debt is well-managed, covered by operating cash flow at 107.4%, while short-term assets exceed both long-term and short-term liabilities significantly. Recent earnings reports indicate strong growth, with sales reaching CN¥1,697.27 million for the first nine months of 2024 and net income improving to CN¥71.29 million from the previous year’s figures.

- Click here to discover the nuances of Guangdong Shunna Electric with our detailed analytical financial health report.

- Review our historical performance report to gain insights into Guangdong Shunna Electric's track record.

Taking Advantage

- Reveal the 5,756 hidden gems among our Penny Stocks screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Boyaa Interactive International, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Boyaa Interactive International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:434

Boyaa Interactive International

An investment holding company, develops and operates online card and board games in the People’s Republic of China and Hong Kong.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives