Nanjing Inform Storage Equipment Group And 2 Other Undiscovered Gems To Consider

Reviewed by Simply Wall St

In a global market marked by volatility and uncertainty, particularly with the recent shifts in U.S. policy and fluctuating interest rates, investors are increasingly looking toward small-cap stocks for potential opportunities amid broader market turbulence. As major indices like the S&P 600 reflect these dynamics, identifying promising yet under-the-radar companies can be crucial for those seeking to navigate this complex landscape effectively. In this context, understanding what makes a stock an "undiscovered gem" involves evaluating its growth potential, financial stability, and ability to adapt to changing economic conditions—factors that are particularly relevant given today's market environment.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SALUS Ljubljana d. d | NA | 13.11% | 9.95% | ★★★★★★ |

| Parker Drilling | 46.25% | -0.33% | 53.04% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Indo Tech Transformers | 1.82% | 23.43% | 58.49% | ★★★★★☆ |

| Magadh Sugar & Energy | 50.50% | 6.14% | 14.35% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Nanjing Inform Storage Equipment (Group) (SHSE:603066)

Simply Wall St Value Rating: ★★★★★☆

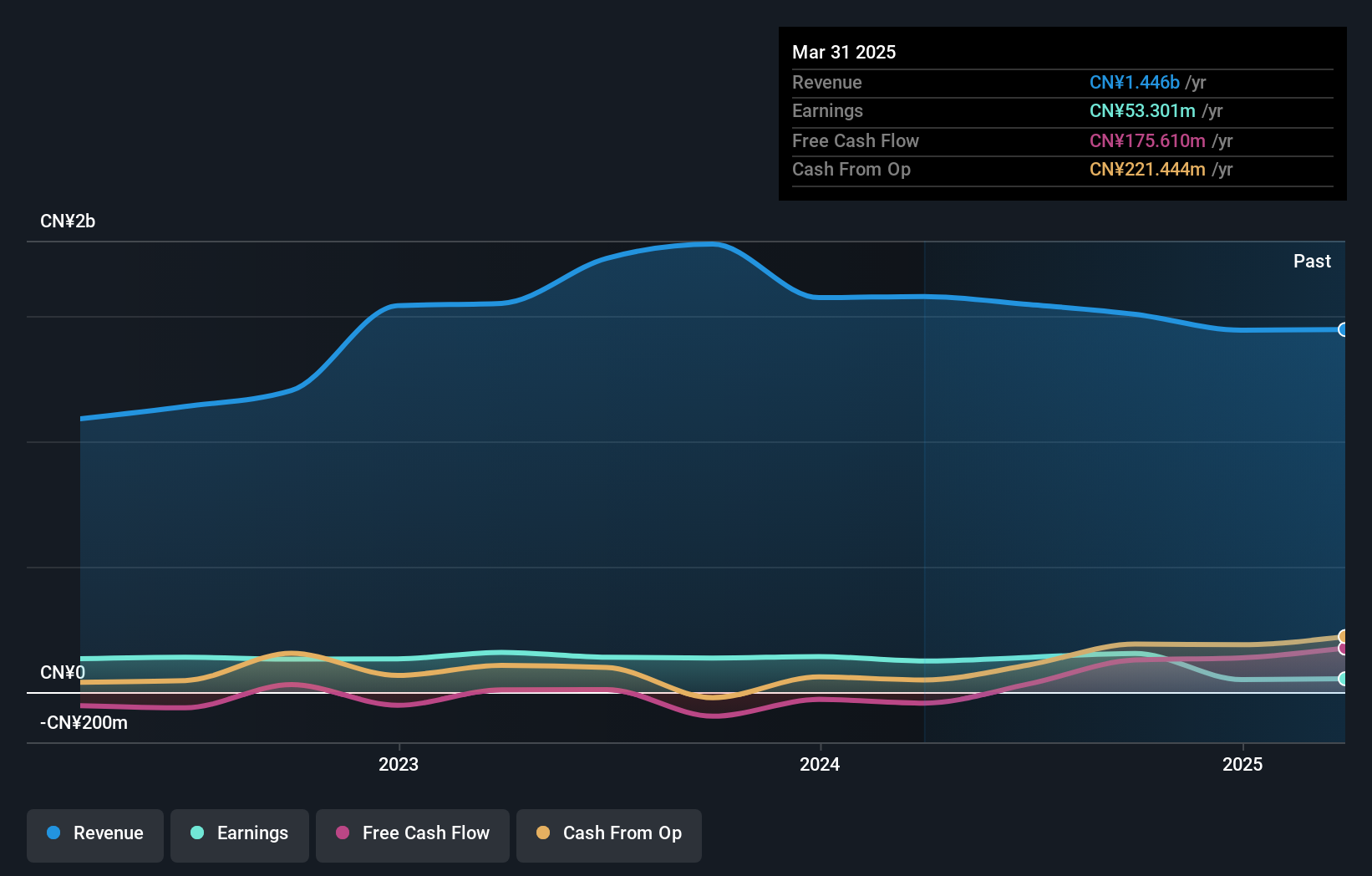

Overview: Nanjing Inform Storage Equipment (Group) Co., Ltd. engages in the research, development, manufacturing, sales, and installation of shelf and storage equipment in China with a market capitalization of approximately CN¥3.25 billion.

Operations: Inform Storage generates revenue primarily from its Furniture & Fixtures segment, amounting to approximately CN¥1.51 billion.

Nanjing Inform Storage Equipment, a smaller player in the machinery sector, is showing robust financial health. Despite a dip in sales to CNY 902.09 million from CNY 968.74 million, net income rose to CNY 106.11 million compared to last year's CNY 93.69 million, indicating improved profitability with earnings per share climbing to CNY 0.3607 from CNY 0.3185. The company’s earnings growth of 13% outpaces the industry average and its debt interest is comfortably covered by EBIT at a ratio of 28 times, suggesting solid operational efficiency and financial management amidst market challenges.

- Take a closer look at Nanjing Inform Storage Equipment (Group)'s potential here in our health report.

Understand Nanjing Inform Storage Equipment (Group)'s track record by examining our Past report.

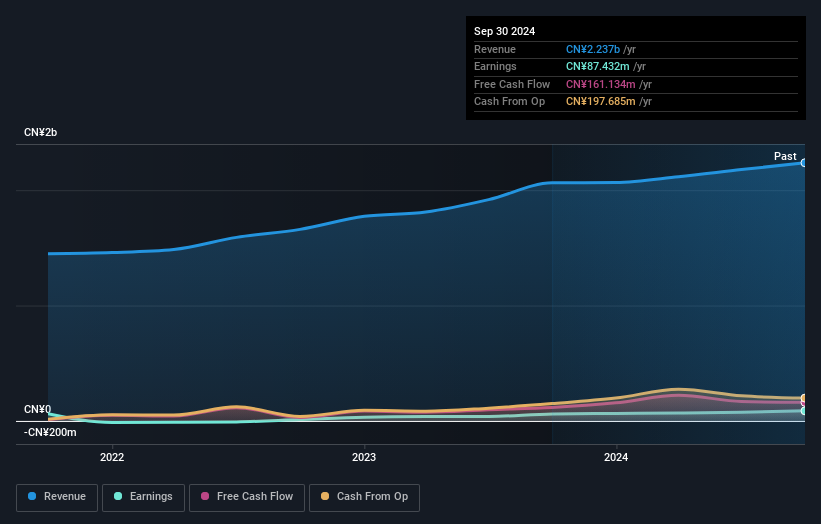

Guangdong Shunna Electric (SZSE:000533)

Simply Wall St Value Rating: ★★★★★★

Overview: Guangdong Shunna Electric Co., Ltd. specializes in providing power transmission and distribution equipment in China, with a market capitalization of CN¥2.91 billion.

Operations: Guangdong Shunna Electric derives its revenue from the sale of power transmission and distribution equipment. The company's net profit margin stands at 8.5%, reflecting its efficiency in managing costs relative to its revenue generation.

Guangdong Shunna Electric, a smaller player in the electrical sector, has shown promising financial health. Over the past year, its earnings surged by 43.9%, outpacing the industry's 1.1% growth rate. The company reported net income of CNY 71.29 million for the first nine months of 2024, up from CNY 48.23 million a year prior, with basic earnings per share rising to CNY 0.1032 from CNY 0.0698. Its debt management appears prudent with a net debt to equity ratio at just 4.7%, and interest payments are well-covered by EBIT at a substantial multiple of 33x, indicating robust operational efficiency and financial stability amidst industry challenges.

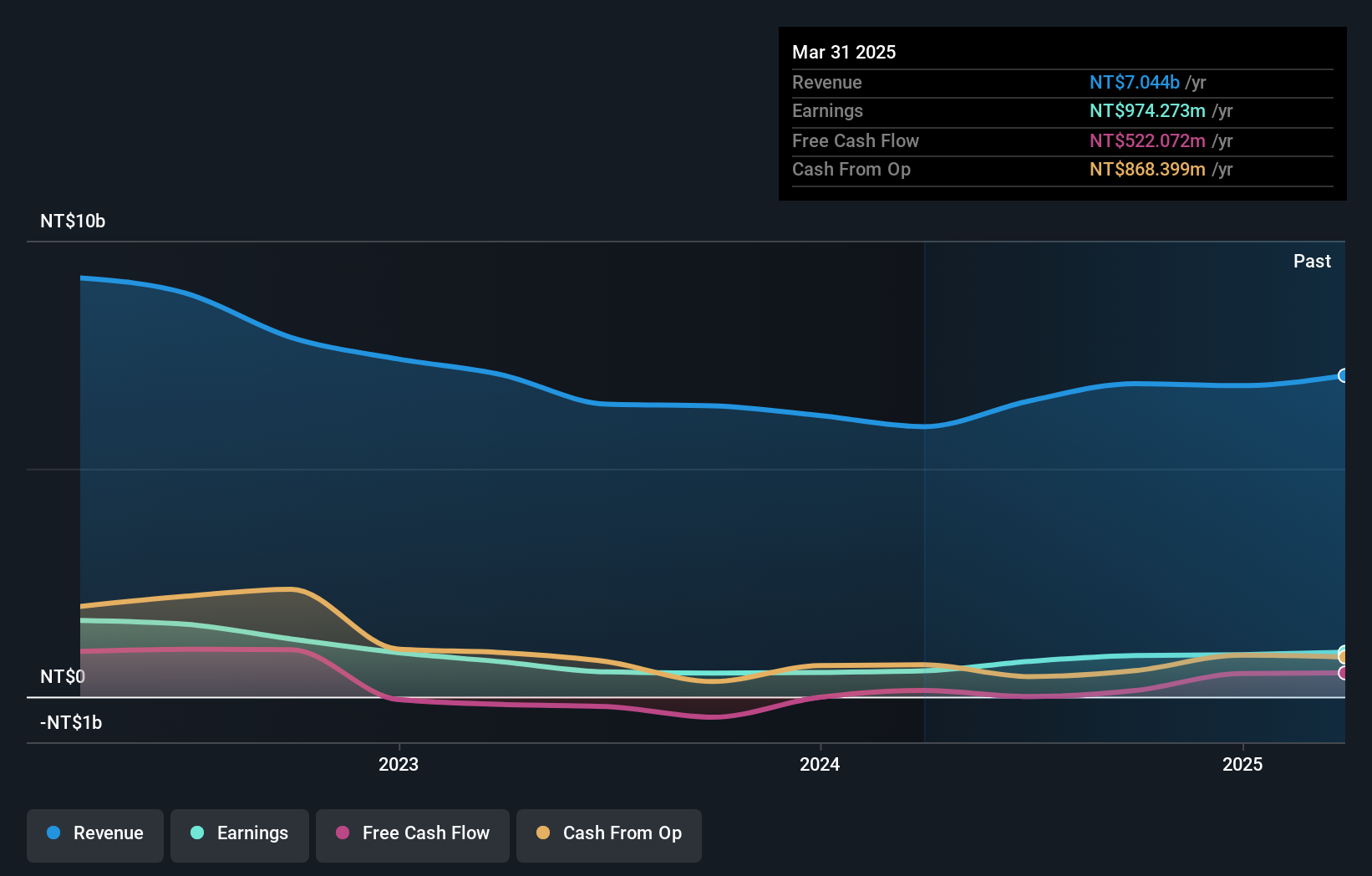

Co-Tech Development (TPEX:8358)

Simply Wall St Value Rating: ★★★★★☆

Overview: Co-Tech Development Corporation, along with its subsidiaries, specializes in producing and selling copper foil for the printed circuit board industry in Taiwan and China, with a market capitalization of NT$14.70 billion.

Operations: Co-Tech generates revenue primarily from the sale of copper foil, amounting to NT$6.87 billion. The company's market capitalization stands at NT$14.70 billion.

Co-Tech Development has been making waves with its recent performance, showcasing a robust earnings growth of 74.2% over the past year, significantly outpacing the electronic industry's average of 9%. The company reported third-quarter sales of TWD 1.79 billion, up from TWD 1.41 billion last year, and net income rose to TWD 222.71 million from TWD 92.29 million—a clear indicator of its financial strength. With a price-to-earnings ratio at a favorable 17.2x compared to the TW market's average of 21x and interest payments well-covered by EBIT at an impressive coverage ratio of 118.6x, Co-Tech appears well-positioned in its sector despite a slight rise in debt-to-equity from 23.6% to 26.8% over five years.

Taking Advantage

- Dive into all 4627 of the Undiscovered Gems With Strong Fundamentals we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nanjing Inform Storage Equipment (Group) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603066

Nanjing Inform Storage Equipment (Group)

Researches and develops, manufactures, sells, and installs shelf and storage equipment in China.

Solid track record with excellent balance sheet.