Huasu HoldingsLtd (SZSE:000509) shareholders are still up 50% over 5 years despite pulling back 8.9% in the past week

Generally speaking the aim of active stock picking is to find companies that provide returns that are superior to the market average. And the truth is, you can make significant gains if you buy good quality businesses at the right price. To wit, the Huasu HoldingsLtd share price has climbed 50% in five years, easily topping the market return of 15% (ignoring dividends).

Since the long term performance has been good but there's been a recent pullback of 8.9%, let's check if the fundamentals match the share price.

Check out our latest analysis for Huasu HoldingsLtd

Huasu HoldingsLtd isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

For the last half decade, Huasu HoldingsLtd can boast revenue growth at a rate of 48% per year. That's well above most pre-profit companies. While the compound gain of 9% per year is good, it's not unreasonable given the strong revenue growth. If you think there could be more growth to come, now might be the time to take a close look at Huasu HoldingsLtd. Opportunity lies where the market hasn't fully priced growth in the underlying business.

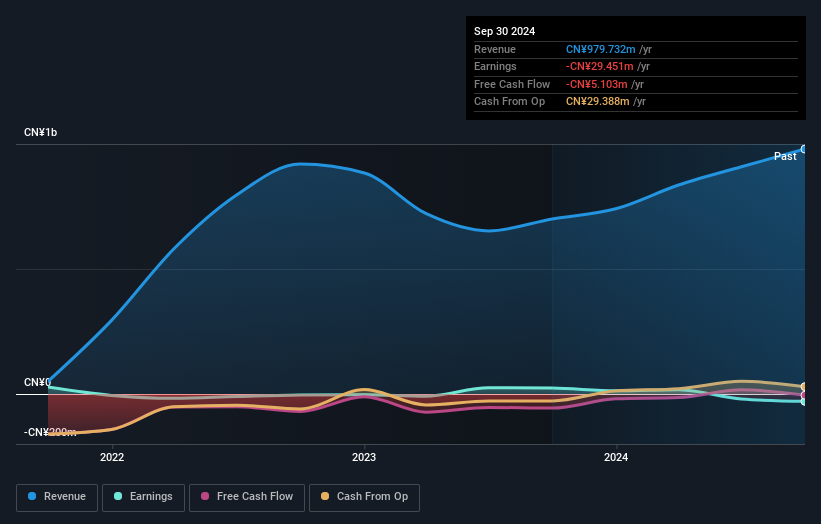

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

If you are thinking of buying or selling Huasu HoldingsLtd stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Investors in Huasu HoldingsLtd had a tough year, with a total loss of 7.0%, against a market gain of about 14%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 9%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. You could get a better understanding of Huasu HoldingsLtd's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Huasu HoldingsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000509

Huasu HoldingsLtd

Engages in the development, design, production, and sales of electronic information display terminals.

Mediocre balance sheet with weak fundamentals.