As global markets navigate through tariff uncertainties and mixed economic signals, small-cap stocks have shown resilience despite broader market pressures. With the S&P 600 for small-cap stocks reflecting these dynamics, investors are increasingly on the lookout for companies that demonstrate strong fundamentals and adaptability in challenging environments. In this context, identifying undiscovered gems requires a keen eye for businesses with solid growth potential and innovative strategies that can thrive amidst volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Oakworth Capital | 31.49% | 14.78% | 4.46% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Hermes Transportes Blindados | 50.88% | 4.57% | 3.33% | ★★★★★☆ |

| Inverfal PerúA | 31.20% | 10.56% | 17.83% | ★★★★★☆ |

| Sociedad Eléctrica del Sur Oeste | 42.67% | 8.52% | 4.10% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

| Central Cooperative Bank AD | 4.88% | 37.94% | 537.05% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Storytel (OM:STORY B)

Simply Wall St Value Rating: ★★★★★★

Overview: Storytel AB (publ) offers streaming services for audiobooks and e-books, with a market cap of approximately SEK7.52 billion.

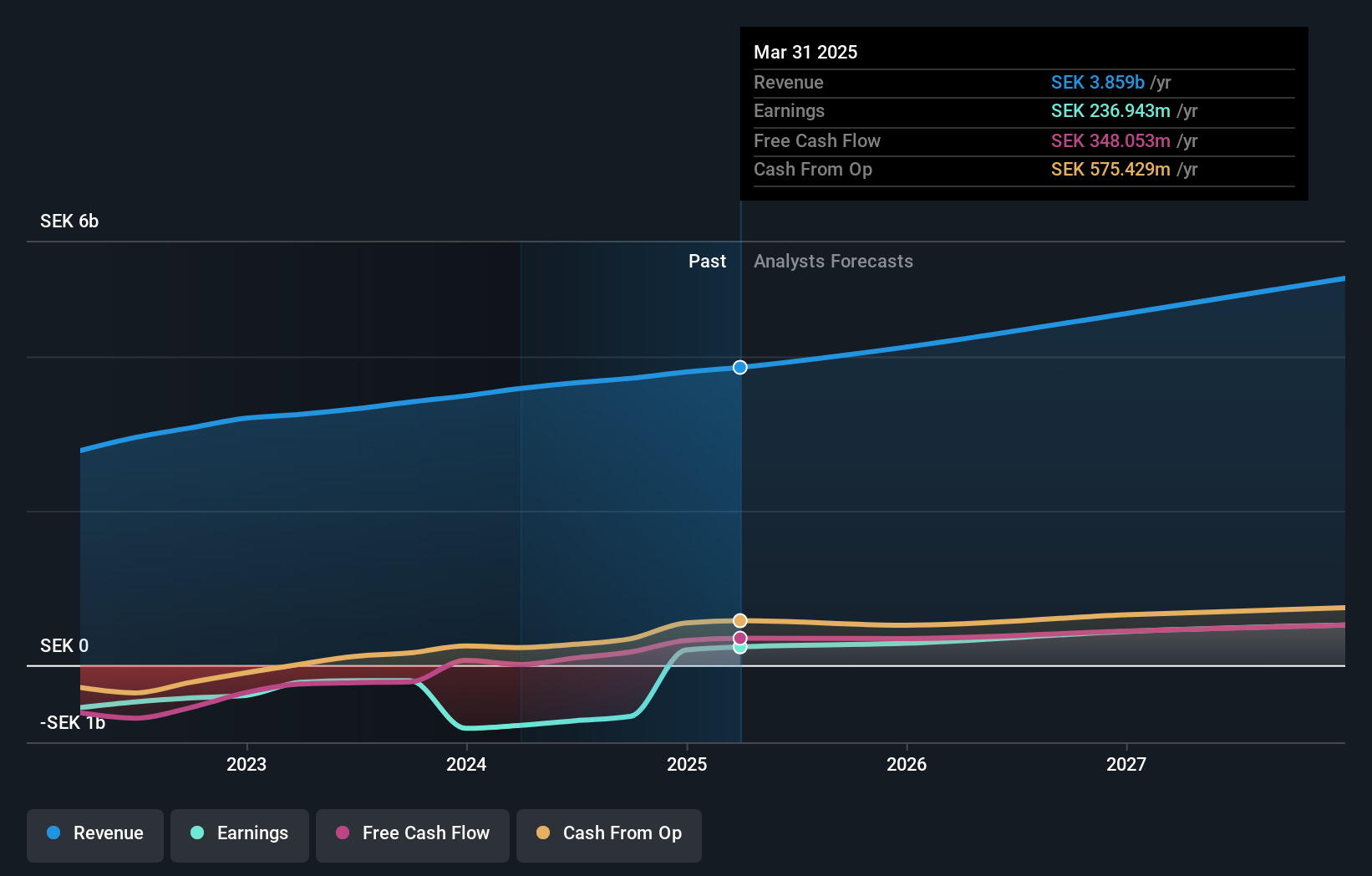

Operations: Storytel generates revenue primarily through its audiobook and e-book streaming services. The company's net profit margin has shown variability over recent periods. Operating costs include content acquisition and technology expenses, which impact profitability.

Storytel, a promising player in the media industry, has recently turned profitable with net income hitting SEK 196.71 million for 2024, compared to a loss of SEK 819.19 million the previous year. This turnaround is bolstered by its strategic partnership with Vodafone Turkey, potentially expanding its reach to over 20 million subscribers. The company trades at approximately 35.6% below estimated fair value and boasts high-quality earnings with well-covered interest payments by EBIT at a robust 29x coverage. Additionally, Storytel's debt situation has improved significantly from a debt-to-equity ratio of 116.9% five years ago to just 41.9%.

- Click to explore a detailed breakdown of our findings in Storytel's health report.

Gain insights into Storytel's past trends and performance with our Past report.

Suzhou Secote Precision ElectronicLTD (SHSE:603283)

Simply Wall St Value Rating: ★★★★★☆

Overview: Suzhou Secote Precision Electronic Co., LTD offers automation solutions in the People’s Republic of China and has a market capitalization of CN¥12.71 billion.

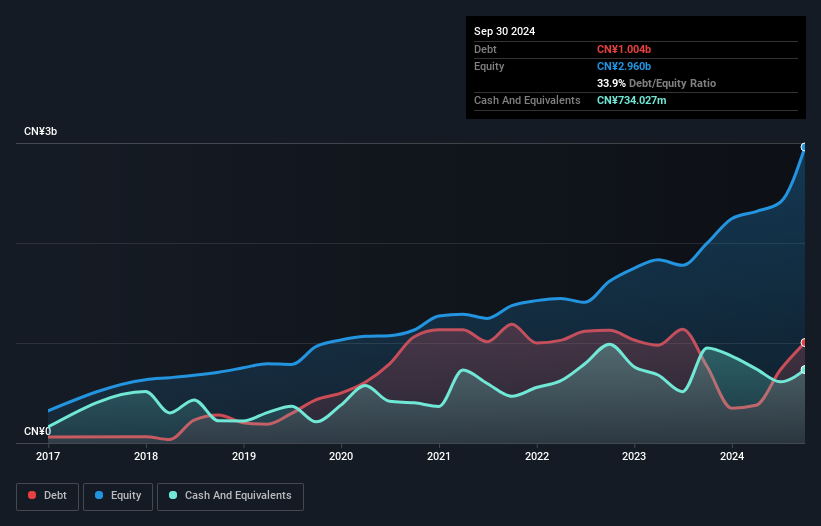

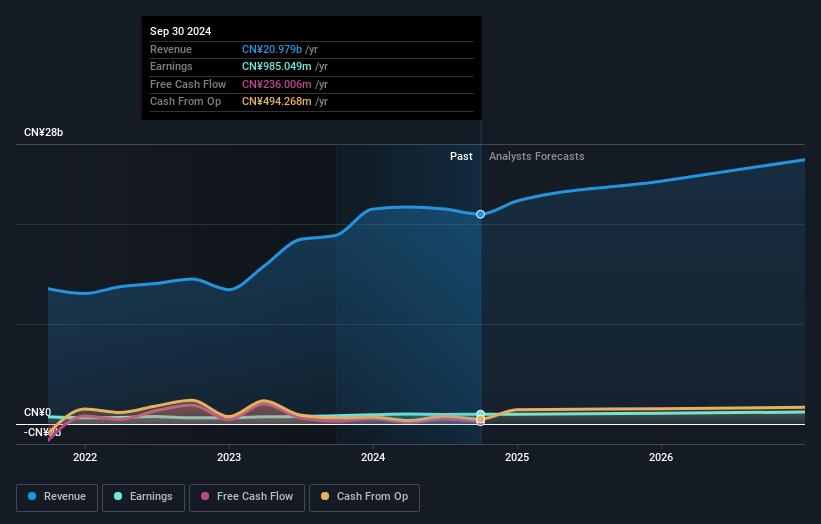

Operations: Secote generates revenue primarily from its Intelligent Manufacturing Equipment segment, which accounts for CN¥5.02 billion. The company has a market capitalization of CN¥12.71 billion.

Secote Precision, a promising player in the machinery sector, has shown impressive earnings growth of 60.2% over the past year, outpacing its industry peers. Its P/E ratio of 16.7x suggests it's trading at a favorable value compared to the broader Chinese market average of 37.1x. The company's interest payments are comfortably covered by EBIT at an impressive 239 times, highlighting robust financial health in this area. While free cash flow remains negative, Secote's debt-to-equity ratio improved from 44.9% to a satisfactory 33.9% over five years, indicating prudent management of financial leverage and potential for future growth amidst industry challenges.

NORINCO International Cooperation (SZSE:000065)

Simply Wall St Value Rating: ★★★★☆☆

Overview: NORINCO International Cooperation Ltd. is an engineering contractor with operations in Asia, Africa, the Middle East, and beyond, with a market cap of CN¥10.29 billion.

Operations: NORINCO International derives its revenue primarily from engineering contracting services across multiple regions. The company's cost structure is significantly influenced by project execution expenses, which impact its profitability metrics. Its net profit margin has shown variability in recent periods, reflecting changes in operational efficiency and market conditions.

NORINCO International Cooperation's financial health appears robust, with interest payments on its debt well covered by EBIT at 22.3 times, indicating strong profitability. The company's net debt to equity ratio stands at a satisfactory 27.9%, suggesting prudent financial management. Over the past year, NORINCO's earnings grew by 19%, outperforming the construction industry's -3.9% performance, and it continues to trade at a good value with a price-to-earnings ratio of 10.4x compared to the CN market average of 37.1x. Despite an increase in its debt to equity ratio from 25.2% five years ago to 62.8%, free cash flow remains positive, supporting future growth prospects effectively.

- Take a closer look at NORINCO International Cooperation's potential here in our health report.

Understand NORINCO International Cooperation's track record by examining our Past report.

Turning Ideas Into Actions

- Dive into all 4703 of the Undiscovered Gems With Strong Fundamentals we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603283

Suzhou Secote Precision ElectronicLTD

Provides automation solutions in the People’s Republic of China.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives