- China

- /

- Aerospace & Defense

- /

- SHSE:688788

Optimistic Investors Push ShenZhen Consys Science&Technology Co., Ltd. (SHSE:688788) Shares Up 44% But Growth Is Lacking

Despite an already strong run, ShenZhen Consys Science&Technology Co., Ltd. (SHSE:688788) shares have been powering on, with a gain of 44% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 84% in the last year.

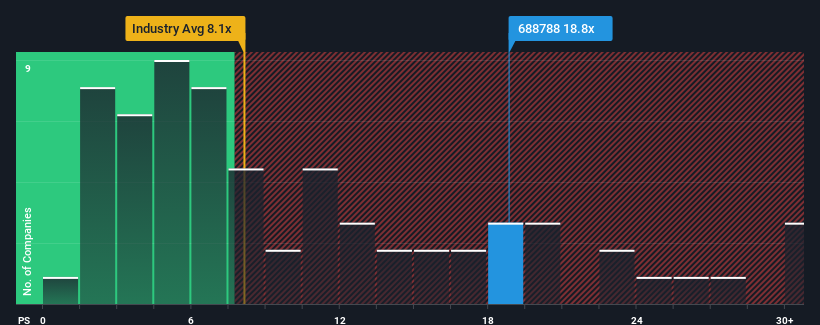

After such a large jump in price, ShenZhen Consys Science&Technology may be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 18.8x, when you consider almost half of the companies in the Aerospace & Defense industry in China have P/S ratios under 8.1x and even P/S lower than 4x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for ShenZhen Consys Science&Technology

How Has ShenZhen Consys Science&Technology Performed Recently?

Revenue has risen firmly for ShenZhen Consys Science&Technology recently, which is pleasing to see. It might be that many expect the respectable revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders may be a little nervous about the viability of the share price.

Although there are no analyst estimates available for ShenZhen Consys Science&Technology, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like ShenZhen Consys Science&Technology's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 27% gain to the company's top line. However, this wasn't enough as the latest three year period has seen the company endure a nasty 70% drop in revenue in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 53% shows it's an unpleasant look.

In light of this, it's alarming that ShenZhen Consys Science&Technology's P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Key Takeaway

The strong share price surge has lead to ShenZhen Consys Science&Technology's P/S soaring as well. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of ShenZhen Consys Science&Technology revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. Right now we aren't comfortable with the high P/S as this revenue performance is highly unlikely to support such positive sentiment for long. Should recent medium-term revenue trends persist, it would pose a significant risk to existing shareholders' investments and prospective investors will have a hard time accepting the current value of the stock.

You should always think about risks. Case in point, we've spotted 2 warning signs for ShenZhen Consys Science&Technology you should be aware of, and 1 of them is significant.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688788

ShenZhen Consys Science&Technology

ShenZhen Consys Science&Technology Co., Ltd.

Flawless balance sheet with very low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026