- Thailand

- /

- Telecom Services and Carriers

- /

- SET:TRUE

Asian Stocks Trading Below Estimated Value For July 2025

Reviewed by Simply Wall St

As global markets respond positively to recent trade deals, Asian stocks are gaining attention amid hopes for continued economic stability and growth. In this environment, identifying undervalued stocks can be a strategic move for investors seeking opportunities in the region's evolving market landscape.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zhuhai CosMX Battery (SHSE:688772) | CN¥14.21 | CN¥27.87 | 49% |

| Xi'an NovaStar Tech (SZSE:301589) | CN¥155.04 | CN¥309.43 | 49.9% |

| SpiderPlus (TSE:4192) | ¥506.00 | ¥993.77 | 49.1% |

| Polaris Holdings (TSE:3010) | ¥220.00 | ¥433.42 | 49.2% |

| LigaChem Biosciences (KOSDAQ:A141080) | ₩139900.00 | ₩277418.79 | 49.6% |

| Hibino (TSE:2469) | ¥2370.00 | ¥4686.23 | 49.4% |

| Guangdong Marubi Biotechnology (SHSE:603983) | CN¥40.40 | CN¥78.51 | 48.5% |

| GEM (SZSE:002340) | CN¥6.69 | CN¥13.14 | 49.1% |

| Fositek (TWSE:6805) | NT$883.00 | NT$1737.53 | 49.2% |

| cottaLTD (TSE:3359) | ¥435.00 | ¥852.54 | 49% |

Let's uncover some gems from our specialized screener.

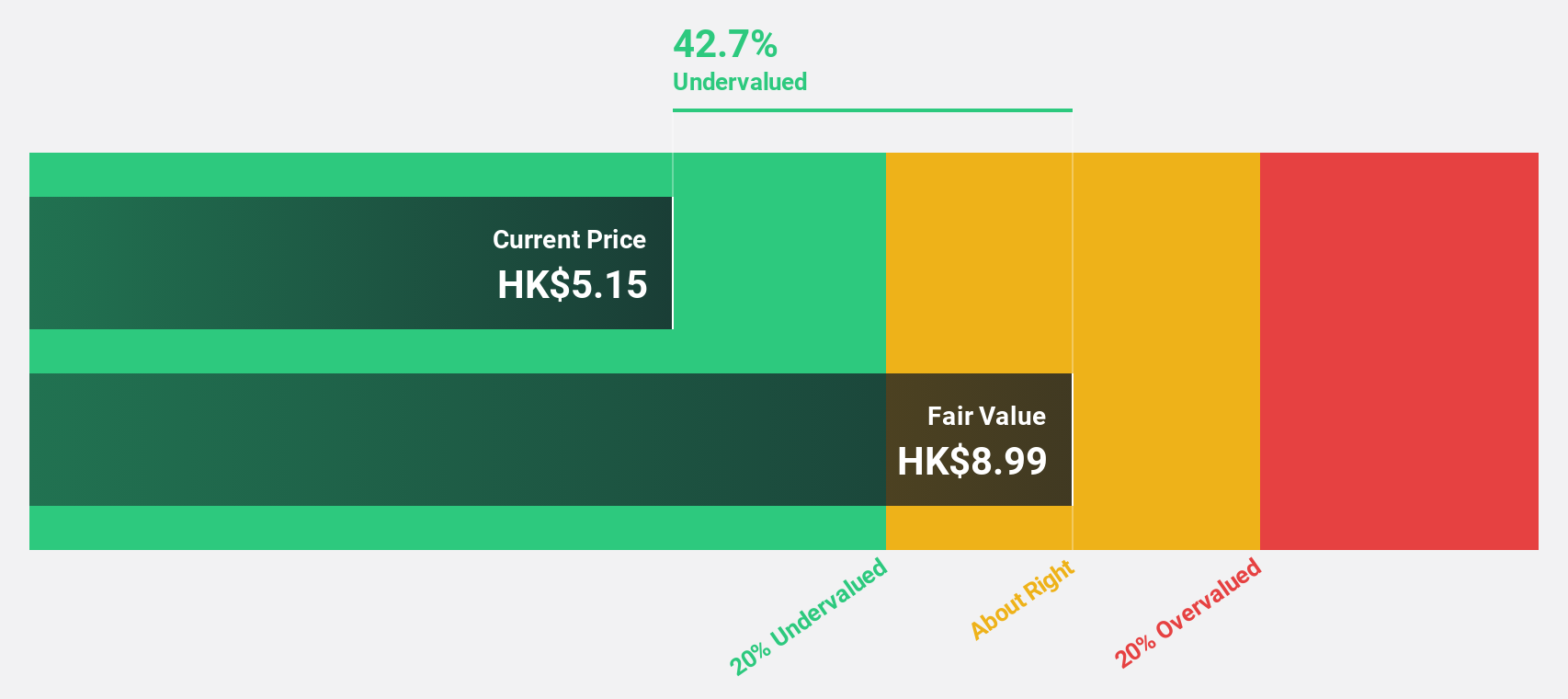

OrbusNeich Medical Group Holdings (SEHK:6929)

Overview: OrbusNeich Medical Group Holdings Limited is involved in the manufacturing, trading, sales, and marketing of medical devices for coronary and peripheral vascular diseases across multiple regions including Japan, Europe, the Middle East, Africa, Asia Pacific, China, and the United States with a market cap of HK$4.18 billion.

Operations: The company's revenue from its Surgical & Medical Equipment segment is $164.10 million.

Estimated Discount To Fair Value: 43.4%

OrbusNeich Medical Group Holdings is trading at HK$5.07, significantly below its estimated fair value of HK$8.96, suggesting it may be undervalued based on cash flows. With expected annual earnings growth of 21.9%, surpassing the Hong Kong market's average, and revenue growth projected at 8.9% per year, the company shows potential for appreciation despite a forecasted low return on equity of 15.7%. Recent dividend affirmations further bolster investor confidence.

- Upon reviewing our latest growth report, OrbusNeich Medical Group Holdings' projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of OrbusNeich Medical Group Holdings stock in this financial health report.

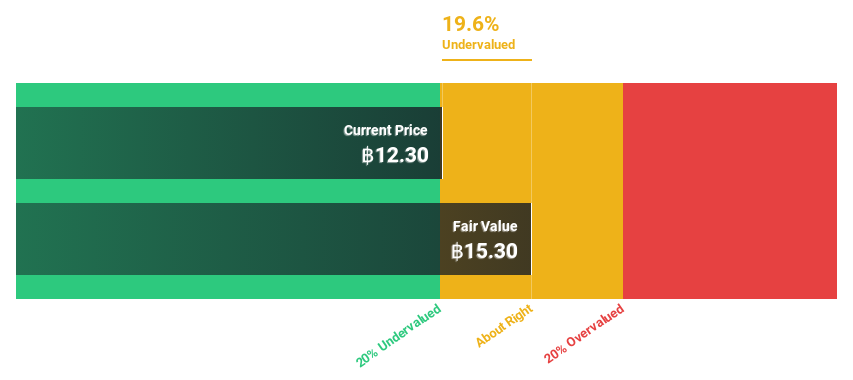

True Corporation (SET:TRUE)

Overview: True Corporation Public Company Limited, along with its subsidiaries, offers telecommunications and value-added services in Thailand with a market cap of THB373.16 billion.

Operations: The company generates revenue from several segments, including Mobile at THB171.52 billion, Pay TV at THB6.79 billion, and Broadband Internet and Others at THB27.79 billion.

Estimated Discount To Fair Value: 29.2%

True Corporation, trading at THB10.8, is undervalued relative to its estimated fair value of THB15.25 and trades 29.2% below this estimate based on discounted cash flow analysis. Despite a forecasted annual revenue decline of 0.5%, earnings are expected to grow significantly by 71.07% per year, outpacing the market average and indicating potential for profitability within three years. Recent leadership changes may influence strategic direction positively amidst these financial dynamics.

- Our growth report here indicates True Corporation may be poised for an improving outlook.

- Take a closer look at True Corporation's balance sheet health here in our report.

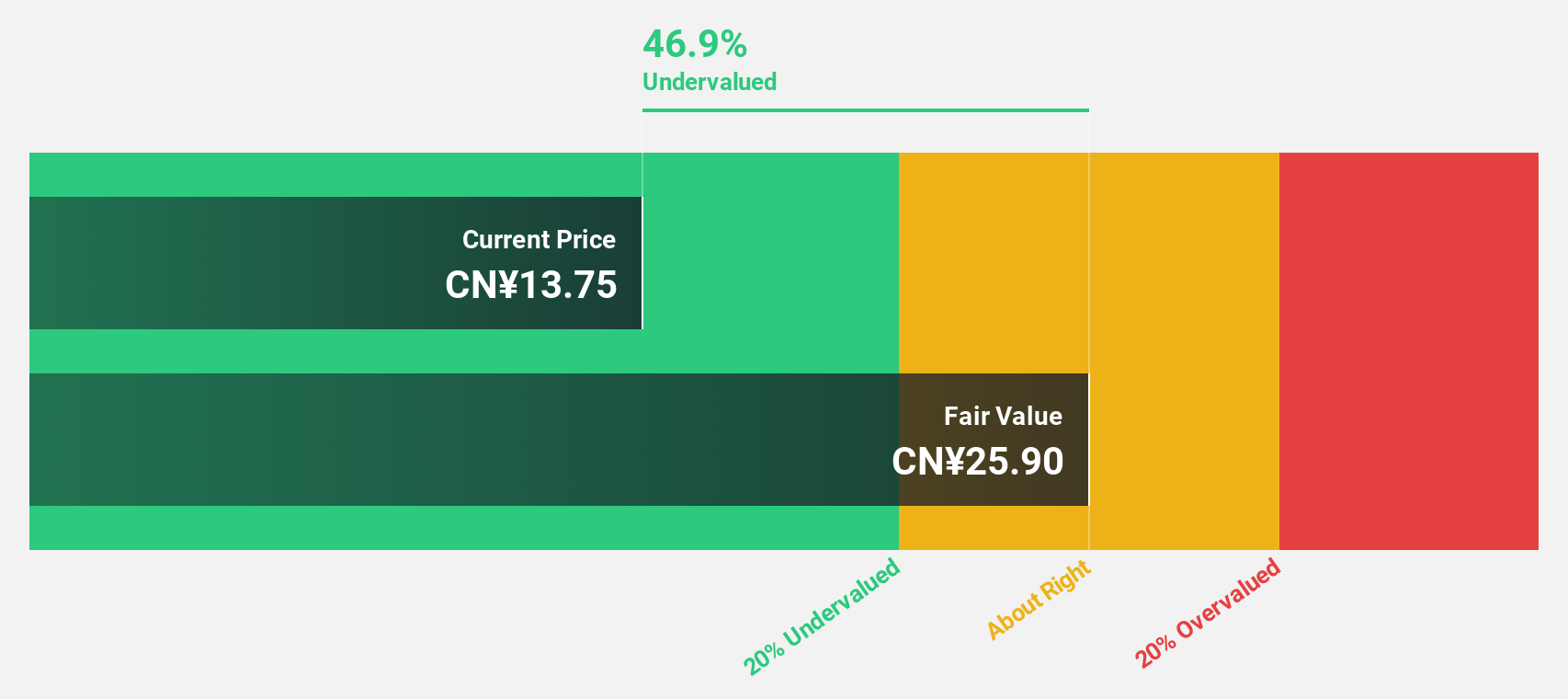

Zhuhai CosMX Battery (SHSE:688772)

Overview: Zhuhai CosMX Battery Co., Ltd. is a global manufacturer and supplier of polymer lithium-ion batteries, with a market cap of CN¥15.99 billion.

Operations: Zhuhai CosMX Battery Co., Ltd. generates its revenue from the manufacturing and supply of polymer lithium-ion batteries on a global scale.

Estimated Discount To Fair Value: 49%

Zhuhai CosMX Battery, priced at CN¥14.21, is significantly undervalued against its fair value estimate of CN¥27.87 based on discounted cash flow analysis, trading 49% below this value. Despite a high debt level and low forecasted return on equity of 15%, its earnings are projected to grow by over 40% annually for the next three years, surpassing market expectations and highlighting strong potential for profitability improvement despite a modest dividend coverage.

- Our earnings growth report unveils the potential for significant increases in Zhuhai CosMX Battery's future results.

- Navigate through the intricacies of Zhuhai CosMX Battery with our comprehensive financial health report here.

Make It Happen

- Get an in-depth perspective on all 261 Undervalued Asian Stocks Based On Cash Flows by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if True Corporation might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:TRUE

True Corporation

Provides telecommunications and value-added services in Thailand.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives