Kunshan Dongwei Technology Co.,Ltd. (SHSE:688700) Not Lagging Industry On Growth Or Pricing

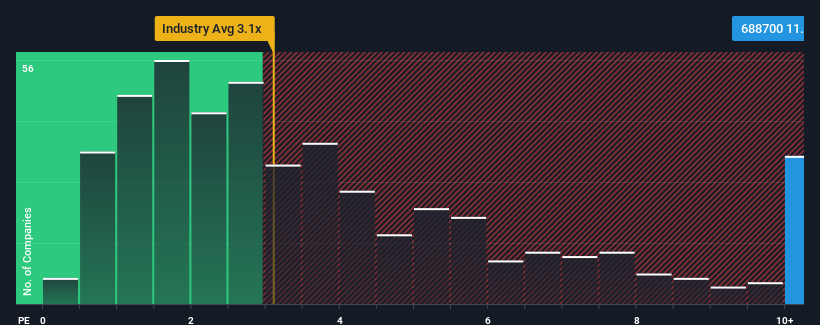

When you see that almost half of the companies in the Machinery industry in China have price-to-sales ratios (or "P/S") below 3.1x, Kunshan Dongwei Technology Co.,Ltd. (SHSE:688700) looks to be giving off strong sell signals with its 11x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Kunshan Dongwei TechnologyLtd

What Does Kunshan Dongwei TechnologyLtd's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Kunshan Dongwei TechnologyLtd's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Kunshan Dongwei TechnologyLtd.How Is Kunshan Dongwei TechnologyLtd's Revenue Growth Trending?

In order to justify its P/S ratio, Kunshan Dongwei TechnologyLtd would need to produce outstanding growth that's well in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 28%. Unfortunately, that's brought it right back to where it started three years ago with revenue growth being virtually non-existent overall during that time. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 134% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 22%, which is noticeably less attractive.

With this in mind, it's not hard to understand why Kunshan Dongwei TechnologyLtd's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Kunshan Dongwei TechnologyLtd's P/S

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Kunshan Dongwei TechnologyLtd's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Kunshan Dongwei TechnologyLtd (at least 1 which is potentially serious), and understanding these should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Kunshan Dongwei TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688700

Kunshan Dongwei TechnologyLtd

Engages in the research and development, manufacture, and sale of print circuit board plating equipment in China.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives