- China

- /

- Electrical

- /

- SHSE:688698

Suzhou Veichi Electric Co., Ltd. (SHSE:688698) Not Flying Under The Radar

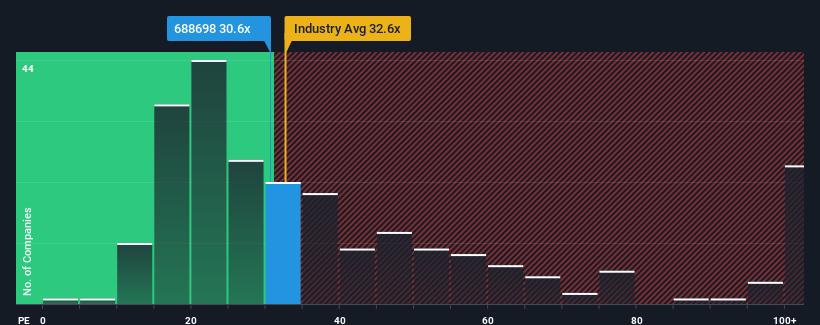

With a median price-to-earnings (or "P/E") ratio of close to 31x in China, you could be forgiven for feeling indifferent about Suzhou Veichi Electric Co., Ltd.'s (SHSE:688698) P/E ratio of 30.6x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Recent times have been advantageous for Suzhou Veichi Electric as its earnings have been rising faster than most other companies. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for Suzhou Veichi Electric

What Are Growth Metrics Telling Us About The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Suzhou Veichi Electric's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 22%. The strong recent performance means it was also able to grow EPS by 39% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 26% per year during the coming three years according to the four analysts following the company. Meanwhile, the rest of the market is forecast to expand by 25% per annum, which is not materially different.

With this information, we can see why Suzhou Veichi Electric is trading at a fairly similar P/E to the market. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What We Can Learn From Suzhou Veichi Electric's P/E?

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Suzhou Veichi Electric maintains its moderate P/E off the back of its forecast growth being in line with the wider market, as expected. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. It's hard to see the share price moving strongly in either direction in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 3 warning signs for Suzhou Veichi Electric you should be aware of, and 1 of them is significant.

If these risks are making you reconsider your opinion on Suzhou Veichi Electric, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Suzhou Veichi Electric, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688698

Suzhou Veichi Electric

Develops, manufactures, and markets industrial automation control products and system solutions in China and internationally.

Flawless balance sheet with high growth potential.