- China

- /

- Electrical

- /

- SHSE:688668

Why Investors Shouldn't Be Surprised By Dongguan Dingtong Precision Metal Co., Ltd.'s (SHSE:688668) 32% Share Price Surge

Dongguan Dingtong Precision Metal Co., Ltd. (SHSE:688668) shareholders are no doubt pleased to see that the share price has bounced 32% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 34% over that time.

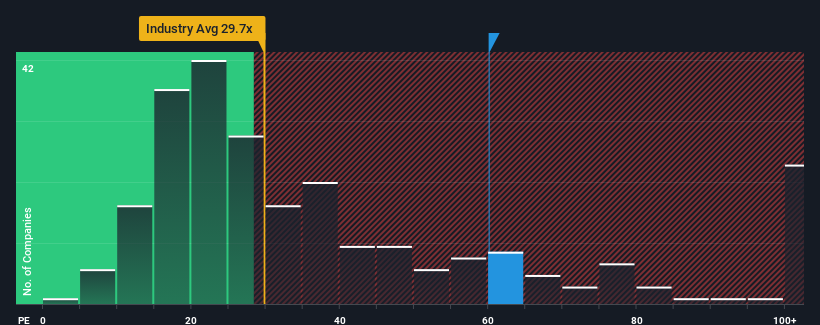

Following the firm bounce in price, given close to half the companies in China have price-to-earnings ratios (or "P/E's") below 30x, you may consider Dongguan Dingtong Precision Metal as a stock to avoid entirely with its 60.1x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

With earnings that are retreating more than the market's of late, Dongguan Dingtong Precision Metal has been very sluggish. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. If not, then existing shareholders may be very nervous about the viability of the share price.

View our latest analysis for Dongguan Dingtong Precision Metal

What Are Growth Metrics Telling Us About The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as Dongguan Dingtong Precision Metal's is when the company's growth is on track to outshine the market decidedly.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 64%. This means it has also seen a slide in earnings over the longer-term as EPS is down 38% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 209% as estimated by the three analysts watching the company. With the market only predicted to deliver 41%, the company is positioned for a stronger earnings result.

With this information, we can see why Dongguan Dingtong Precision Metal is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

The strong share price surge has got Dongguan Dingtong Precision Metal's P/E rushing to great heights as well. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Dongguan Dingtong Precision Metal's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Dongguan Dingtong Precision Metal (at least 1 which is a bit concerning), and understanding these should be part of your investment process.

If these risks are making you reconsider your opinion on Dongguan Dingtong Precision Metal, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688668

Dongguan Dingtong Precision Metal

Dongguan Dingtong Precision Metal Co., Ltd.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives