- China

- /

- Electrical

- /

- SHSE:688663

Here's Why We Think WindSun Science&TechnologyLtd (SHSE:688663) Is Well Worth Watching

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like WindSun Science&TechnologyLtd (SHSE:688663). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide WindSun Science&TechnologyLtd with the means to add long-term value to shareholders.

Check out our latest analysis for WindSun Science&TechnologyLtd

How Quickly Is WindSun Science&TechnologyLtd Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Over the last three years, WindSun Science&TechnologyLtd has grown EPS by 5.3% per year. That might not be particularly high growth, but it does show that per-share earnings are moving steadily in the right direction.

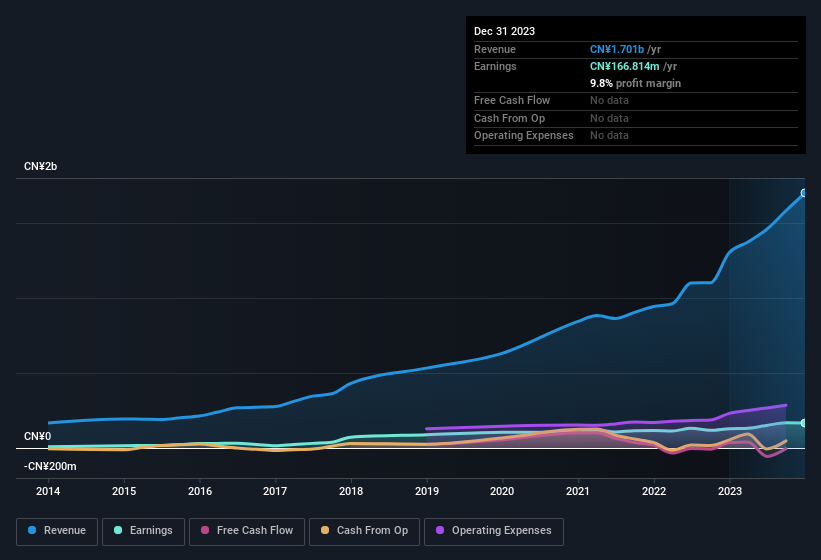

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. WindSun Science&TechnologyLtd maintained stable EBIT margins over the last year, all while growing revenue 30% to CN¥1.7b. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are WindSun Science&TechnologyLtd Insiders Aligned With All Shareholders?

It's a necessity that company leaders act in the best interest of shareholders and so insider investment always comes as a reassurance to the market. WindSun Science&TechnologyLtd followers will find comfort in knowing that insiders have a significant amount of capital that aligns their best interests with the wider shareholder group. As a matter of fact, their holding is valued at CN¥284m. That shows significant buy-in, and may indicate conviction in the business strategy. As a percentage, this totals to 8.1% of the shares on issue for the business, an appreciable amount considering the market cap.

Is WindSun Science&TechnologyLtd Worth Keeping An Eye On?

One positive for WindSun Science&TechnologyLtd is that it is growing EPS. That's nice to see. If that's not enough on its own, there is also the rather notable levels of insider ownership. The combination definitely favoured by investors so consider keeping the company on a watchlist. You should always think about risks though. Case in point, we've spotted 2 warning signs for WindSun Science&TechnologyLtd you should be aware of.

Although WindSun Science&TechnologyLtd certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with insider buying, then check out this handpicked selection of Chinese companies that not only boast of strong growth but have also seen recent insider buying..

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade WindSun Science&TechnologyLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if WindSun Science&TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688663

WindSun Science&TechnologyLtd

Engages in the research and development, production, sale, and service of power electronic energy-saving control technology and related products in China.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives