Amid a backdrop of cautious sentiment in global markets, Asian stocks have shown resilience, with mainland Chinese indices posting gains and Japanese markets rising despite geopolitical uncertainties. In this dynamic environment, identifying promising small-cap stocks requires a keen eye for companies that not only navigate economic challenges but also leverage unique growth opportunities within their sectors.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| FALCO HOLDINGS | 5.07% | -0.61% | -1.29% | ★★★★★★ |

| Techno Ryowa | 1.51% | 9.64% | 32.40% | ★★★★★★ |

| Lumax International | NA | 5.83% | 6.31% | ★★★★★★ |

| Triocean Industrial Corporation | 41.36% | 46.98% | 79.47% | ★★★★★★ |

| TCM Biotech International | 2.84% | 2.11% | 5.25% | ★★★★★★ |

| Johnson Chemical Pharmaceutical Works | 9.07% | 9.87% | 8.78% | ★★★★★☆ |

| Tait Marketing & Distribution | 0.69% | 8.02% | 10.61% | ★★★★★☆ |

| HannStar Board | 96.47% | -3.24% | -4.55% | ★★★★☆☆ |

| Hospital Corporation of China | 138.30% | 28.23% | 50.13% | ★★★★☆☆ |

| Dong Fang Offshore | 41.99% | 33.40% | 39.04% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

China Post Technology (SHSE:688648)

Simply Wall St Value Rating: ★★★★★★

Overview: China Post Technology Co., Ltd. focuses on the research, design, production, sale, and servicing of intelligent logistics systems in China with a market cap of CN¥9.59 billion.

Operations: The primary revenue stream for China Post Technology is the sale of intelligent logistics system products, generating CN¥958.94 million.

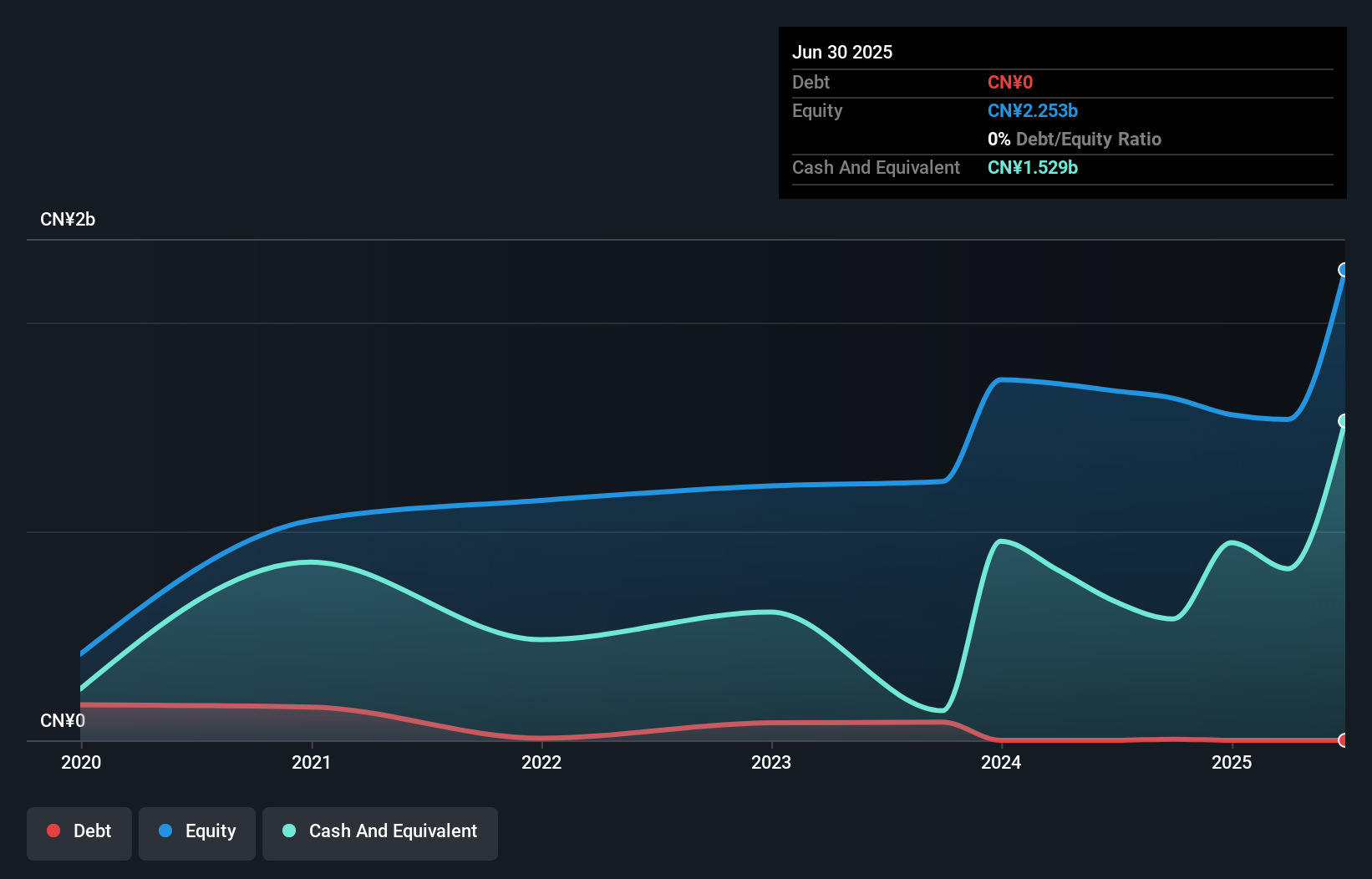

China Post Technology, a nimble player in the industry, stands out with its impressive earnings growth of 16,887% over the past year, far surpassing the Machinery sector's 4%. The company reported CNY 414.22 million in sales for H1 2025 compared to CNY 367.17 million last year and achieved a net income of CNY 694.7 million from a previous loss of CNY 33.28 million. With no debt on its books now versus a debt-to-equity ratio of 22.5% five years ago and a favorable P/E ratio at 16.5x against the market's broader average of 45.5x, it seems well-positioned for potential growth despite recent share price volatility.

- Navigate through the intricacies of China Post Technology with our comprehensive health report here.

Assess China Post Technology's past performance with our detailed historical performance reports.

Xiamen Kingdomway Group (SZSE:002626)

Simply Wall St Value Rating: ★★★★★☆

Overview: Xiamen Kingdomway Group Company is involved in the manufacturing and sale of nutrition and health products both in China and internationally, with a market capitalization of approximately CN¥12.28 billion.

Operations: Xiamen Kingdomway Group generates revenue primarily from pharmaceutical raw materials, contributing CN¥58.40 million.

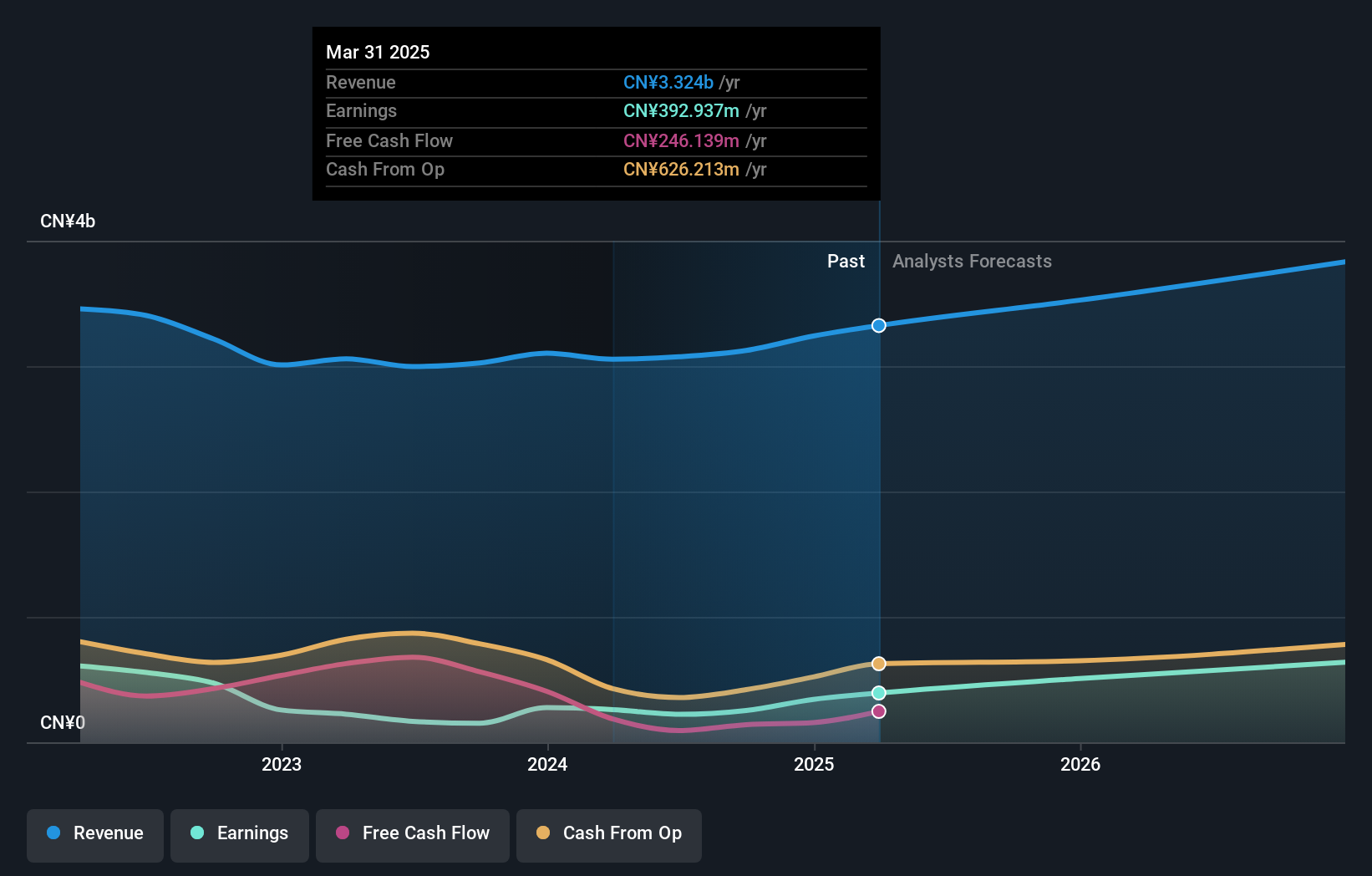

Xiamen Kingdomway Group, a notable player in the pharmaceutical sector, has demonstrated impressive earnings growth of 106% over the past year, significantly outpacing the industry average of -0.6%. Its price-to-earnings ratio stands at 26.8x, which is attractive compared to the broader CN market's 45.5x. Despite an increase in its debt-to-equity ratio from 27.6% to 36.7% over five years, it remains financially sound with more cash than total debt and positive free cash flow. Future earnings are expected to grow by approximately 14% annually, suggesting potential for continued robust performance in this competitive field.

- Click to explore a detailed breakdown of our findings in Xiamen Kingdomway Group's health report.

Understand Xiamen Kingdomway Group's track record by examining our Past report.

Ruida FuturesLtd (SZSE:002961)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Ruida Futures Co., Ltd. operates as a futures company in China with a market capitalization of CN¥9.59 billion.

Operations: Ruida Futures generates revenue primarily from risk management and futures brokerage, with CN¥1.01 billion and CN¥627.15 million, respectively. The asset management business contributes CN¥197.12 million to the total revenue stream.

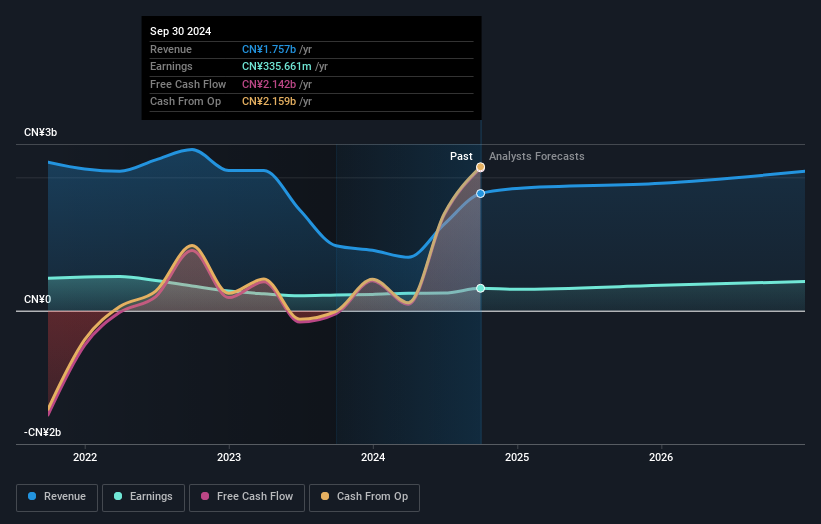

Ruida Futures, a dynamic player in the capital markets, has seen its earnings soar by 79.9% over the past year, outpacing industry growth of 57%. Trading at a price-to-earnings ratio of 20.3x, it offers good value compared to the broader CN market's 45.5x. Despite an increase in its debt-to-equity ratio from 19.5 to 25.3 over five years, Ruida holds more cash than total debt and boasts high-quality earnings with positive free cash flow of CNY 2.14 billion as of September 2024. Recent dividends highlight strong performance with net income climbing from CNY 136 million to CNY 228 million year-over-year for H1-2025.

- Unlock comprehensive insights into our analysis of Ruida FuturesLtd stock in this health report.

Explore historical data to track Ruida FuturesLtd's performance over time in our Past section.

Summing It All Up

- Discover the full array of 2380 Asian Undiscovered Gems With Strong Fundamentals right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002626

Xiamen Kingdomway Group

Engages in the manufacturing and sale of the nutrition and health products in China and internationally.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives