- China

- /

- Aerospace & Defense

- /

- SHSE:688631

Nanjing LES Information Technology Co., Ltd.'s (SHSE:688631) 25% Share Price Surge Not Quite Adding Up

Nanjing LES Information Technology Co., Ltd. (SHSE:688631) shareholders are no doubt pleased to see that the share price has bounced 25% in the last month, although it is still struggling to make up recently lost ground. The last month tops off a massive increase of 296% in the last year.

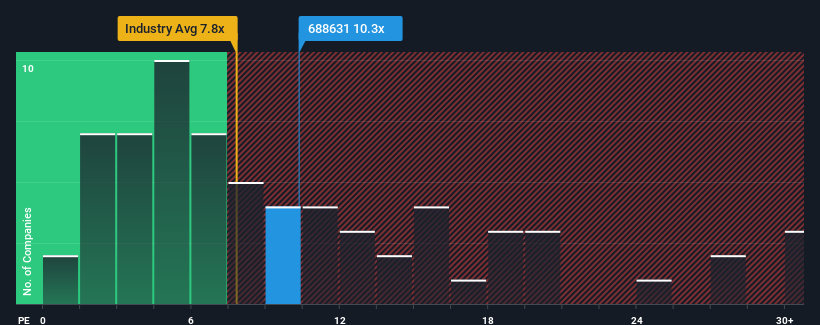

Since its price has surged higher, given close to half the companies operating in China's Aerospace & Defense industry have price-to-sales ratios (or "P/S") below 7.8x, you may consider Nanjing LES Information Technology as a stock to potentially avoid with its 10.3x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Nanjing LES Information Technology

How Has Nanjing LES Information Technology Performed Recently?

There hasn't been much to differentiate Nanjing LES Information Technology's and the industry's retreating revenue lately. It might be that many expect the company's revenue to strengthen positively despite the tough industry conditions, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Nanjing LES Information Technology will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

Nanjing LES Information Technology's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 4.3%. At least revenue has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, revenue is anticipated to climb by 30% during the coming year according to the two analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 53%, which is noticeably more attractive.

In light of this, it's alarming that Nanjing LES Information Technology's P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From Nanjing LES Information Technology's P/S?

Nanjing LES Information Technology's P/S is on the rise since its shares have risen strongly. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It comes as a surprise to see Nanjing LES Information Technology trade at such a high P/S given the revenue forecasts look less than stellar. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

You should always think about risks. Case in point, we've spotted 2 warning signs for Nanjing LES Information Technology you should be aware of, and 1 of them is significant.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Nanjing LES Information Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688631

Nanjing LES Information Technology

Nanjing LES Information Technology Co., Ltd.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives