- China

- /

- Electrical

- /

- SHSE:688629

Sichuan Huafeng Technology Co., LTD.'s (SHSE:688629) P/S Still Appears To Be Reasonable

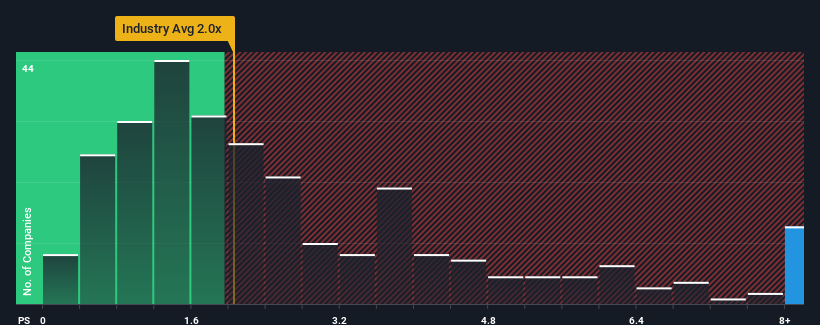

When you see that almost half of the companies in the Electrical industry in China have price-to-sales ratios (or "P/S") below 2x, Sichuan Huafeng Technology Co., LTD. (SHSE:688629) looks to be giving off strong sell signals with its 11.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Sichuan Huafeng Technology

What Does Sichuan Huafeng Technology's P/S Mean For Shareholders?

Sichuan Huafeng Technology hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Keen to find out how analysts think Sichuan Huafeng Technology's future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For Sichuan Huafeng Technology?

The only time you'd be truly comfortable seeing a P/S as steep as Sichuan Huafeng Technology's is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 5.2%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 24% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 45% as estimated by the dual analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 27%, which is noticeably less attractive.

With this in mind, it's not hard to understand why Sichuan Huafeng Technology's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Sichuan Huafeng Technology's P/S Mean For Investors?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Sichuan Huafeng Technology maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Electrical industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

You should always think about risks. Case in point, we've spotted 2 warning signs for Sichuan Huafeng Technology you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688629

Sichuan Huafeng Technology

Sichuan Huafeng Technology Co., Ltd. engages in the research, development, manufacture, and sale of electrical connectors.

High growth potential with mediocre balance sheet.