- China

- /

- Electrical

- /

- SHSE:688629

Sichuan Huafeng Technology Co., LTD.'s (SHSE:688629) 25% Cheaper Price Remains In Tune With Revenues

The Sichuan Huafeng Technology Co., LTD. (SHSE:688629) share price has softened a substantial 25% over the previous 30 days, handing back much of the gains the stock has made lately. To make matters worse, the recent drop has wiped out a year's worth of gains with the share price now back where it started a year ago.

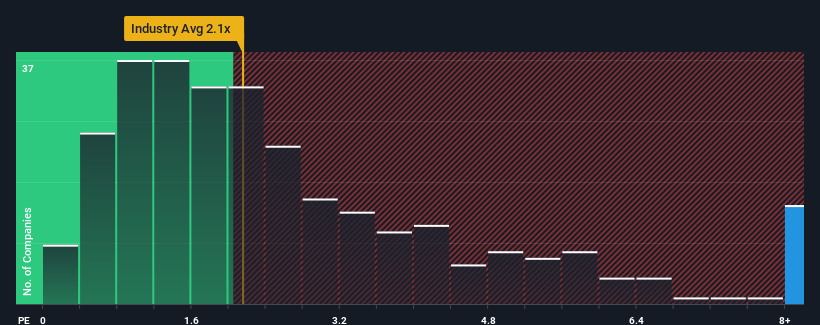

Even after such a large drop in price, you could still be forgiven for thinking Sichuan Huafeng Technology is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 11.4x, considering almost half the companies in China's Electrical industry have P/S ratios below 2.1x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Sichuan Huafeng Technology

What Does Sichuan Huafeng Technology's Recent Performance Look Like?

Sichuan Huafeng Technology hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Sichuan Huafeng Technology will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as steep as Sichuan Huafeng Technology's is when the company's growth is on track to outshine the industry decidedly.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 8.0%. Regardless, revenue has managed to lift by a handy 25% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 31% over the next year. That's shaping up to be materially higher than the 23% growth forecast for the broader industry.

In light of this, it's understandable that Sichuan Huafeng Technology's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Even after such a strong price drop, Sichuan Huafeng Technology's P/S still exceeds the industry median significantly. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look into Sichuan Huafeng Technology shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Before you take the next step, you should know about the 1 warning sign for Sichuan Huafeng Technology that we have uncovered.

If these risks are making you reconsider your opinion on Sichuan Huafeng Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688629

Sichuan Huafeng Technology

Engages in the research, development, manufacture, and sale of optical and electrical connectors and cable assemblies in China.

High growth potential with adequate balance sheet.