It's A Story Of Risk Vs Reward With Beijing Tieke Shougang Rail Way-Tech Co., Ltd. (SHSE:688569)

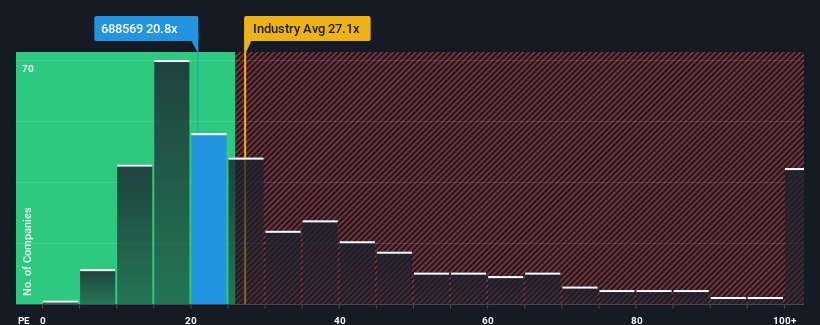

When close to half the companies in China have price-to-earnings ratios (or "P/E's") above 29x, you may consider Beijing Tieke Shougang Rail Way-Tech Co., Ltd. (SHSE:688569) as an attractive investment with its 20.8x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Beijing Tieke Shougang Rail Way-Tech could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Beijing Tieke Shougang Rail Way-Tech

Is There Any Growth For Beijing Tieke Shougang Rail Way-Tech?

There's an inherent assumption that a company should underperform the market for P/E ratios like Beijing Tieke Shougang Rail Way-Tech's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 37% decrease to the company's bottom line. That put a dampener on the good run it was having over the longer-term as its three-year EPS growth is still a noteworthy 22% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 51% each year during the coming three years according to the sole analyst following the company. Meanwhile, the rest of the market is forecast to only expand by 25% each year, which is noticeably less attractive.

In light of this, it's peculiar that Beijing Tieke Shougang Rail Way-Tech's P/E sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Beijing Tieke Shougang Rail Way-Tech's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Beijing Tieke Shougang Rail Way-Tech that you need to be mindful of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Tieke Shougang Rail Way-Tech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688569

Beijing Tieke Shougang Rail Way-Tech

Beijing Tieke Shougang Rail Way-Tech Co., Ltd.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives