Shenzhen United Winners Laser Co., Ltd. (SHSE:688518) Soars 33% But It's A Story Of Risk Vs Reward

Shenzhen United Winners Laser Co., Ltd. (SHSE:688518) shareholders are no doubt pleased to see that the share price has bounced 33% in the last month, although it is still struggling to make up recently lost ground. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 52% share price drop in the last twelve months.

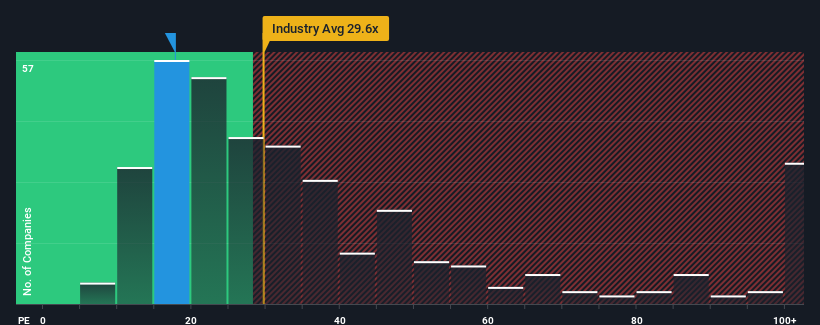

Although its price has surged higher, Shenzhen United Winners Laser's price-to-earnings (or "P/E") ratio of 17.8x might still make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 30x and even P/E's above 55x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

The recently shrinking earnings for Shenzhen United Winners Laser have been in line with the market. It might be that many expect the company's earnings performance to degrade further, which has repressed the P/E. You'd much rather the company wasn't bleeding earnings if you still believe in the business. At the very least, you'd be hoping that earnings don't fall off a cliff if your plan is to pick up some stock while it's out of favour.

Check out our latest analysis for Shenzhen United Winners Laser

How Is Shenzhen United Winners Laser's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as low as Shenzhen United Winners Laser's is when the company's growth is on track to lag the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 2.3%. Still, the latest three year period has seen an excellent 230% overall rise in EPS, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Looking ahead now, EPS is anticipated to climb by 53% during the coming year according to the eight analysts following the company. That's shaping up to be materially higher than the 41% growth forecast for the broader market.

With this information, we find it odd that Shenzhen United Winners Laser is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From Shenzhen United Winners Laser's P/E?

The latest share price surge wasn't enough to lift Shenzhen United Winners Laser's P/E close to the market median. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Shenzhen United Winners Laser currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

You should always think about risks. Case in point, we've spotted 1 warning sign for Shenzhen United Winners Laser you should be aware of.

Of course, you might also be able to find a better stock than Shenzhen United Winners Laser. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688518

Shenzhen United Winners Laser

Manufactures and sells laser welding equipment in China and internationally.

Reasonable growth potential with adequate balance sheet.