- China

- /

- Auto Components

- /

- SZSE:002536

Undiscovered Gems And 2 Other Small Caps With Strong Fundamentals

Reviewed by Simply Wall St

As the global markets navigate a landscape of rising inflation and volatile interest rates, small-cap stocks have been trailing behind their larger counterparts, with the Russell 2000 Index underperforming compared to major indices like the S&P 500. Amidst this backdrop, discovering stocks with strong fundamentals becomes crucial, as these attributes can provide resilience and potential growth opportunities even when broader market sentiment is uncertain.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Powertip Image | 0.57% | 10.95% | 29.26% | ★★★★★★ |

| Ad-Sol Nissin | NA | 7.54% | 9.63% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Fauji Foods | 62.10% | 30.05% | 58.43% | ★★★★★★ |

| Kenturn Nano. Tec | 45.38% | 9.73% | 28.94% | ★★★★★☆ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| Hollyland (China) Electronics Technology | 3.46% | 13.95% | 11.27% | ★★★★★☆ |

| Pizu Group Holdings | 48.10% | -4.86% | -19.23% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Dongsung FineTec (KOSDAQ:A033500)

Simply Wall St Value Rating: ★★★★★★

Overview: Dongsung FineTec Co., Ltd. is a South Korean company specializing in the manufacture and sale of cryogenic insulation products, with a market cap of approximately ₩601 billion.

Operations: Dongsung FineTec generates revenue primarily from its Cooling Material segment, contributing ₩528.74 billion, and a smaller portion from its Gas Business at ₩21.94 billion.

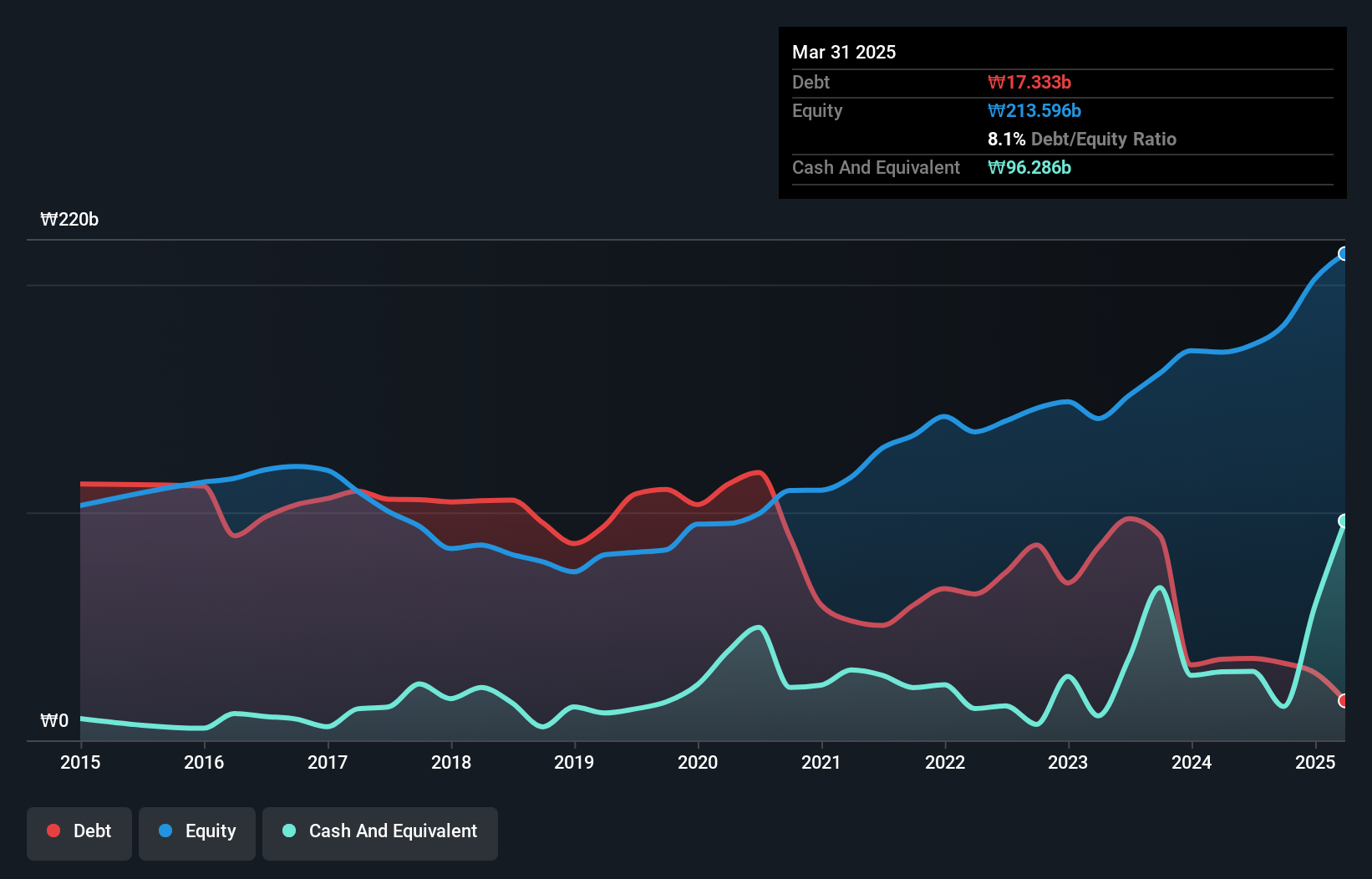

In the bustling world of small-cap stocks, Dongsung FineTec stands out with a compelling narrative. Over the past year, its earnings surged by 27.5%, outpacing the broader Chemicals industry growth of 20.9%. This financial dynamo has impressively reduced its debt to equity ratio from 131.6% to just 18.6% over five years, showcasing prudent financial management. With interest payments well covered by EBIT at a robust 23.6 times coverage, it seems poised for stability amidst market fluctuations. Trading at a significant discount of 33.6% below estimated fair value suggests potential upside for discerning investors exploring this sector's opportunities.

- Unlock comprehensive insights into our analysis of Dongsung FineTec stock in this health report.

Assess Dongsung FineTec's past performance with our detailed historical performance reports.

Beijing HyperStrong Technology (SHSE:688411)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Beijing HyperStrong Technology Co., Ltd. specializes in the design, development, integration, and operation of energy storage power stations across China, Europe, North America, and Australia with a market cap of CN¥10.86 billion.

Operations: HyperStrong generates revenue primarily through its energy storage power station operations across multiple regions. The company has a market cap of CN¥10.86 billion, reflecting its position in the industry.

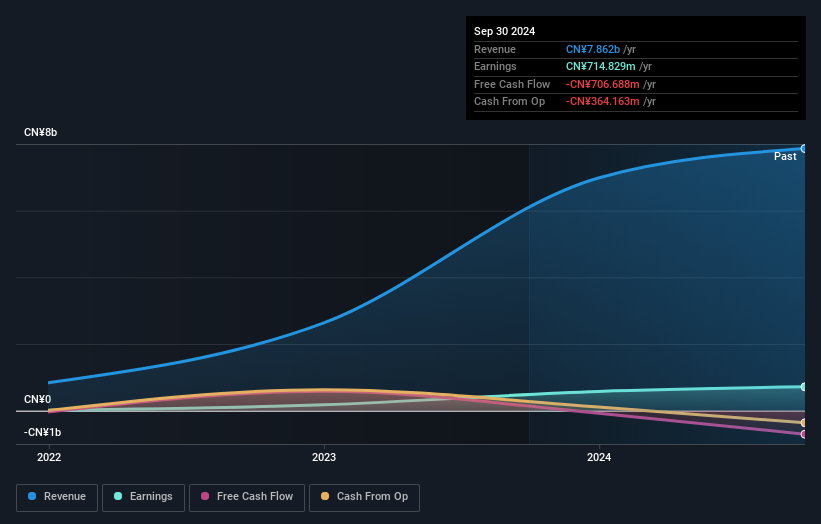

HyperStrong, a relatively small player in the tech space, recently completed an IPO raising CNY 861.10 million, offering shares at CNY 19.38 each. The company boasts impressive earnings growth of 49.8% over the past year, outpacing its industry peers significantly. Despite this growth, their free cash flow remains negative at -CNY 706.69 million as of September 2024, which could be a concern for potential investors. A strategic alliance with NW aims to expand HyperStrong's reach in Asia through energy storage and charging solutions, leveraging its expertise and established presence in battery systems integration across the region.

Feilong Auto Components (SZSE:002536)

Simply Wall St Value Rating: ★★★★★★

Overview: Feilong Auto Components Co., Ltd. processes, manufactures, and sells auto parts both in China and internationally, with a market capitalization of approximately CN¥7.87 billion.

Operations: Feilong Auto Components generates revenue primarily from its automotive parts segment, amounting to approximately CN¥4.50 billion.

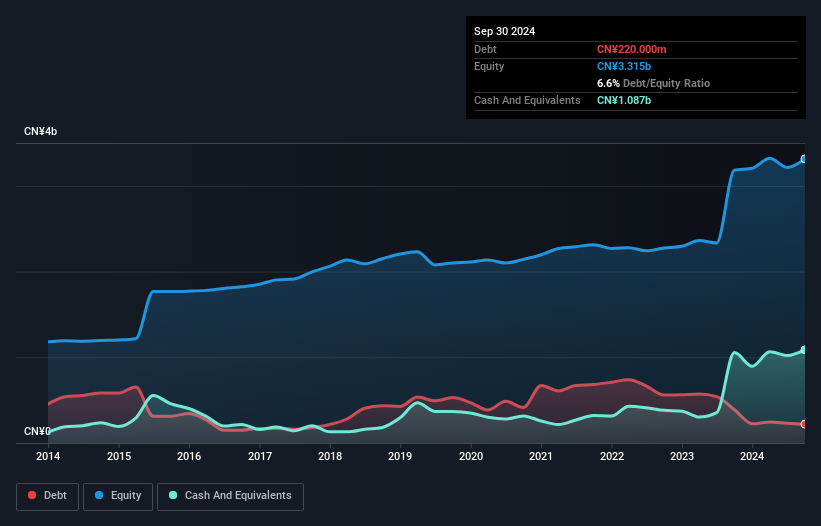

Feilong Auto Components, a smaller player in the auto parts industry, has demonstrated robust performance with earnings growing 21% last year, surpassing the industry's 10.5% growth. The company is poised for future success with earnings projected to increase by 29.7% annually. Its price-to-earnings ratio of 27x offers good value compared to the broader CN market's 36x. Over five years, Feilong has significantly reduced its debt-to-equity ratio from 25% to just under 7%, indicating improved financial health. A recent shareholder meeting aimed at amending governance documents suggests a proactive approach to corporate management and strategy refinement.

Next Steps

- Delve into our full catalog of 4713 Undiscovered Gems With Strong Fundamentals here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002536

Feilong Auto Components

Feilong Auto Components Co., Ltd., together with its subsidiaries, process, manufactures, and sells auto parts in China and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives