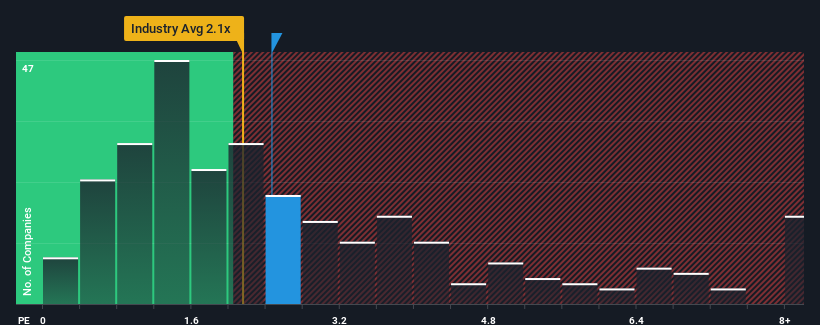

It's not a stretch to say that Arctech Solar Holding Co., Ltd.'s (SHSE:688408) price-to-sales (or "P/S") ratio of 2.5x right now seems quite "middle-of-the-road" for companies in the Electrical industry in China, where the median P/S ratio is around 2.1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Arctech Solar Holding

How Has Arctech Solar Holding Performed Recently?

Arctech Solar Holding certainly has been doing a good job lately as it's been growing revenue more than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Arctech Solar Holding.How Is Arctech Solar Holding's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Arctech Solar Holding's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered an exceptional 64% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 71% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 38% per year as estimated by the three analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 18% each year, which is noticeably less attractive.

With this in consideration, we find it intriguing that Arctech Solar Holding's P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Bottom Line On Arctech Solar Holding's P/S

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Despite enticing revenue growth figures that outpace the industry, Arctech Solar Holding's P/S isn't quite what we'd expect. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

You always need to take note of risks, for example - Arctech Solar Holding has 1 warning sign we think you should be aware of.

If these risks are making you reconsider your opinion on Arctech Solar Holding, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688408

Arctech Solar Holding

Manufactures and supplies solar trackers, fixed-tilt structures, and building-integrated photovoltaics (BIPV) solutions for utility-scale and commercial solar projects worldwide.

Very undervalued with high growth potential.