SBT Ultrasonic Technology Co.,Ltd.'s (SHSE:688392) Share Price Not Quite Adding Up

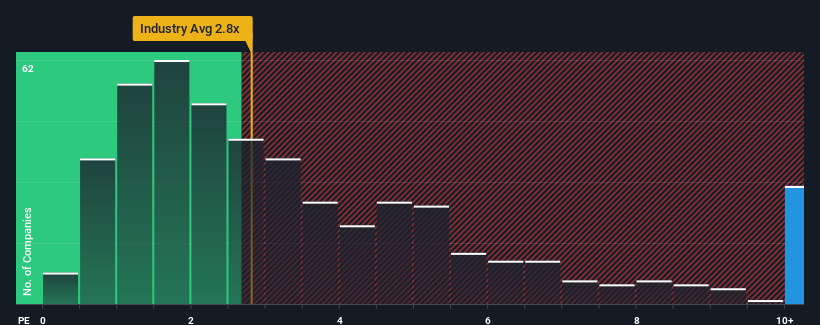

When close to half the companies in the Machinery industry in China have price-to-sales ratios (or "P/S") below 2.8x, you may consider SBT Ultrasonic Technology Co.,Ltd. (SHSE:688392) as a stock to avoid entirely with its 11.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for SBT Ultrasonic TechnologyLtd

How SBT Ultrasonic TechnologyLtd Has Been Performing

Recent times haven't been great for SBT Ultrasonic TechnologyLtd as its revenue has been rising slower than most other companies. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on SBT Ultrasonic TechnologyLtd.Is There Enough Revenue Growth Forecasted For SBT Ultrasonic TechnologyLtd?

In order to justify its P/S ratio, SBT Ultrasonic TechnologyLtd would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 2.8% last year. Pleasingly, revenue has also lifted 103% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 20% over the next year. With the industry predicted to deliver 27% growth, the company is positioned for a weaker revenue result.

In light of this, it's alarming that SBT Ultrasonic TechnologyLtd's P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It comes as a surprise to see SBT Ultrasonic TechnologyLtd trade at such a high P/S given the revenue forecasts look less than stellar. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

We don't want to rain on the parade too much, but we did also find 2 warning signs for SBT Ultrasonic TechnologyLtd that you need to be mindful of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688392

SBT Ultrasonic Technology

Engages in the development, manufacture, and sale of ultrasonic equipment and application solutions worldwide.

High growth potential with proven track record.

Market Insights

Community Narratives