- China

- /

- Electrical

- /

- SHSE:688388

It's Down 25% But Guangdong Jiayuan Technology Co.,Ltd. (SHSE:688388) Could Be Riskier Than It Looks

To the annoyance of some shareholders, Guangdong Jiayuan Technology Co.,Ltd. (SHSE:688388) shares are down a considerable 25% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 59% loss during that time.

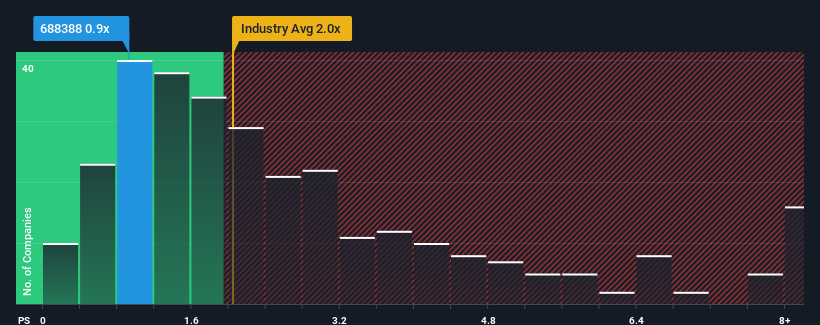

Since its price has dipped substantially, considering around half the companies operating in China's Electrical industry have price-to-sales ratios (or "P/S") above 2x, you may consider Guangdong Jiayuan TechnologyLtd as an solid investment opportunity with its 0.9x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Guangdong Jiayuan TechnologyLtd

What Does Guangdong Jiayuan TechnologyLtd's Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, Guangdong Jiayuan TechnologyLtd has been relatively sluggish. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Guangdong Jiayuan TechnologyLtd will help you uncover what's on the horizon.How Is Guangdong Jiayuan TechnologyLtd's Revenue Growth Trending?

In order to justify its P/S ratio, Guangdong Jiayuan TechnologyLtd would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a decent 5.4% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 210% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 39% over the next year. That's shaping up to be materially higher than the 24% growth forecast for the broader industry.

With this information, we find it odd that Guangdong Jiayuan TechnologyLtd is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Bottom Line On Guangdong Jiayuan TechnologyLtd's P/S

Guangdong Jiayuan TechnologyLtd's P/S has taken a dip along with its share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

A look at Guangdong Jiayuan TechnologyLtd's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Guangdong Jiayuan TechnologyLtd with six simple checks.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688388

Guangdong Jiayuan TechnologyLtd

Engages in the research, development, manufacture, and sale of electrolytic copper foils.

High growth potential and fair value.

Market Insights

Community Narratives