Xi'an Bright Laser Technologies Co.,Ltd. (SHSE:688333) Stocks Shoot Up 43% But Its P/E Still Looks Reasonable

Xi'an Bright Laser Technologies Co.,Ltd. (SHSE:688333) shares have had a really impressive month, gaining 43% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 25% over that time.

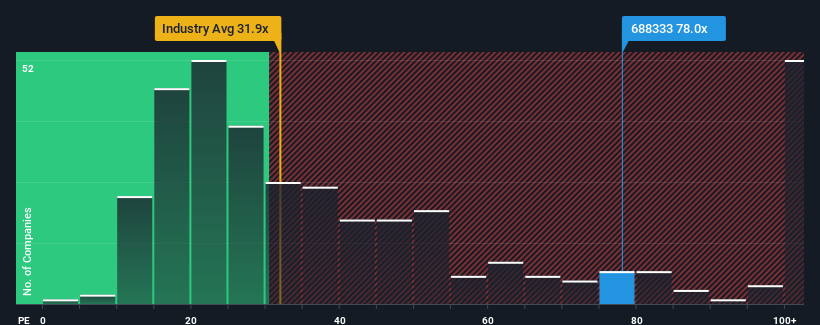

Following the firm bounce in price, Xi'an Bright Laser TechnologiesLtd may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 78x, since almost half of all companies in China have P/E ratios under 33x and even P/E's lower than 20x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Xi'an Bright Laser TechnologiesLtd has been doing quite well of late. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

Check out our latest analysis for Xi'an Bright Laser TechnologiesLtd

What Are Growth Metrics Telling Us About The High P/E?

Xi'an Bright Laser TechnologiesLtd's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 41% last year. The strong recent performance means it was also able to grow EPS by 917% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 37% per year as estimated by the four analysts watching the company. That's shaping up to be materially higher than the 19% each year growth forecast for the broader market.

In light of this, it's understandable that Xi'an Bright Laser TechnologiesLtd's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Xi'an Bright Laser TechnologiesLtd's P/E

Xi'an Bright Laser TechnologiesLtd's P/E is flying high just like its stock has during the last month. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Xi'an Bright Laser TechnologiesLtd's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Xi'an Bright Laser TechnologiesLtd (at least 1 which is a bit unpleasant), and understanding these should be part of your investment process.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688333

Xi'an Bright Laser TechnologiesLtd

Offers metal additive manufacturing and repairing solutions in the People's Republic of China.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives