Xi'an Bright Laser Technologies Co.,Ltd. (SHSE:688333) Stocks Shoot Up 26% But Its P/S Still Looks Reasonable

Xi'an Bright Laser Technologies Co.,Ltd. (SHSE:688333) shareholders are no doubt pleased to see that the share price has bounced 26% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 24% over that time.

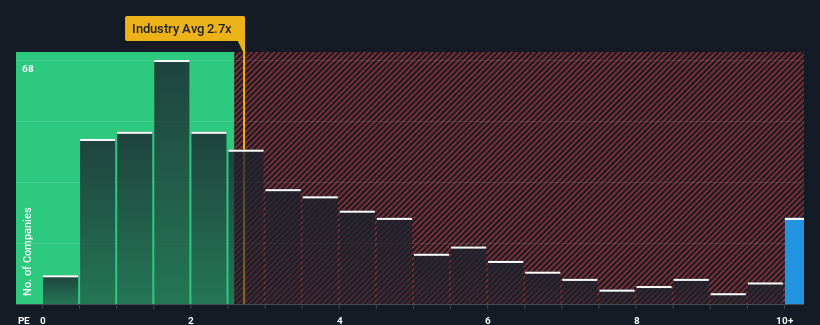

Since its price has surged higher, you could be forgiven for thinking Xi'an Bright Laser TechnologiesLtd is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 13.6x, considering almost half the companies in China's Machinery industry have P/S ratios below 2.7x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Xi'an Bright Laser TechnologiesLtd

What Does Xi'an Bright Laser TechnologiesLtd's P/S Mean For Shareholders?

Recent times have been advantageous for Xi'an Bright Laser TechnologiesLtd as its revenues have been rising faster than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Xi'an Bright Laser TechnologiesLtd.Do Revenue Forecasts Match The High P/S Ratio?

Xi'an Bright Laser TechnologiesLtd's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 37% last year. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 56% during the coming year according to the six analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 27%, which is noticeably less attractive.

With this in mind, it's not hard to understand why Xi'an Bright Laser TechnologiesLtd's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

The strong share price surge has lead to Xi'an Bright Laser TechnologiesLtd's P/S soaring as well. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look into Xi'an Bright Laser TechnologiesLtd shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Xi'an Bright Laser TechnologiesLtd (2 make us uncomfortable) you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688333

Xi'an Bright Laser TechnologiesLtd

Offers metal additive manufacturing and repairing solutions in the People's Republic of China.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives