OKE Precision Cutting Tools Co., Ltd.'s (SHSE:688308) Shares Leap 26% Yet They're Still Not Telling The Full Story

OKE Precision Cutting Tools Co., Ltd. (SHSE:688308) shares have had a really impressive month, gaining 26% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 30% over that time.

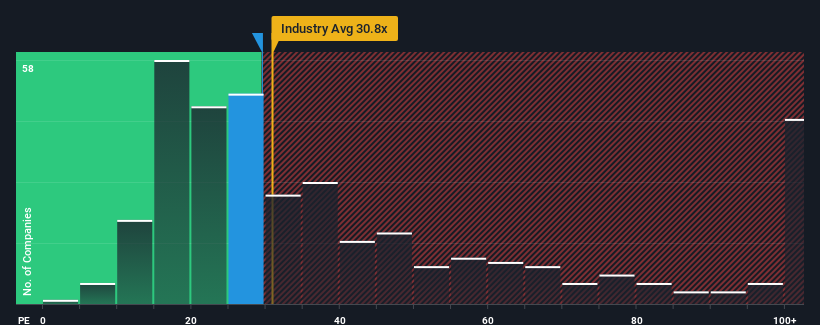

Even after such a large jump in price, there still wouldn't be many who think OKE Precision Cutting Tools' price-to-earnings (or "P/E") ratio of 29.5x is worth a mention when the median P/E in China is similar at about 32x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

OKE Precision Cutting Tools could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. One possibility is that the P/E is moderate because investors think this poor earnings performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

View our latest analysis for OKE Precision Cutting Tools

Does Growth Match The P/E?

OKE Precision Cutting Tools' P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 49%. This means it has also seen a slide in earnings over the longer-term as EPS is down 28% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 32% per annum as estimated by the five analysts watching the company. With the market only predicted to deliver 25% each year, the company is positioned for a stronger earnings result.

With this information, we find it interesting that OKE Precision Cutting Tools is trading at a fairly similar P/E to the market. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

OKE Precision Cutting Tools appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that OKE Precision Cutting Tools currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Before you settle on your opinion, we've discovered 4 warning signs for OKE Precision Cutting Tools (1 makes us a bit uncomfortable!) that you should be aware of.

Of course, you might also be able to find a better stock than OKE Precision Cutting Tools. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688308

OKE Precision Cutting Tools

Engages in the research, development, production, and sale of CNC tool and cemented carbide products.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives