Not Many Are Piling Into OKE Precision Cutting Tools Co., Ltd. (SHSE:688308) Stock Yet As It Plummets 25%

OKE Precision Cutting Tools Co., Ltd. (SHSE:688308) shareholders won't be pleased to see that the share price has had a very rough month, dropping 25% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 33% in that time.

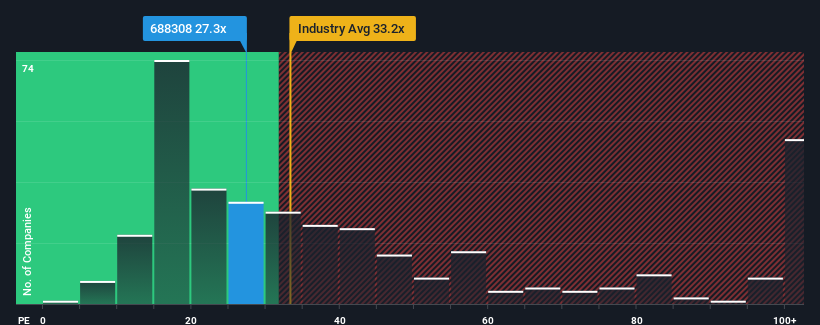

Since its price has dipped substantially, OKE Precision Cutting Tools may be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 27.3x, since almost half of all companies in China have P/E ratios greater than 34x and even P/E's higher than 65x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

OKE Precision Cutting Tools has been struggling lately as its earnings have declined faster than most other companies. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. You'd much rather the company wasn't bleeding earnings if you still believe in the business. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

View our latest analysis for OKE Precision Cutting Tools

What Are Growth Metrics Telling Us About The Low P/E?

OKE Precision Cutting Tools' P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Retrospectively, the last year delivered a frustrating 56% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 60% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next year should generate growth of 111% as estimated by the four analysts watching the company. That's shaping up to be materially higher than the 38% growth forecast for the broader market.

In light of this, it's peculiar that OKE Precision Cutting Tools' P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Bottom Line On OKE Precision Cutting Tools' P/E

OKE Precision Cutting Tools' recently weak share price has pulled its P/E below most other companies. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that OKE Precision Cutting Tools currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Plus, you should also learn about these 3 warning signs we've spotted with OKE Precision Cutting Tools (including 1 which is significant).

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688308

OKE Precision Cutting Tools

Engages in the research, development, production, and sale of CNC tool and cemented carbide products.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives