- China

- /

- Electrical

- /

- SHSE:688226

Wetown Electric Group Co., Ltd.'s (SHSE:688226) Shares Leap 32% Yet They're Still Not Telling The Full Story

Despite an already strong run, Wetown Electric Group Co., Ltd. (SHSE:688226) shares have been powering on, with a gain of 32% in the last thirty days. Taking a wider view, although not as strong as the last month, the full year gain of 11% is also fairly reasonable.

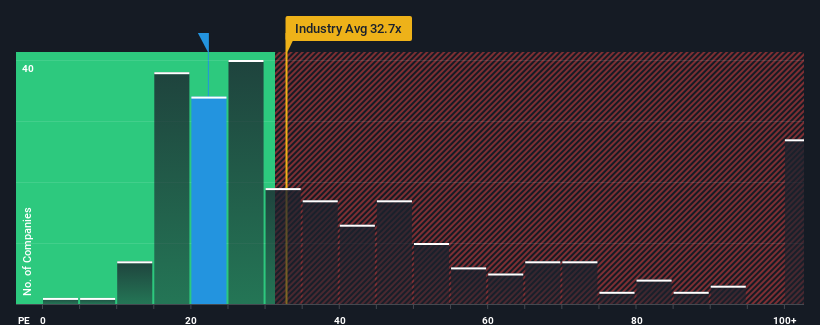

Although its price has surged higher, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 33x, you may still consider Wetown Electric Group as an attractive investment with its 22.2x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Recent times have been advantageous for Wetown Electric Group as its earnings have been rising faster than most other companies. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Wetown Electric Group

How Is Wetown Electric Group's Growth Trending?

In order to justify its P/E ratio, Wetown Electric Group would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered an exceptional 105% gain to the company's bottom line. The latest three year period has also seen an excellent 81% overall rise in EPS, aided by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 37% per year as estimated by the lone analyst watching the company. With the market only predicted to deliver 26% per annum, the company is positioned for a stronger earnings result.

With this information, we find it odd that Wetown Electric Group is trading at a P/E lower than the market. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

The latest share price surge wasn't enough to lift Wetown Electric Group's P/E close to the market median. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Wetown Electric Group currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Wetown Electric Group (2 are a bit concerning!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Wetown Electric Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688226

Wetown Electric Group

Engages in the research, development, production, and sale of electrical products in China and internationally.

High growth potential slight.