- Switzerland

- /

- Medical Equipment

- /

- SWX:STMN

3 Growth Companies With Significant Insider Stake

Reviewed by Simply Wall St

As global markets continue to reach record highs, driven by a blend of domestic policy shifts and geopolitical developments, investors are keenly observing the implications for various sectors. In this environment, growth companies with significant insider ownership can be particularly attractive as they often indicate strong confidence from those most familiar with the business's potential.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| SKS Technologies Group (ASX:SKS) | 32.4% | 24.8% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 110.9% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Here we highlight a subset of our preferred stocks from the screener.

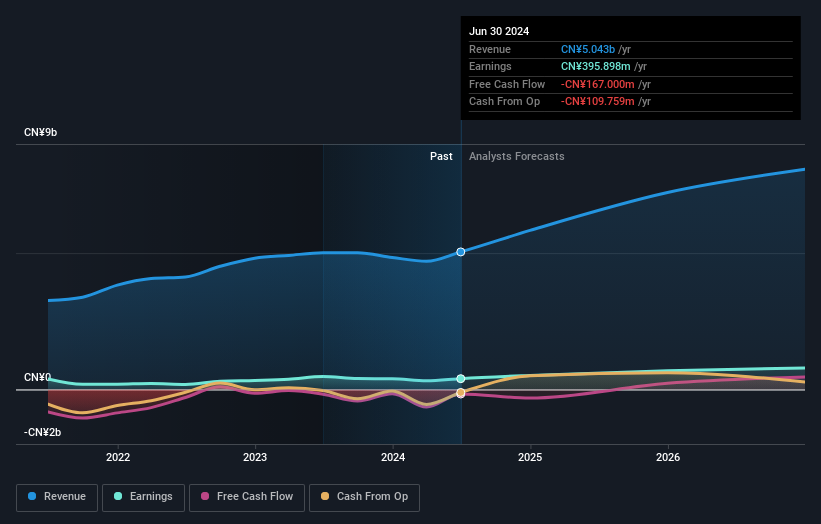

Bozhon Precision Industry TechnologyLtd (SHSE:688097)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Bozhon Precision Industry Technology Co., Ltd. operates in the precision manufacturing sector and has a market cap of CN¥12.68 billion.

Operations: The company generates revenue of CN¥4.87 billion from its Industrial Automation & Controls segment.

Insider Ownership: 29.4%

Bozhon Precision Industry Technology Ltd. is poised for significant growth, with its revenue projected to increase by 20.9% annually, outpacing the Chinese market average. Its earnings are expected to grow at 27% per year, also surpassing market expectations. Despite a relatively low forecasted return on equity of 12.8%, Bozhon's price-to-earnings ratio of 30.6x suggests it offers good value compared to the broader CN market's 36.3x ratio. Recent M&A activity includes a CNY 480 million stake acquisition by Tianjin Xinke Hongchuang Equity Investment Partnership Enterprise, indicating investor confidence in Bozhon's future prospects amidst steady financial performance improvements over the past year.

- Click here to discover the nuances of Bozhon Precision Industry TechnologyLtd with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, Bozhon Precision Industry TechnologyLtd's share price might be too optimistic.

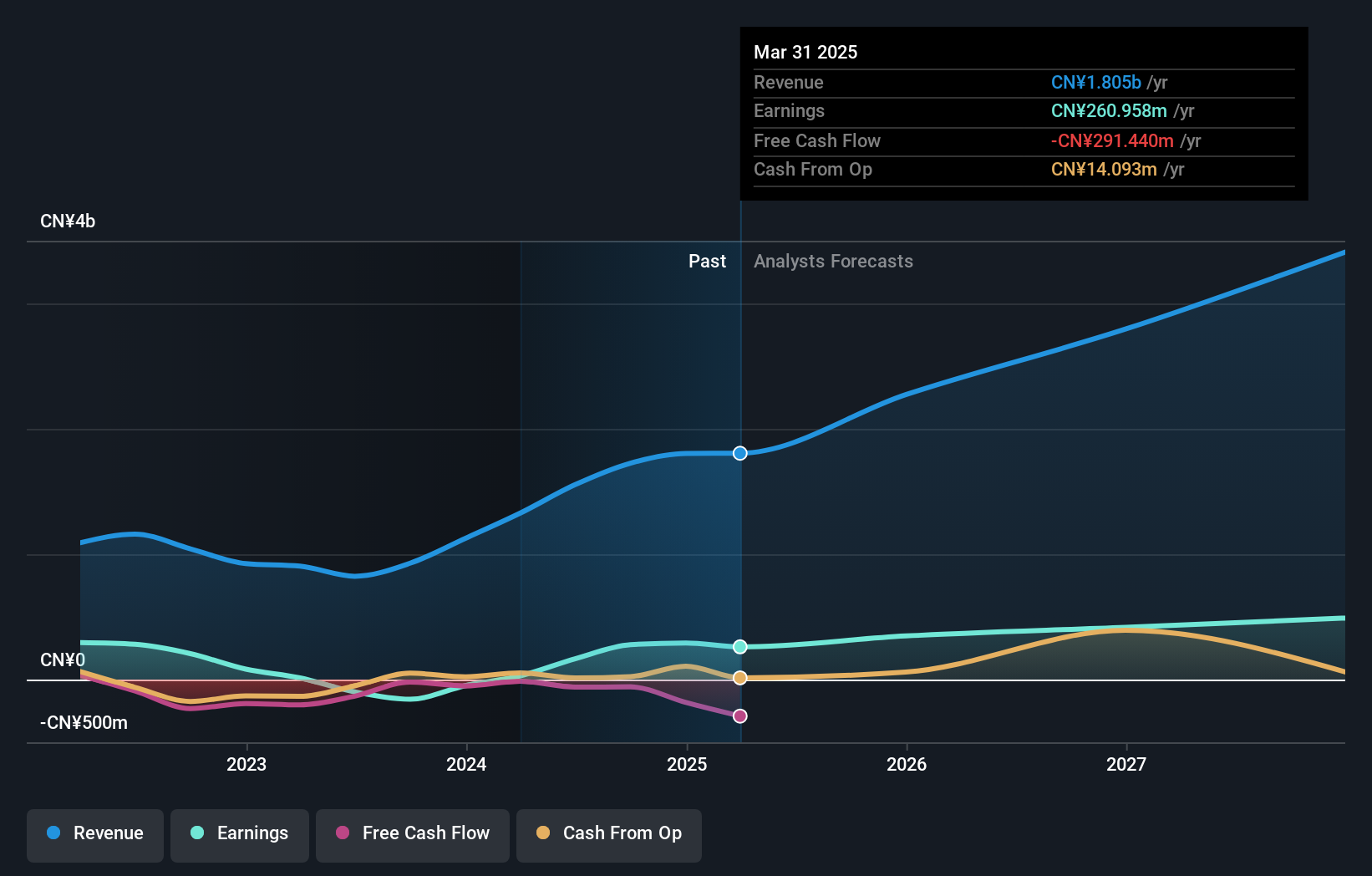

Puya Semiconductor (Shanghai) (SHSE:688766)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Puya Semiconductor (Shanghai) Co., Ltd. designs and sells non-volatile memory chips and derivative chips based on memory chips both in China and internationally, with a market cap of CN¥9.96 billion.

Operations: The company's revenue is primarily generated from its Integrated Circuit segment, amounting to CN¥1.73 billion.

Insider Ownership: 23.8%

Puya Semiconductor (Shanghai) demonstrates robust growth potential, with revenue forecasted to increase by 24.2% annually, surpassing the Chinese market average of 13.8%. Recent financials show a significant turnaround, reporting a net income of CNY 224.75 million for the first nine months of 2024 compared to a loss last year. Despite high share price volatility and a low future return on equity forecast, its price-to-earnings ratio of 35.8x indicates relative value against the CN market average.

- Take a closer look at Puya Semiconductor (Shanghai)'s potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential undervaluation of Puya Semiconductor (Shanghai) shares in the market.

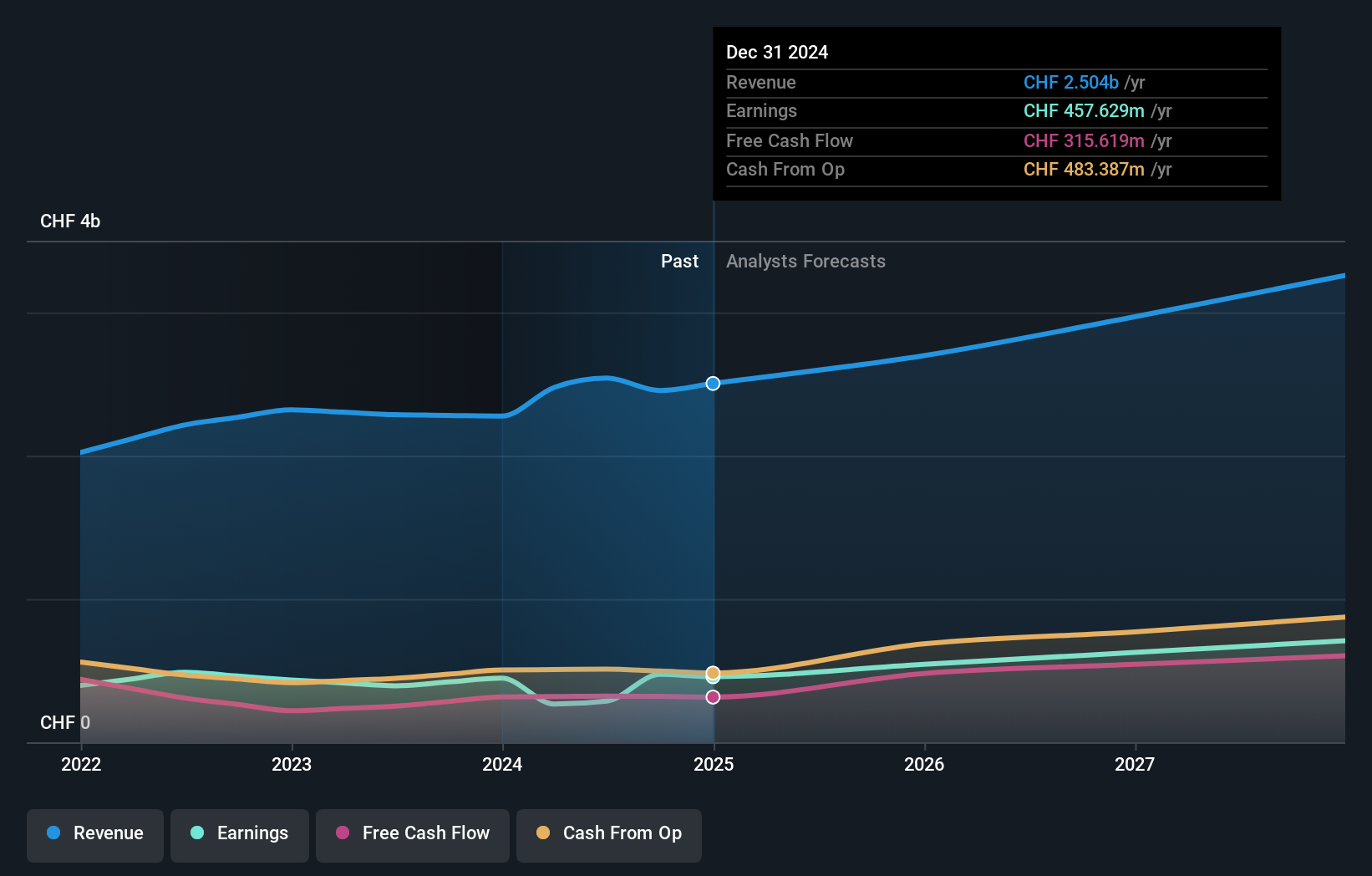

Straumann Holding (SWX:STMN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Straumann Holding AG is a global provider of tooth replacement and orthodontic solutions, with a market cap of CHF18.30 billion.

Operations: Straumann Holding AG's revenue is segmented into Sales NAM at CHF800.14 million, Operations at CHF1.26 billion, Sales APAC at CHF540.74 million, Sales EMEA at CHF1.20 billion, and Sales LATAM at CHF282.34 million.

Insider Ownership: 32.7%

Straumann Holding's earnings are forecast to grow significantly at 21.1% annually, outpacing the Swiss market average. Despite recent share price volatility and a decline in profit margins from 17.3% to 11.3%, it trades near its fair value, suggesting reasonable valuation. The company confirmed low-double-digit revenue growth and strong profitability guidance for 2024, supported by a high future return on equity forecast of 23%, although insider trading data is unavailable for the past three months.

- Click to explore a detailed breakdown of our findings in Straumann Holding's earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of Straumann Holding shares in the market.

Key Takeaways

- Gain an insight into the universe of 1520 Fast Growing Companies With High Insider Ownership by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:STMN

Straumann Holding

Provides tooth replacement and orthodontic solutions worldwide.

Flawless balance sheet with high growth potential.