- China

- /

- Aerospace & Defense

- /

- SHSE:688084

Beijing Jingpin Tezhuang Technology Co.,Ltd.'s (SHSE:688084) 26% Cheaper Price Remains In Tune With Revenues

To the annoyance of some shareholders, Beijing Jingpin Tezhuang Technology Co.,Ltd. (SHSE:688084) shares are down a considerable 26% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 53% share price decline.

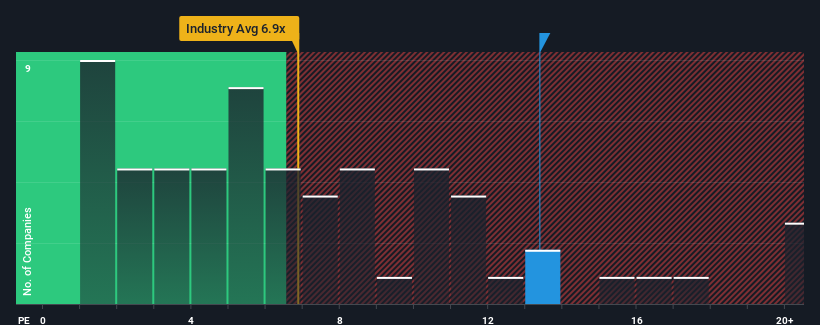

Even after such a large drop in price, Beijing Jingpin Tezhuang TechnologyLtd may still be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 13.4x, when you consider almost half of the companies in the Aerospace & Defense industry in China have P/S ratios under 6.9x and even P/S lower than 3x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Beijing Jingpin Tezhuang TechnologyLtd

What Does Beijing Jingpin Tezhuang TechnologyLtd's P/S Mean For Shareholders?

Beijing Jingpin Tezhuang TechnologyLtd hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Beijing Jingpin Tezhuang TechnologyLtd.How Is Beijing Jingpin Tezhuang TechnologyLtd's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Beijing Jingpin Tezhuang TechnologyLtd's is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 20%. The last three years don't look nice either as the company has shrunk revenue by 21% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the only analyst covering the company suggest revenue should grow by 118% over the next year. That's shaping up to be materially higher than the 27% growth forecast for the broader industry.

In light of this, it's understandable that Beijing Jingpin Tezhuang TechnologyLtd's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Beijing Jingpin Tezhuang TechnologyLtd's shares may have suffered, but its P/S remains high. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Beijing Jingpin Tezhuang TechnologyLtd's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

It is also worth noting that we have found 1 warning sign for Beijing Jingpin Tezhuang TechnologyLtd that you need to take into consideration.

If you're unsure about the strength of Beijing Jingpin Tezhuang TechnologyLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Jingpin Tezhuang TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688084

Beijing Jingpin Tezhuang TechnologyLtd

Beijing Jingpin Tezhuang Technology Co.,Ltd.

Adequate balance sheet very low.

Market Insights

Community Narratives