- China

- /

- Aerospace & Defense

- /

- SHSE:688070

Revenues Tell The Story For Chengdu JOUAV Automation Tech Co.,Ltd. (SHSE:688070) As Its Stock Soars 46%

Chengdu JOUAV Automation Tech Co.,Ltd. (SHSE:688070) shareholders are no doubt pleased to see that the share price has bounced 46% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 31% over that time.

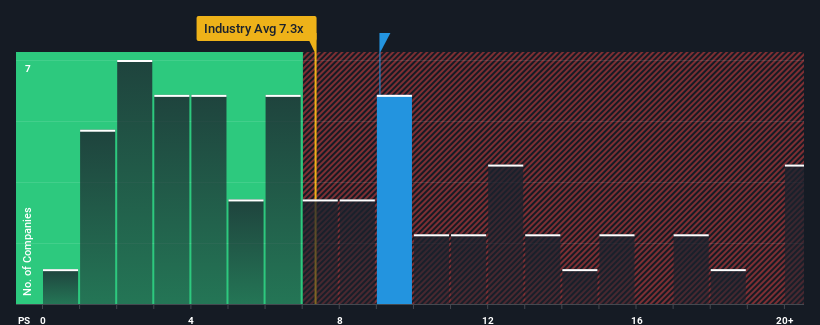

After such a large jump in price, Chengdu JOUAV Automation TechLtd may be sending sell signals at present with a price-to-sales (or "P/S") ratio of 9.1x, when you consider almost half of the companies in the Aerospace & Defense industry in China have P/S ratios under 7.3x and even P/S lower than 3x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for Chengdu JOUAV Automation TechLtd

What Does Chengdu JOUAV Automation TechLtd's Recent Performance Look Like?

There hasn't been much to differentiate Chengdu JOUAV Automation TechLtd's and the industry's revenue growth lately. Perhaps the market is expecting future revenue performance to improve, justifying the currently elevated P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Chengdu JOUAV Automation TechLtd.How Is Chengdu JOUAV Automation TechLtd's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as Chengdu JOUAV Automation TechLtd's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a decent 3.5% gain to the company's revenues. Revenue has also lifted 9.4% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 102% during the coming year according to the only analyst following the company. That's shaping up to be materially higher than the 48% growth forecast for the broader industry.

With this in mind, it's not hard to understand why Chengdu JOUAV Automation TechLtd's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Chengdu JOUAV Automation TechLtd's P/S is on the rise since its shares have risen strongly. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look into Chengdu JOUAV Automation TechLtd shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

Plus, you should also learn about these 2 warning signs we've spotted with Chengdu JOUAV Automation TechLtd (including 1 which doesn't sit too well with us).

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688070

Chengdu JOUAV Automation TechLtd

Develops, manufactures, sells, and services industrial drone-related products in China and internationally.

Excellent balance sheet with limited growth.

Market Insights

Community Narratives