Beijing Tianyishangjia New Material Corp., Ltd.'s (SHSE:688033) Popularity With Investors Under Threat As Stock Sinks 27%

Beijing Tianyishangjia New Material Corp., Ltd. (SHSE:688033) shareholders won't be pleased to see that the share price has had a very rough month, dropping 27% and undoing the prior period's positive performance. For any long-term shareholders, the last month ends a year to forget by locking in a 67% share price decline.

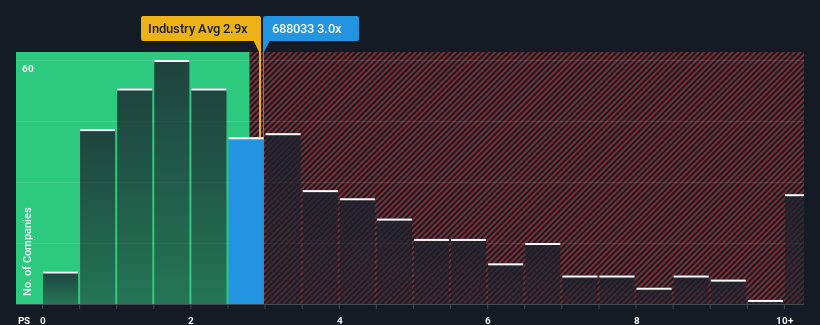

Even after such a large drop in price, you could still be forgiven for feeling indifferent about Beijing Tianyishangjia New Material's P/S ratio of 3x, since the median price-to-sales (or "P/S") ratio for the Machinery industry in China is also close to 2.9x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Beijing Tianyishangjia New Material

How Has Beijing Tianyishangjia New Material Performed Recently?

Beijing Tianyishangjia New Material hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Beijing Tianyishangjia New Material.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Beijing Tianyishangjia New Material would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 53% decrease to the company's top line. Even so, admirably revenue has lifted 77% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to slump, contracting by 11% during the coming year according to the sole analyst following the company. Meanwhile, the broader industry is forecast to expand by 22%, which paints a poor picture.

In light of this, it's somewhat alarming that Beijing Tianyishangjia New Material's P/S sits in line with the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

The Key Takeaway

Following Beijing Tianyishangjia New Material's share price tumble, its P/S is just clinging on to the industry median P/S. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

While Beijing Tianyishangjia New Material's P/S isn't anything out of the ordinary for companies in the industry, we didn't expect it given forecasts of revenue decline. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If the poor revenue outlook tells us one thing, it's that these current price levels could be unsustainable.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Beijing Tianyishangjia New Material with six simple checks will allow you to discover any risks that could be an issue.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Tianyishangjia New Material might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688033

Beijing Tianyishangjia New Material

Beijing Tianyishangjia New Material Corp., Ltd.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives