- China

- /

- Electrical

- /

- SHSE:688005

Ningbo Ronbay New Energy TechnologyLtd (SHSE:688005) shareholders have endured a 73% loss from investing in the stock three years ago

As an investor, mistakes are inevitable. But you want to avoid the really big losses like the plague. So take a moment to sympathize with the long term shareholders of Ningbo Ronbay New Energy Technology Co.,Ltd. (SHSE:688005), who have seen the share price tank a massive 74% over a three year period. That might cause some serious doubts about the merits of the initial decision to buy the stock, to put it mildly. Furthermore, it's down 11% in about a quarter. That's not much fun for holders.

Since shareholders are down over the longer term, lets look at the underlying fundamentals over the that time and see if they've been consistent with returns.

Check out our latest analysis for Ningbo Ronbay New Energy TechnologyLtd

We don't think that Ningbo Ronbay New Energy TechnologyLtd's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

Over three years, Ningbo Ronbay New Energy TechnologyLtd grew revenue at 13% per year. That's a fairly respectable growth rate. So it seems unlikely the 20% share price drop (each year) is entirely about the revenue. It could be that the losses were much larger than expected. This is exactly why investors need to diversify - even when a loss making company grows revenue, it can fail to deliver for shareholders.

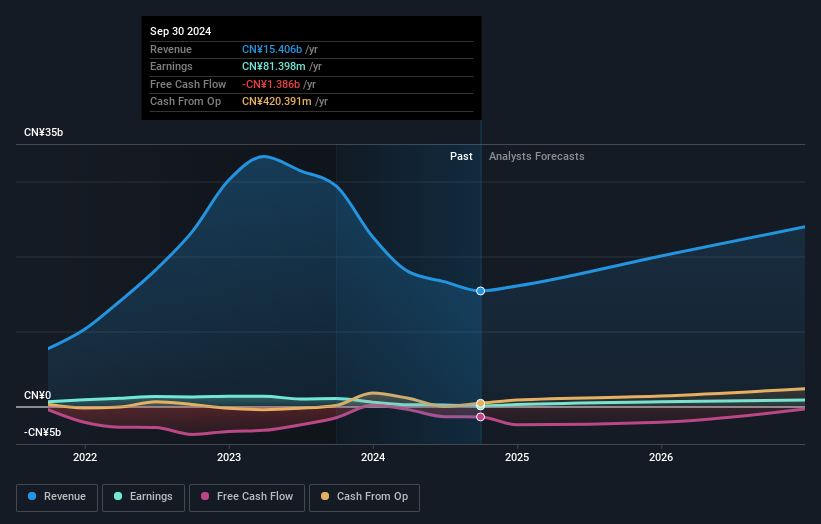

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Ningbo Ronbay New Energy TechnologyLtd is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

Ningbo Ronbay New Energy TechnologyLtd provided a TSR of 13% over the last twelve months. Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 4% endured over half a decade. It could well be that the business is stabilizing. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 3 warning signs for Ningbo Ronbay New Energy TechnologyLtd you should be aware of, and 1 of them is a bit concerning.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Ningbo Ronbay New Energy TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688005

Ningbo Ronbay New Energy TechnologyLtd

Ningbo Ronbay New Energy Technology Co.,Ltd.

High growth potential and fair value.

Market Insights

Community Narratives