- China

- /

- Electrical

- /

- SHSE:605365

Three Undiscovered Gems on None with Promising Potential

Reviewed by Simply Wall St

In a week marked by record highs in several key indices, including the Russell 2000 for small-cap stocks, global markets have shown resilience amidst geopolitical tensions and fluctuating economic indicators. As investors navigate these dynamic conditions, identifying promising opportunities within lesser-known small-cap stocks can be rewarding, especially those that demonstrate strong fundamentals and adaptability to current market shifts.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| Padma Oil | 0.76% | 4.42% | 9.81% | ★★★★★★ |

| Zambia Sugar | 1.04% | 20.60% | 44.34% | ★★★★★★ |

| Mobile Telecommunications | NA | 4.98% | 0.14% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Invest Bank | 135.69% | 11.07% | 18.67% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Henan Thinker Automatic EquipmentLtd (SHSE:603508)

Simply Wall St Value Rating: ★★★★★☆

Overview: Henan Thinker Automatic Equipment Co., Ltd. focuses on providing automation solutions and services, with a market cap of CN¥8.93 billion.

Operations: Henan Thinker derives its revenue primarily from the Software and Information Technology Services segment, amounting to CN¥1.35 billion.

Henan Thinker, operating in the automation sector, has shown promising growth with sales reaching CNY 905.78 million for the first nine months of 2024, up from CNY 731.47 million a year prior. Net income also rose to CNY 327.69 million compared to last year's CNY 244.59 million, reflecting a robust performance in its niche market. The company's basic earnings per share increased to CNY 0.86 from CNY 0.64, indicating improved profitability and operational efficiency over the past year. These figures suggest that Henan Thinker is effectively navigating its competitive landscape and capitalizing on industry demand trends.

Leedarson IoT Technology (SHSE:605365)

Simply Wall St Value Rating: ★★★★★★

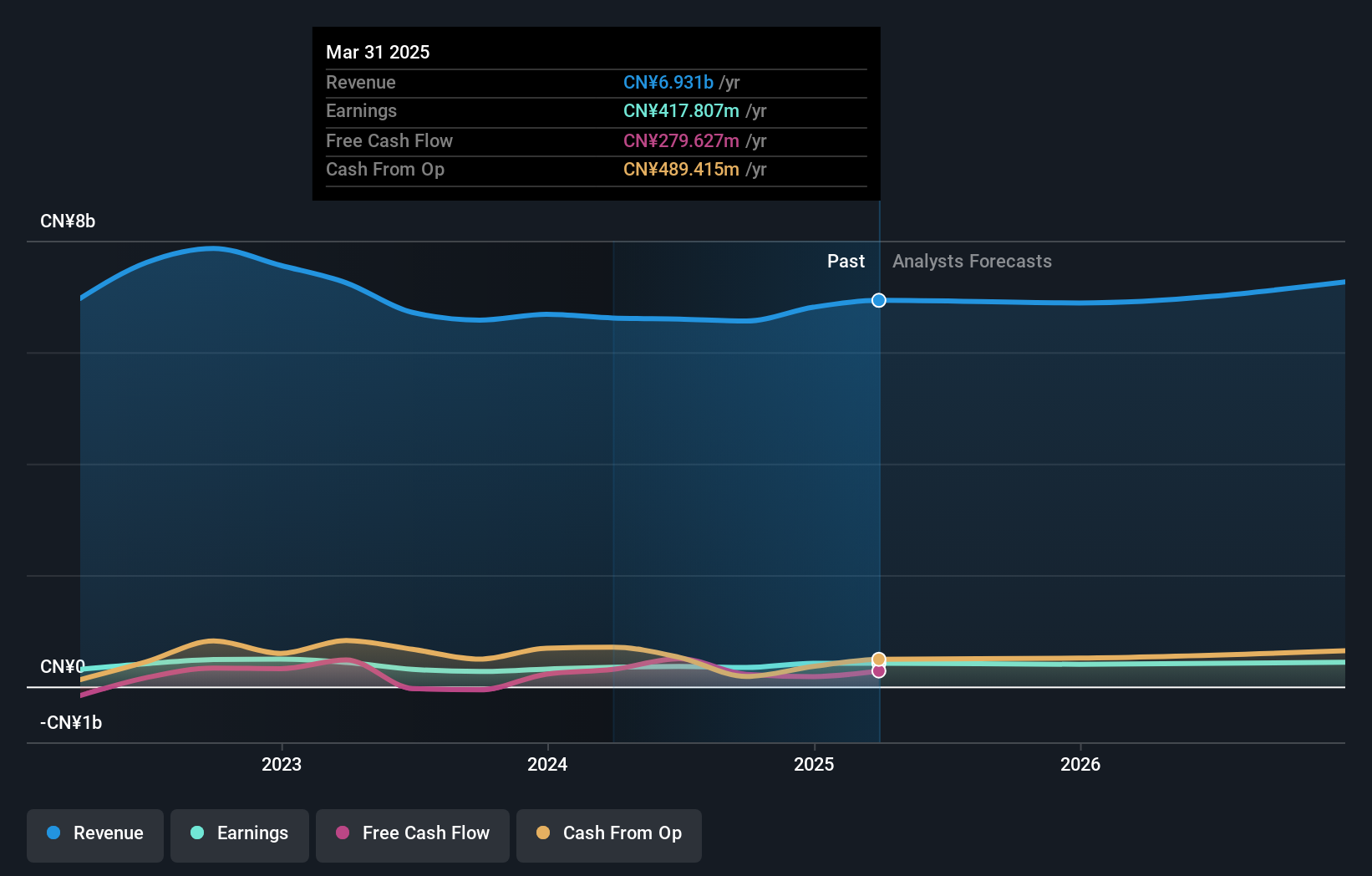

Overview: Leedarson IoT Technology Inc. focuses on the research, development, and production of IoT-enabled products such as LED bulbs, fixtures, luminaires, and light sources with a market capitalization of CN¥8.10 billion.

Operations: Leedarson IoT Technology generates revenue primarily from the sale of IoT-enabled products, including LED bulbs and lighting solutions. The company has shown a notable trend in its gross profit margin, which reflects its ability to manage production costs relative to sales.

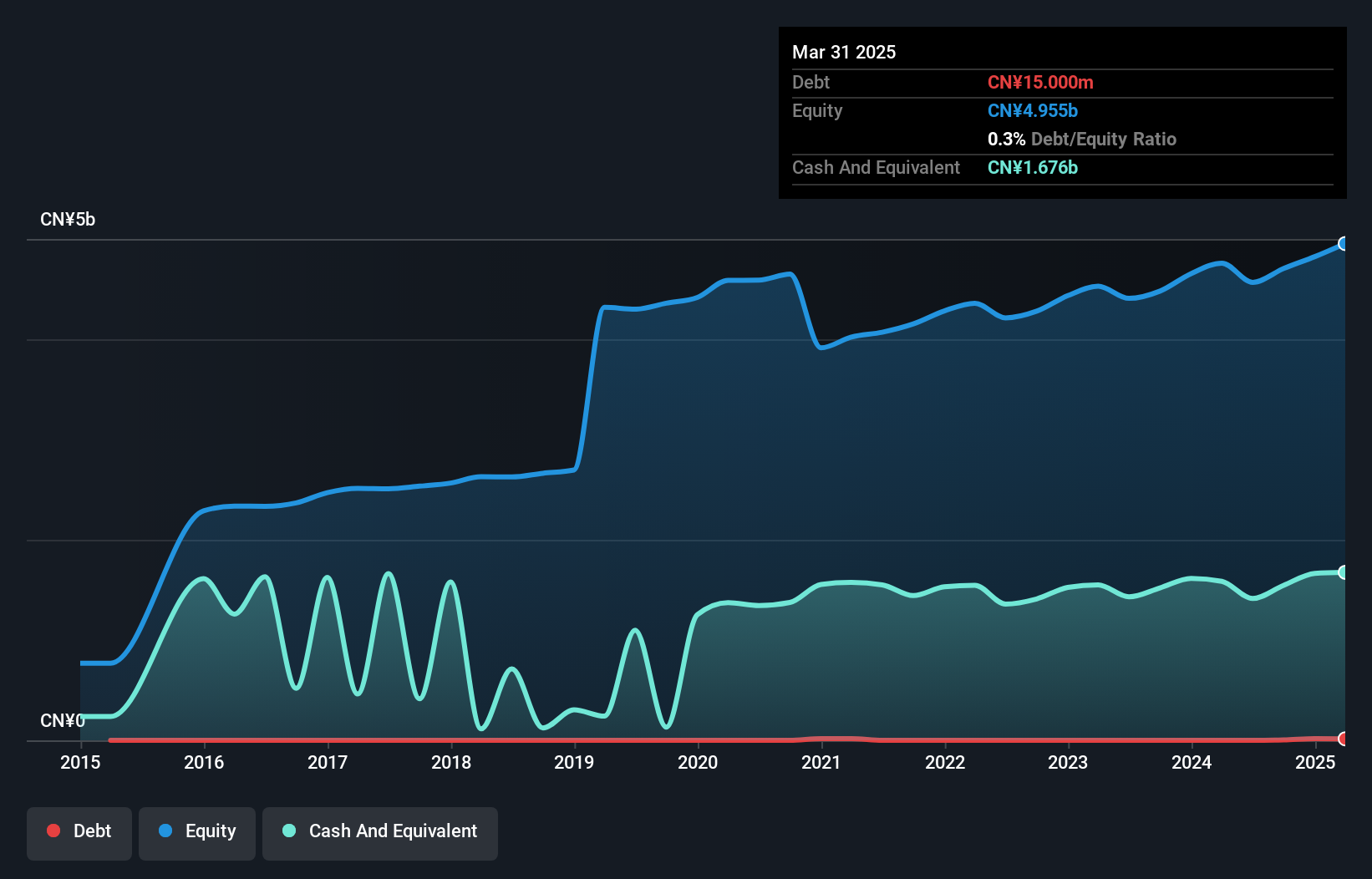

Leedarson IoT Technology, a smaller player in the tech space, has shown resilience with a net income of CNY 278.88 million for the nine months ending September 2024, up from CNY 250.95 million the previous year. Despite a slight dip in sales to CNY 4,940.28 million from CNY 5,062.05 million last year, earnings per share improved to CNY 0.556 from CNY 0.498, indicating operational efficiency gains. The company is considering a buyback program worth up to CNY 10 million at no more than CNY 17 per share to enhance shareholder value and support employee incentives using internal funds pending shareholder approval.

- Unlock comprehensive insights into our analysis of Leedarson IoT Technology stock in this health report.

Learn about Leedarson IoT Technology's historical performance.

Zhejiang VIE Science & Technology (SZSE:002590)

Simply Wall St Value Rating: ★★★★★★

Overview: Zhejiang VIE Science & Technology Co., Ltd. is a company with a market cap of CN¥7.56 billion, involved in various industrial operations.

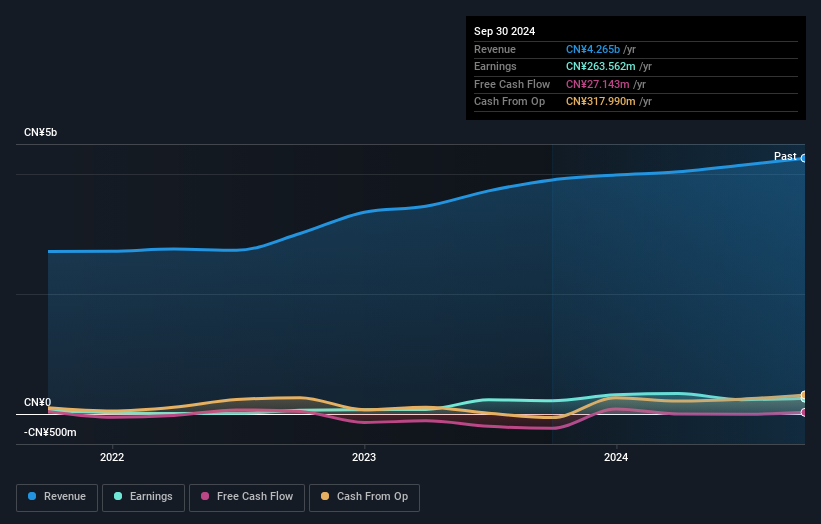

Operations: The company generates revenue primarily from its industrial segment, amounting to CN¥4.26 billion.

Zhejiang VIE, a dynamic player, recently reported sales of CNY 3.03 billion for the first nine months of 2024, up from CNY 2.75 billion in the prior year. Despite this growth, net income slipped to CNY 147.57 million from CNY 203.56 million, reflecting challenges in profitability with basic earnings per share at CNY 0.3 compared to last year's CNY 0.42. The company seems focused on strategic changes as indicated by its upcoming shareholder meeting aimed at altering registered capital and revising articles of association, potentially setting the stage for future developments in its business structure and market positioning.

Next Steps

- Take a closer look at our Undiscovered Gems With Strong Fundamentals list of 4645 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:605365

Leedarson IoT Technology

Engages in the research and development, and production of Internet of things (IoT)-enabled products, LED bulbs, fixtures, luminaires, light sources, and other products.

Flawless balance sheet and fair value.