- Belgium

- /

- Communications

- /

- ENXTBR:EVS

Undiscovered Gems Three Small Caps With Promising Potential

Reviewed by Simply Wall St

In recent weeks, global markets have experienced significant movements, with U.S. stocks rallying on growth and tax hopes following a political shift, while the small-cap Russell 2000 Index led gains yet remained slightly below record highs. Amidst this backdrop of economic optimism and policy changes, investors are increasingly turning their attention to small-cap stocks that exhibit strong fundamentals and potential for growth in an evolving market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| AGI Infra | 61.29% | 29.16% | 33.44% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Abans Holdings | 94.08% | 16.32% | 18.24% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Al-Ahleia Insurance CompanyK.P | 8.09% | 10.20% | 16.85% | ★★★★☆☆ |

| Al-Deera Holding Company K.P.S.C | 6.11% | 51.44% | 59.77% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

EVS Broadcast Equipment (ENXTBR:EVS)

Simply Wall St Value Rating: ★★★★★★

Overview: EVS Broadcast Equipment SA specializes in live video technology for global broadcast and media productions, with a market cap of €381.40 million.

Operations: The primary revenue stream for EVS Broadcast Equipment SA is its solutions based on tapeless workflows with a modular architecture, generating €183.85 million. The company's net profit margin shows notable trends over the periods analyzed, reflecting its operational efficiency and profitability.

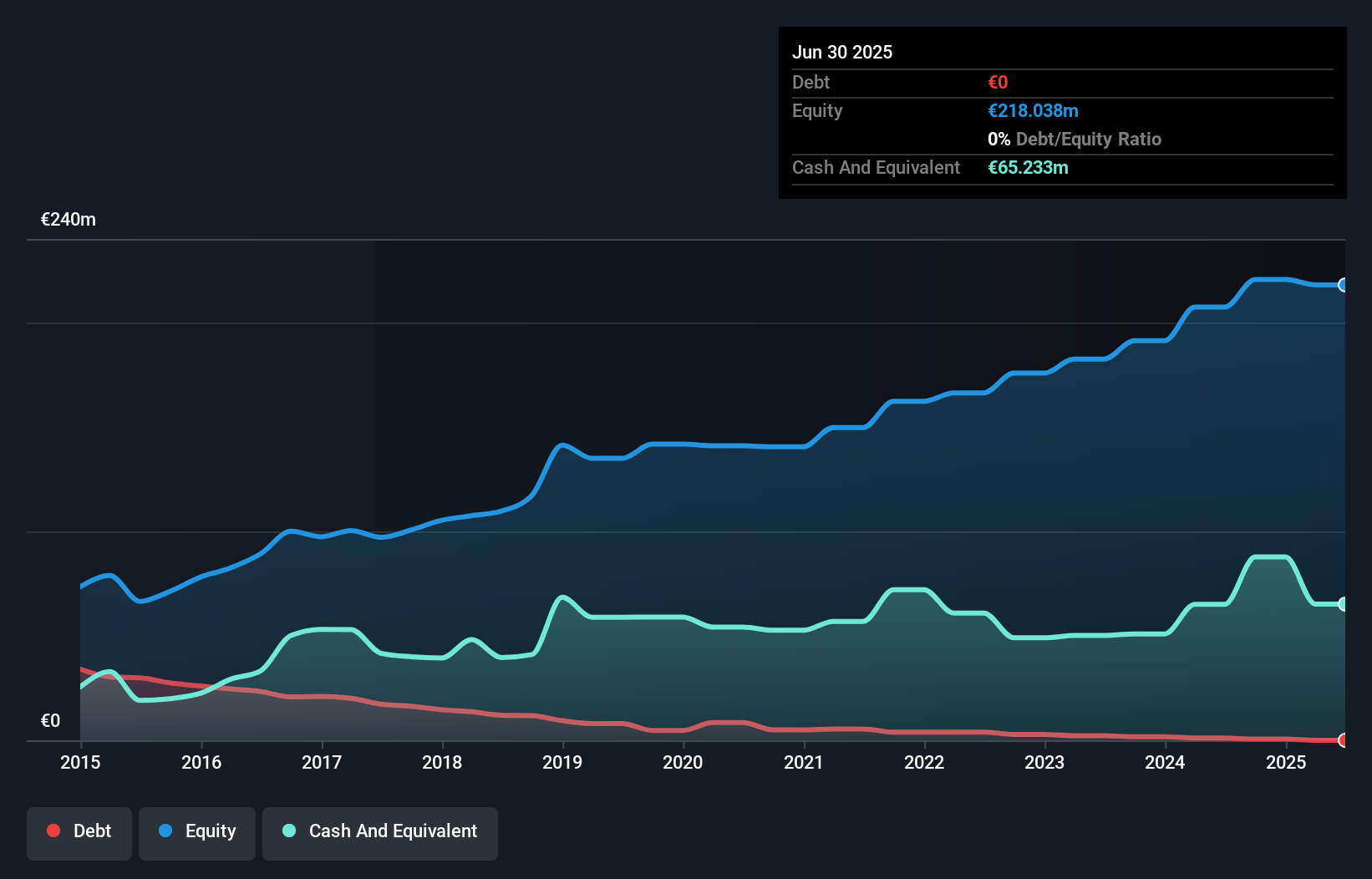

EVS Broadcast Equipment, a promising player in the broadcasting solutions industry, showcases impressive financial health with its cash reserves surpassing total debt and a reduced debt-to-equity ratio from 5.9% to 0.5% over five years. The company is trading at a significant discount of 55.4% below its estimated fair value, suggesting potential upside for investors. Recent earnings growth of 1.3%, outperforming the sector's -22.9%, highlights its resilience and strategic positioning. With an EBIT coverage of interest payments at an impressive 61.9 times, EVS seems well-equipped to handle financial obligations while pursuing profitable growth into the future.

- Click here to discover the nuances of EVS Broadcast Equipment with our detailed analytical health report.

Understand EVS Broadcast Equipment's track record by examining our Past report.

Nederman Holding (OM:NMAN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Nederman Holding AB (publ) is an environmental technology company that operates globally in regions including the Americas, Asia Pacific, Europe, the Middle East, and Asia, with a market capitalization of approximately SEK7.71 billion.

Operations: Nederman generates revenue primarily from its Extraction & Filtration Technology segment, which contributes SEK2.61 billion, followed by Process Technology at SEK1.64 billion. The company also earns from Duct & Filter Technology and Monitoring & Control Technology, with revenues of SEK864.50 million and SEK784.40 million, respectively.

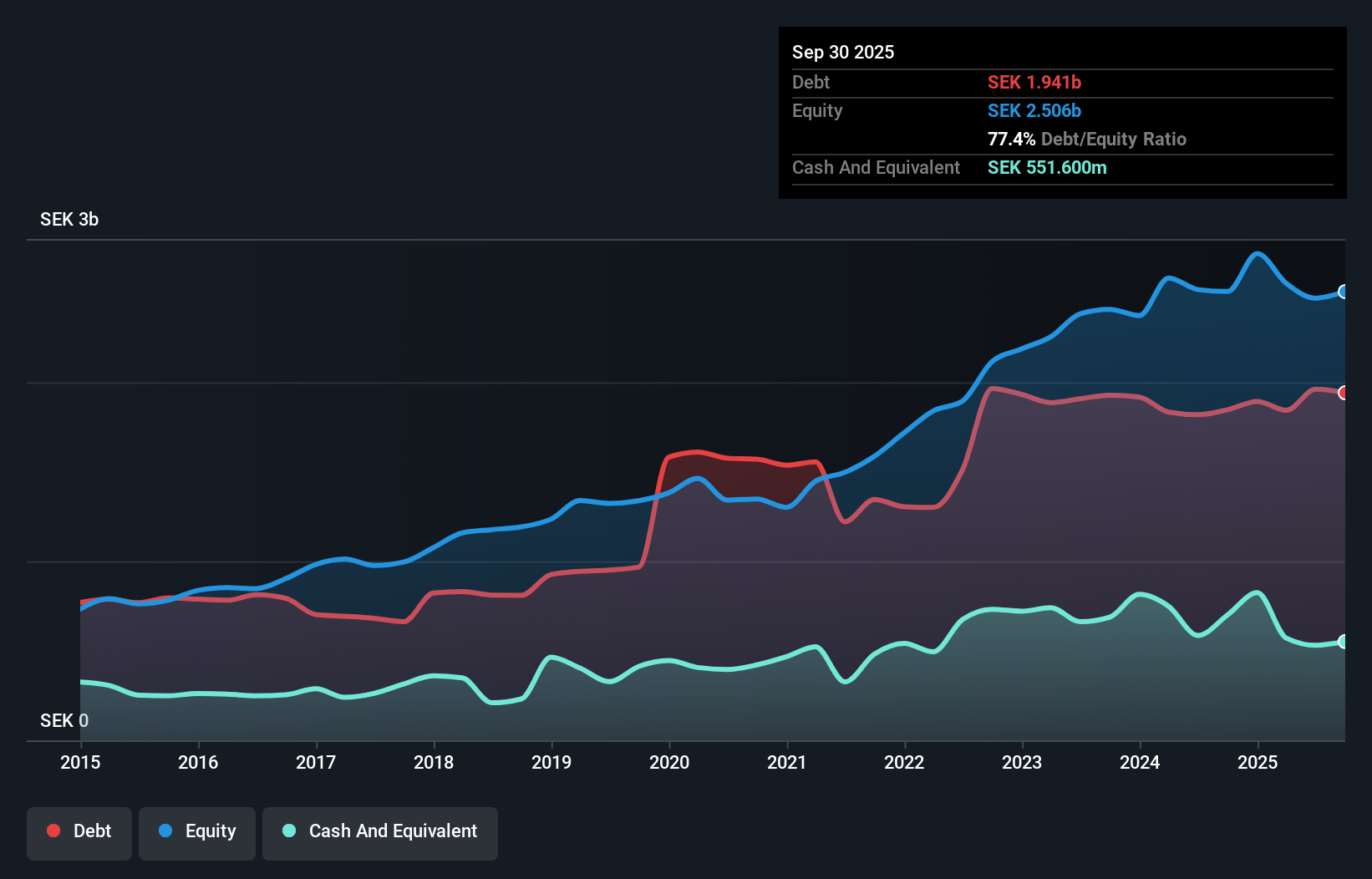

Nederman Holding, a player in the industrial air filtration sector, seems to be navigating a challenging landscape with its sales dipping to SEK 1.42 billion from SEK 1.57 billion year-on-year for Q3 2024. Despite this, it maintains high-quality earnings and covers interest payments well at 5.9 times EBIT. However, its net debt to equity ratio is high at 45.7%, signaling financial leverage concerns as it rose from 72% over five years to nearly 74%. Trading at about 22% below fair value could indicate potential upside if market conditions improve or strategic adjustments are made successfully.

- Dive into the specifics of Nederman Holding here with our thorough health report.

Explore historical data to track Nederman Holding's performance over time in our Past section.

Jiangsu Libert (SHSE:605167)

Simply Wall St Value Rating: ★★★★★☆

Overview: Jiangsu Libert INC. designs, manufactures, and sells industrial modules in China and internationally, with a market cap of CN¥4.18 billion.

Operations: Jiangsu Libert's revenue is primarily derived from the sale of industrial modules. The company's net profit margin has shown variability, reflecting changes in operational efficiency and cost management over time.

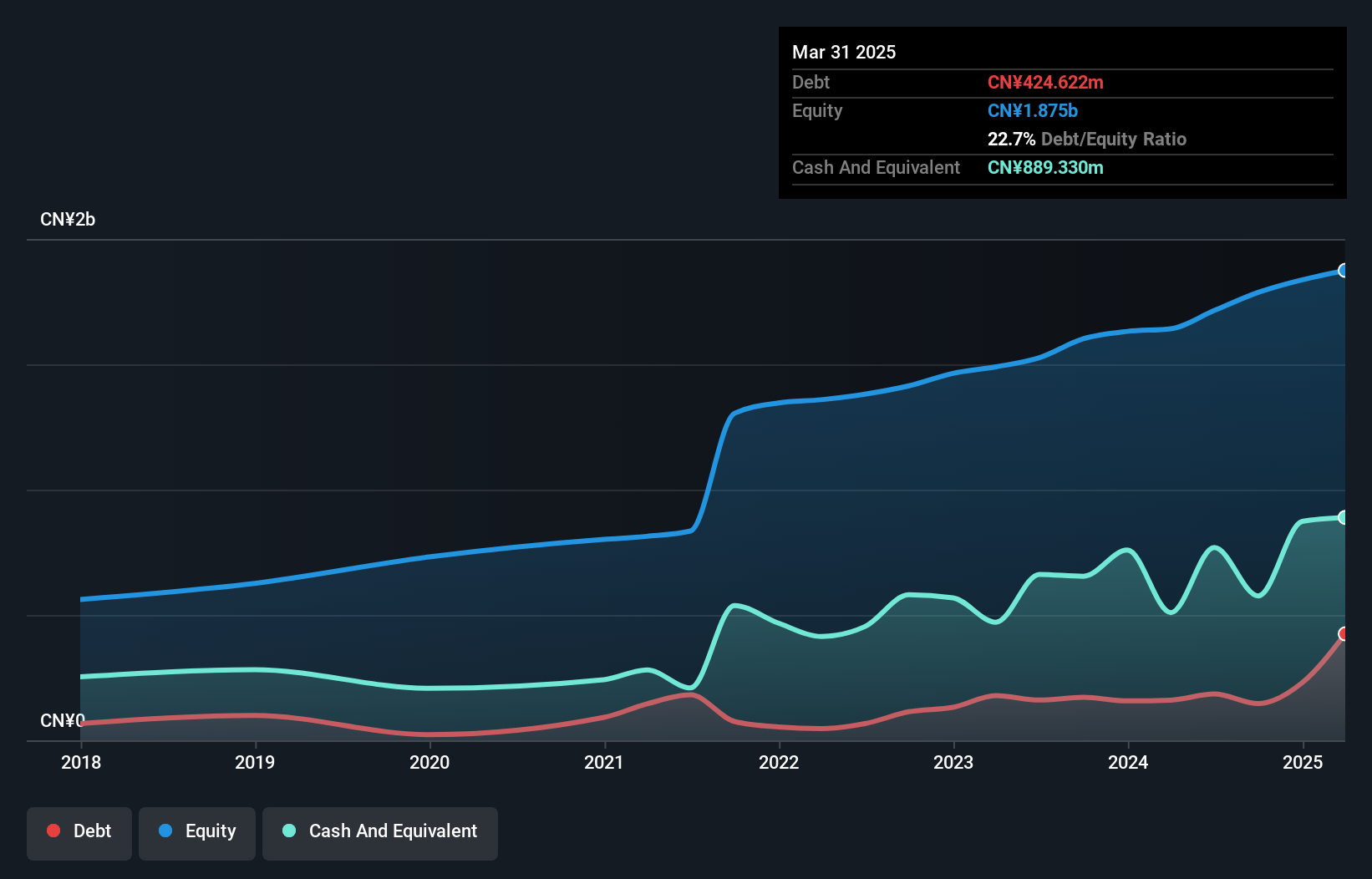

Jiangsu Libert, a smaller player in its field, has shown promising financial growth with earnings increasing by 3.4% last year, outpacing the construction industry's negative trend of -4.1%. The company reported sales of CNY 2.59 billion for the first nine months of 2024, up from CNY 2.38 billion the previous year, alongside net income rising to CNY 200 million from CNY 157 million. Trading at a price-to-earnings ratio of 17.9x compared to the market's average of 35.8x suggests good value relative to peers and industry standards while maintaining high-quality earnings and positive free cash flow further reinforces its financial health and potential as an investment opportunity in this sector.

- Navigate through the intricacies of Jiangsu Libert with our comprehensive health report here.

Gain insights into Jiangsu Libert's past trends and performance with our Past report.

Key Takeaways

- Click through to start exploring the rest of the 4655 Undiscovered Gems With Strong Fundamentals now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EVS Broadcast Equipment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:EVS

EVS Broadcast Equipment

Provides live video technology for broadcast and media productions in the United States, Europe, Africa, Middle East, and Asia Pacific.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives