Zhejiang Xidamen New Material Co.,Ltd.'s (SHSE:605155) Price Is Right But Growth Is Lacking After Shares Rocket 35%

The Zhejiang Xidamen New Material Co.,Ltd. (SHSE:605155) share price has done very well over the last month, posting an excellent gain of 35%. Looking back a bit further, it's encouraging to see the stock is up 64% in the last year.

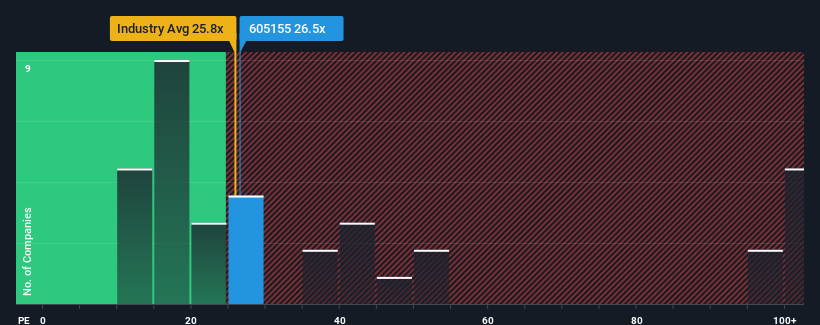

In spite of the firm bounce in price, Zhejiang Xidamen New MaterialLtd's price-to-earnings (or "P/E") ratio of 26.5x might still make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 39x and even P/E's above 77x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Zhejiang Xidamen New MaterialLtd certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Zhejiang Xidamen New MaterialLtd

Does Growth Match The Low P/E?

Zhejiang Xidamen New MaterialLtd's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 12% last year. However, due to its less than impressive performance prior to this period, EPS growth is practically non-existent over the last three years overall. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the lone analyst covering the company suggest earnings should grow by 19% over the next year. That's shaping up to be materially lower than the 37% growth forecast for the broader market.

In light of this, it's understandable that Zhejiang Xidamen New MaterialLtd's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Zhejiang Xidamen New MaterialLtd's P/E

Zhejiang Xidamen New MaterialLtd's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Zhejiang Xidamen New MaterialLtd's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for Zhejiang Xidamen New MaterialLtd with six simple checks will allow you to discover any risks that could be an issue.

If you're unsure about the strength of Zhejiang Xidamen New MaterialLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Xidamen New MaterialLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:605155

Zhejiang Xidamen New MaterialLtd

Engages in the research and development, design, production, and sale of indoor and outdoor light and heat block, anti-dust, anti-UV, and energy saving products in China.

Flawless balance sheet with proven track record.