- China

- /

- Construction

- /

- SHSE:603929

3 Dividend Stocks To Consider With Yields Up To 5.6%

Reviewed by Simply Wall St

As global markets continue to navigate the complexities of rising inflation and volatile interest rates, U.S. stock indexes are climbing toward record highs, with growth stocks outpacing value shares. In this environment, dividend stocks can offer a reliable income stream and potential stability amidst market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.92% | ★★★★★★ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.33% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.51% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.90% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.32% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.04% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 3.99% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.23% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.60% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.97% | ★★★★★★ |

Click here to see the full list of 1970 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

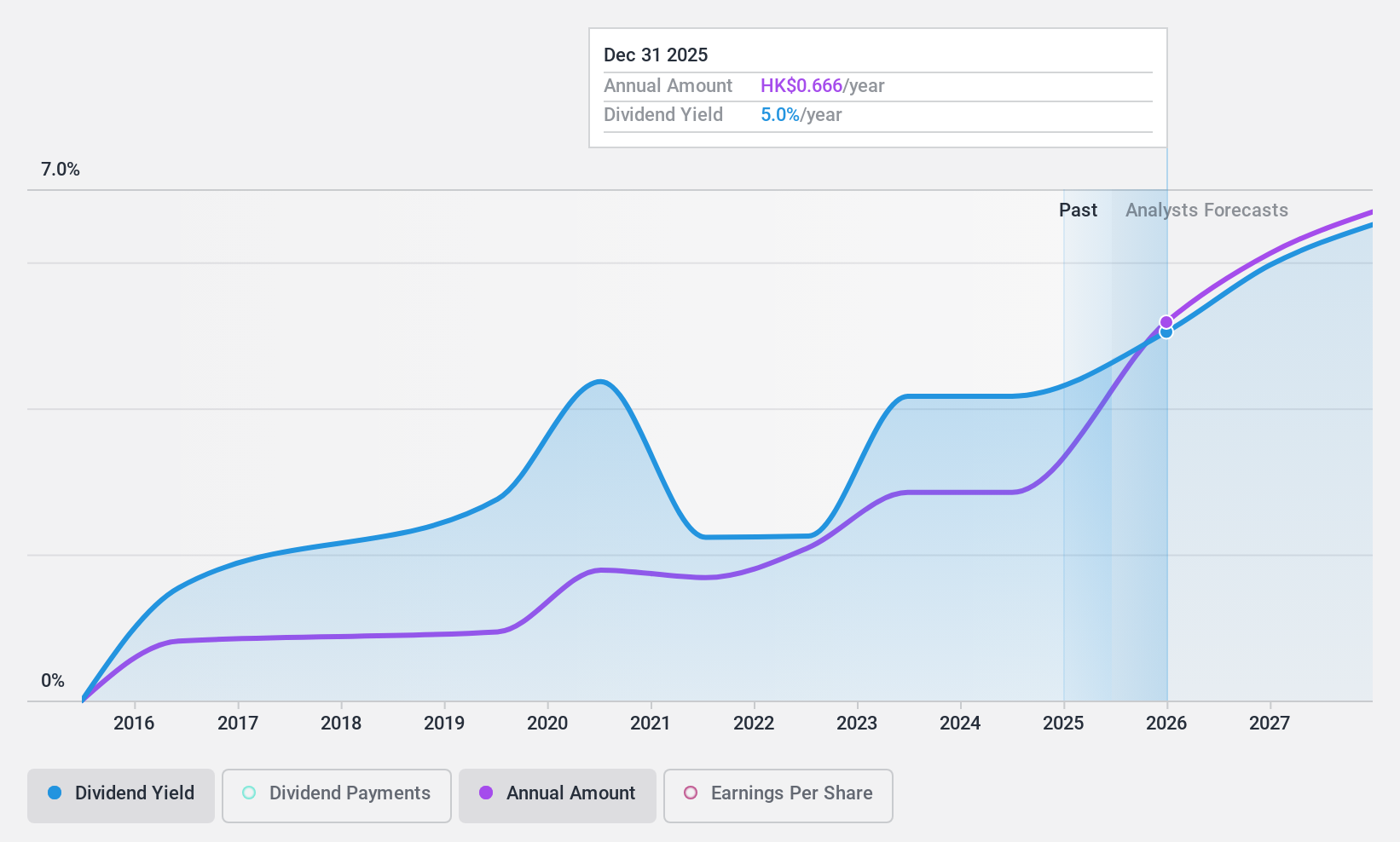

Dongfang Electric (SEHK:1072)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dongfang Electric Corporation Limited designs, develops, manufactures, and sells power generation equipment both in China and internationally, with a market cap of HK$48.02 billion.

Operations: Dongfang Electric Corporation Limited's revenue primarily comes from its power generation equipment segment, which serves both domestic and international markets.

Dividend Yield: 5.2%

Dongfang Electric's dividend yield of 5.19% is below the top 25% in Hong Kong, but its payout ratio of 45.3% and cash payout ratio of 33.9% indicate dividends are well-covered by earnings and cash flow. Despite this, the dividend history has been volatile over the past decade, suggesting unreliability. Recent changes include a new joint company secretary and a framework agreement with Honghua Group for product and service purchases from January 2025 to December 2027.

- Click here and access our complete dividend analysis report to understand the dynamics of Dongfang Electric.

- The valuation report we've compiled suggests that Dongfang Electric's current price could be quite moderate.

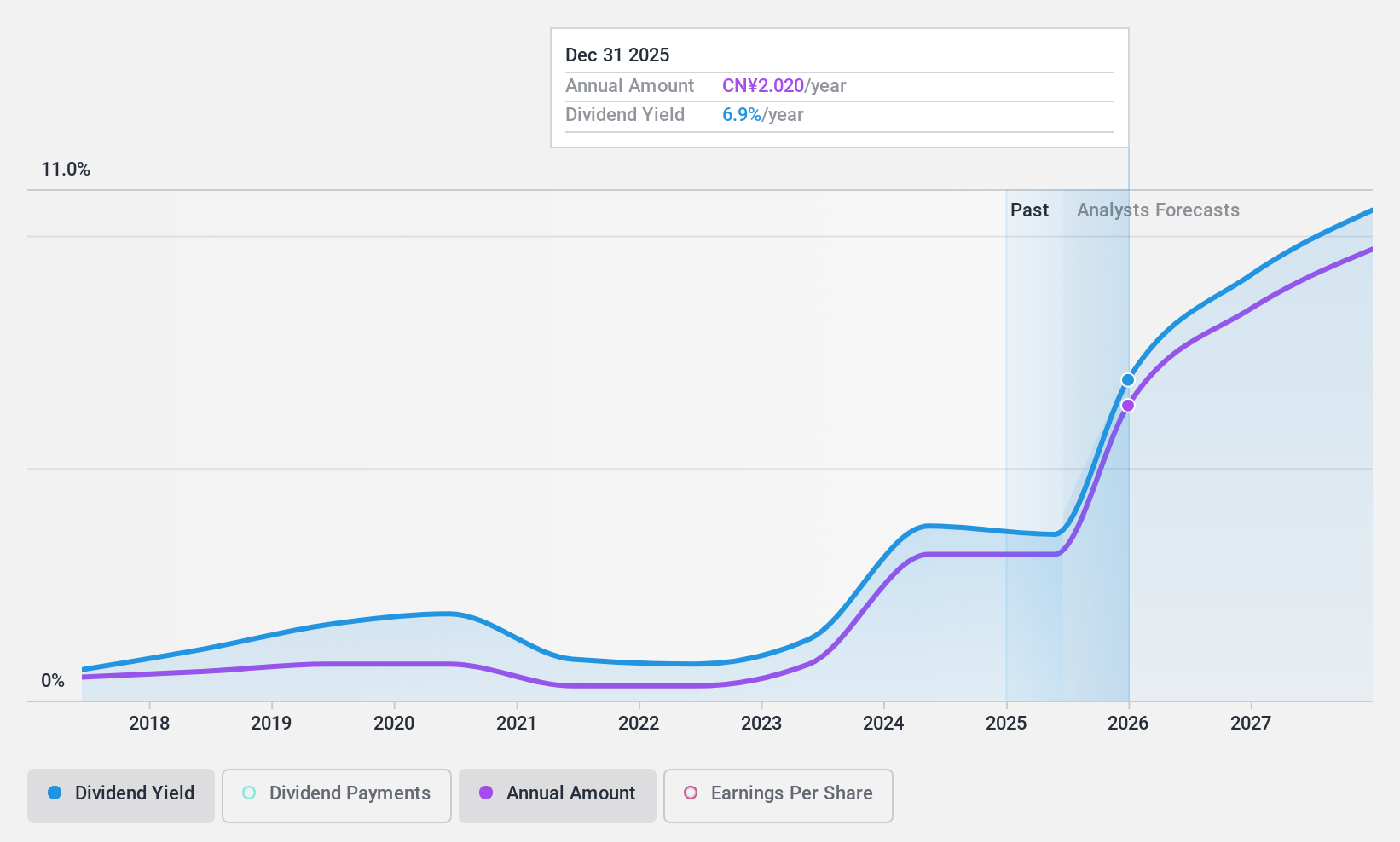

L&K Engineering (Suzhou)Ltd (SHSE:603929)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: L&K Engineering (Suzhou) Co., Ltd. offers specialized engineering technical services in China and has a market capitalization of CN¥6.70 billion.

Operations: L&K Engineering (Suzhou) Co., Ltd. generates its revenue through the provision of specialized engineering technical services within China.

Dividend Yield: 3.2%

L&K Engineering (Suzhou) Ltd. offers a dividend yield of 3.19%, placing it in the top 25% of dividend payers in China. Its dividends are well-covered by earnings and cash flows, with payout ratios at 43% and 21.6%, respectively, indicating sustainability. However, its less than decade-long history of dividend payments has been marked by volatility and unreliability, raising concerns about consistency despite trading below estimated fair value by 33.2%.

- Delve into the full analysis dividend report here for a deeper understanding of L&K Engineering (Suzhou)Ltd.

- Our expertly prepared valuation report L&K Engineering (Suzhou)Ltd implies its share price may be lower than expected.

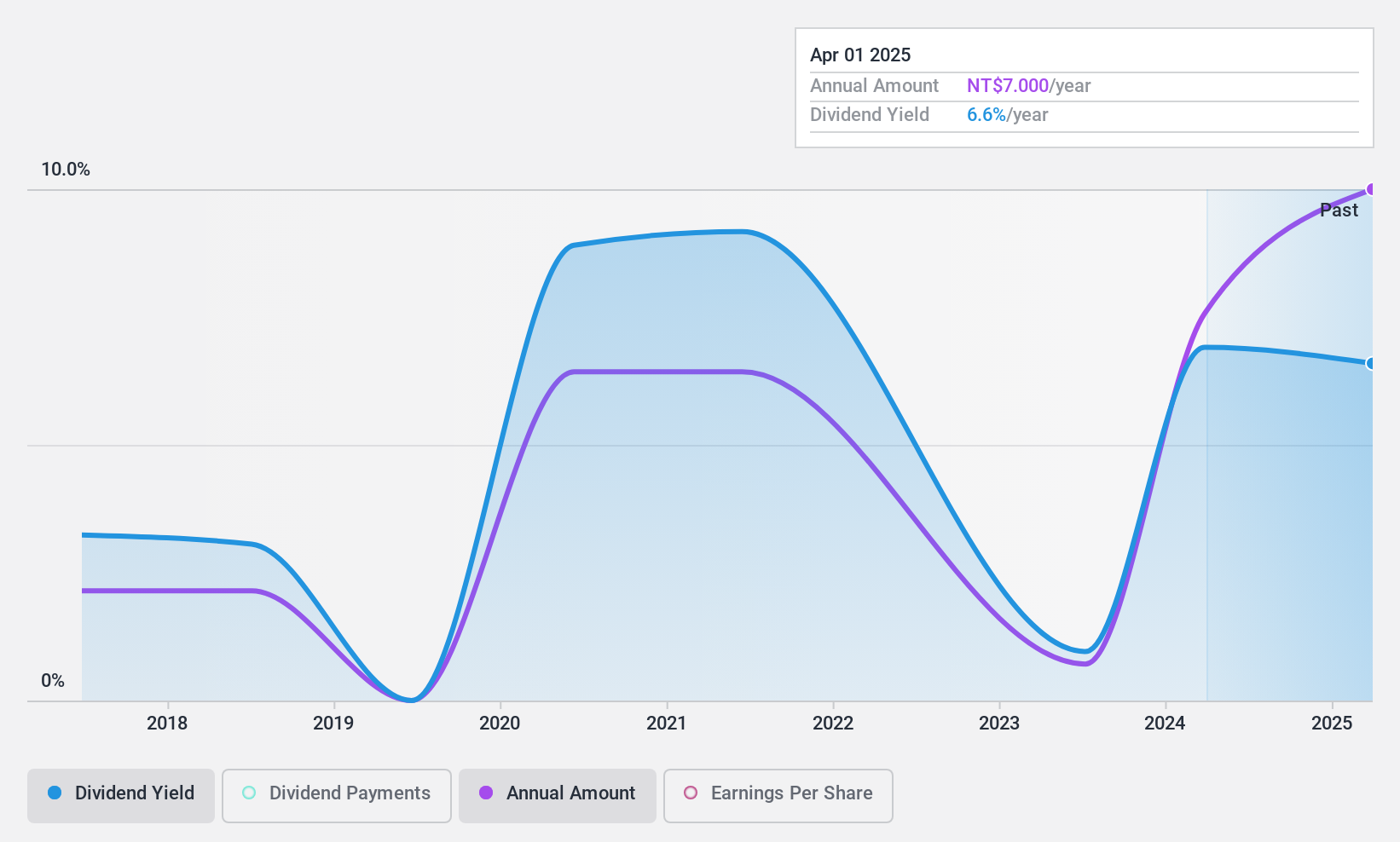

Kuang Hong Arts Management Incorporation (TPEX:6596)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kuang Hong Arts Management Incorporation is involved in organizing and co-organizing music and dance activities in Taiwan, with a market cap of NT$3.57 billion.

Operations: Kuang Hong Arts Management Incorporation generates revenue primarily from its recreational activities segment, which accounted for NT$1.79 billion.

Dividend Yield: 5.6%

Kuang Hong Arts Management Incorporation's dividend yield of 5.64% is among the top 25% in Taiwan, with dividends covered by both earnings (69.2% payout ratio) and cash flows (51% cash payout ratio). Despite this, its eight-year dividend history has been volatile and unreliable, with significant annual drops over 20%. The company trades at a substantial discount to its estimated fair value but has experienced shareholder dilution recently.

- Click here to discover the nuances of Kuang Hong Arts Management Incorporation with our detailed analytical dividend report.

- Our valuation report here indicates Kuang Hong Arts Management Incorporation may be undervalued.

Make It Happen

- Gain an insight into the universe of 1970 Top Dividend Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603929

L&K Engineering (Suzhou)Ltd

Provides specialized engineering technical services in China.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives