As global markets navigate a mixed start to the new year, with U.S. stocks closing out a strong 2024 despite recent economic data concerns, investors are increasingly focused on identifying resilient growth opportunities. In this context, companies with significant insider ownership often stand out as potential candidates for robust performance, as insider stakes can signal confidence in long-term prospects and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 23.8% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 110.9% |

Below we spotlight a couple of our favorites from our exclusive screener.

J&T Global Express (SEHK:1519)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: J&T Global Express Limited, with a market cap of HK$51.67 billion, is an investment holding company that provides express delivery services.

Operations: The company generates revenue from its Transportation - Air Freight segment, totaling $9.68 billion.

Insider Ownership: 18.9%

Earnings Growth Forecast: 61.4% p.a.

J&T Global Express demonstrates significant growth potential, evidenced by its recent surge in parcel volumes and a strategic share repurchase program aimed at enhancing shareholder value. The company is trading well below its estimated fair value and is expected to achieve profitability with earnings projected to grow 61.43% annually. Despite a lower forecasted return on equity of 15.2%, revenue growth outpaces the Hong Kong market, bolstered by strong insider ownership stability without recent substantial insider trading activity.

- Unlock comprehensive insights into our analysis of J&T Global Express stock in this growth report.

- The analysis detailed in our J&T Global Express valuation report hints at an deflated share price compared to its estimated value.

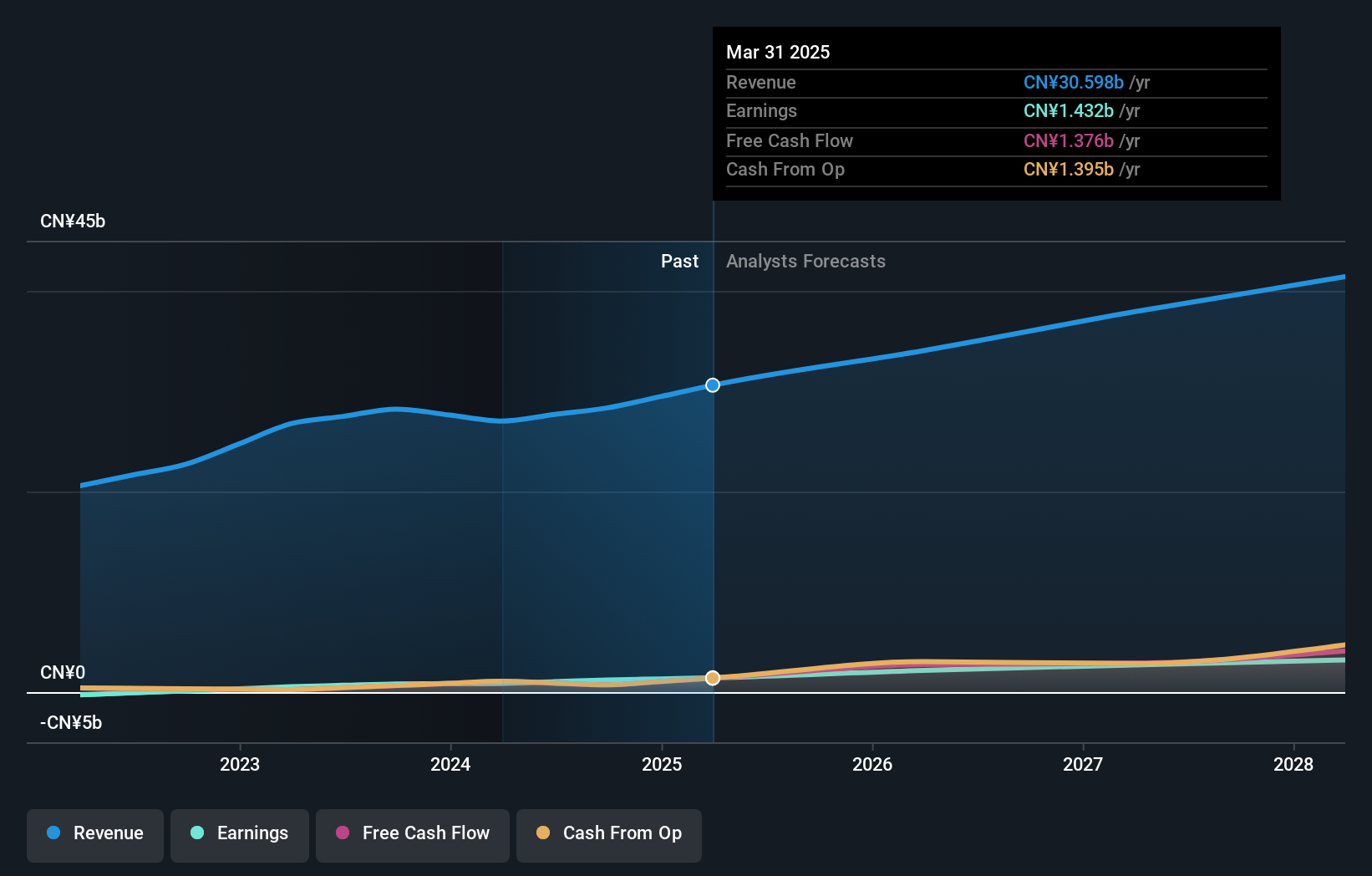

Alibaba Health Information Technology (SEHK:241)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Alibaba Health Information Technology Limited operates in pharmaceutical direct sales, e-commerce platforms, and healthcare and digital services in Mainland China and Hong Kong, with a market cap of HK$51.78 billion.

Operations: The company's revenue segments include CN¥28.34 billion from the distribution and development of pharmaceutical and healthcare business.

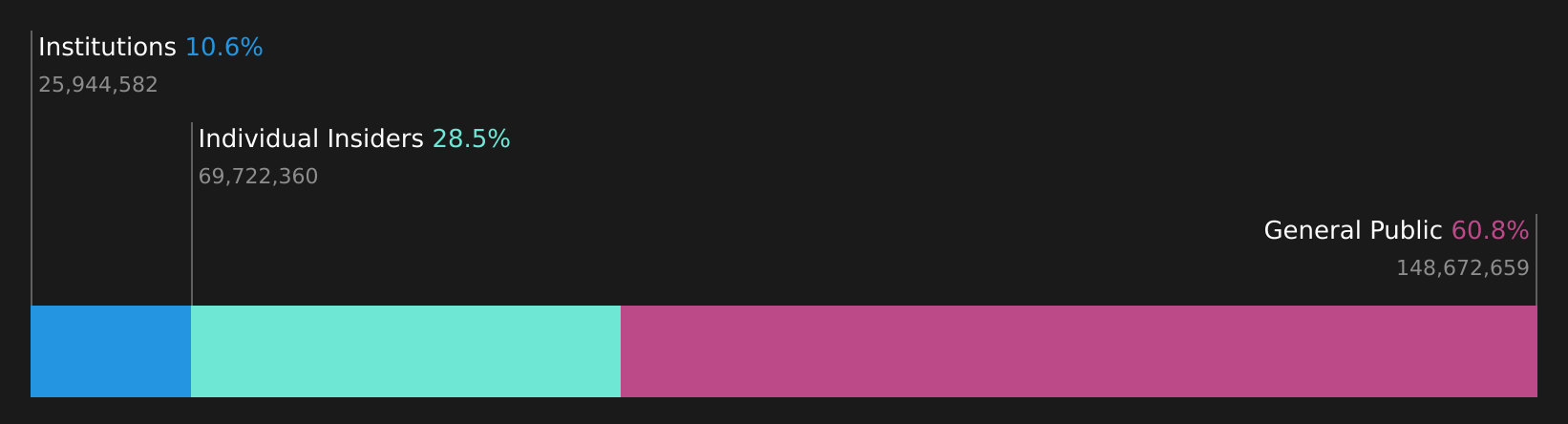

Insider Ownership: 19.3%

Earnings Growth Forecast: 21.6% p.a.

Alibaba Health Information Technology is experiencing robust earnings growth, with a 47.3% increase over the past year and forecasts indicating a significant 21.6% annual growth rate, surpassing the Hong Kong market average. Trading at a substantial discount to its estimated fair value, it offers potential value for investors despite slower revenue growth of 9.9%. Recent financial results highlight improved profitability, though impacted by large one-off items without recent substantial insider trading activity.

- Delve into the full analysis future growth report here for a deeper understanding of Alibaba Health Information Technology.

- Upon reviewing our latest valuation report, Alibaba Health Information Technology's share price might be too optimistic.

Nancal TechnologyLtd (SHSE:603859)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Nancal Technology Co., Ltd specializes in smart manufacturing and smart electrical technology products in China, with a market cap of CN¥6.85 billion.

Operations: Nancal Technology Co., Ltd's revenue is primarily derived from its smart manufacturing and smart electrical technology product segments in China.

Insider Ownership: 29.1%

Earnings Growth Forecast: 36.6% p.a.

Nancal Technology Ltd. is projected to achieve substantial earnings growth of 36.6% annually, outpacing the Chinese market's average. Despite a recent decline in earnings, it trades significantly below its estimated fair value, suggesting potential undervaluation. Revenue growth is anticipated at 24% yearly, exceeding market expectations. However, the company's share price has been highly volatile recently and lacks significant insider trading activity over the past three months.

- Take a closer look at Nancal TechnologyLtd's potential here in our earnings growth report.

- Our valuation report here indicates Nancal TechnologyLtd may be overvalued.

Make It Happen

- Investigate our full lineup of 1487 Fast Growing Companies With High Insider Ownership right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1519

J&T Global Express

An investment holding company, offers express delivery services.

Excellent balance sheet with reasonable growth potential.