There's No Escaping Zbom Home Collection Co.,Ltd's (SHSE:603801) Muted Earnings Despite A 36% Share Price Rise

Zbom Home Collection Co.,Ltd (SHSE:603801) shareholders would be excited to see that the share price has had a great month, posting a 36% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 19% over that time.

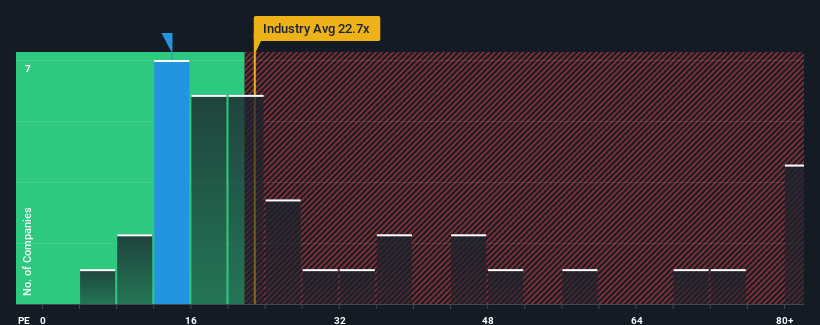

In spite of the firm bounce in price, Zbom Home CollectionLtd may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 13.9x, since almost half of all companies in China have P/E ratios greater than 33x and even P/E's higher than 61x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Recent times have been advantageous for Zbom Home CollectionLtd as its earnings have been rising faster than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Zbom Home CollectionLtd

Is There Any Growth For Zbom Home CollectionLtd?

The only time you'd be truly comfortable seeing a P/E as depressed as Zbom Home CollectionLtd's is when the company's growth is on track to lag the market decidedly.

If we review the last year of earnings growth, the company posted a worthy increase of 7.6%. The latest three year period has also seen a 23% overall rise in EPS, aided somewhat by its short-term performance. So we can start by confirming that the company has actually done a good job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 11% per year as estimated by the analysts watching the company. That's shaping up to be materially lower than the 26% per year growth forecast for the broader market.

With this information, we can see why Zbom Home CollectionLtd is trading at a P/E lower than the market. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

Shares in Zbom Home CollectionLtd are going to need a lot more upward momentum to get the company's P/E out of its slump. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Zbom Home CollectionLtd's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Zbom Home CollectionLtd (of which 1 is a bit unpleasant!) you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Zbom Home CollectionLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603801

Zbom Home CollectionLtd

Engages in the research, development, production and sale of customized building products in China and internationally.

Very undervalued with excellent balance sheet.