- China

- /

- Electrical

- /

- SHSE:603799

Earnings growth of 0.9% over 3 years hasn't been enough to translate into positive returns for Zhejiang Huayou Cobalt (SHSE:603799) shareholders

It is a pleasure to report that the Zhejiang Huayou Cobalt Co., Ltd (SHSE:603799) is up 37% in the last quarter. But that is small recompense for the exasperating returns over three years. Tragically, the share price declined 65% in that time. Some might say the recent bounce is to be expected after such a bad drop. Perhaps the company has turned over a new leaf.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

Check out our latest analysis for Zhejiang Huayou Cobalt

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the unfortunate three years of share price decline, Zhejiang Huayou Cobalt actually saw its earnings per share (EPS) improve by 2.8% per year. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Alternatively, growth expectations may have been unreasonable in the past.

After considering the numbers, we'd posit that the the market had higher expectations of EPS growth, three years back. Looking to other metrics might better explain the share price change.

Revenue is actually up 18% over the three years, so the share price drop doesn't seem to hinge on revenue, either. It's probably worth investigating Zhejiang Huayou Cobalt further; while we may be missing something on this analysis, there might also be an opportunity.

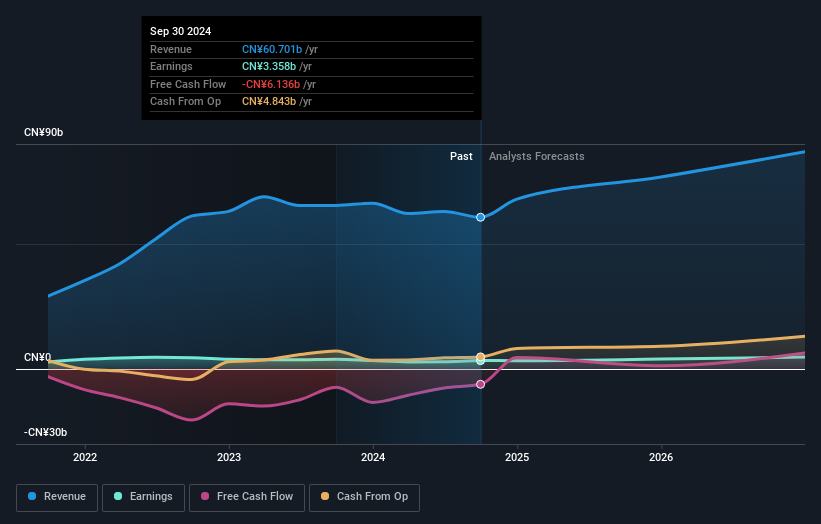

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Zhejiang Huayou Cobalt is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So it makes a lot of sense to check out what analysts think Zhejiang Huayou Cobalt will earn in the future (free analyst consensus estimates)

A Different Perspective

Zhejiang Huayou Cobalt shareholders are up 7.8% for the year (even including dividends). Unfortunately this falls short of the market return. The silver lining is that the gain was actually better than the average annual return of 3% per year over five year. This could indicate that the company is winning over new investors, as it pursues its strategy. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Zhejiang Huayou Cobalt has 2 warning signs (and 1 which shouldn't be ignored) we think you should know about.

We will like Zhejiang Huayou Cobalt better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Huayou Cobalt might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603799

Zhejiang Huayou Cobalt

Engages in the research, development, manufacture, and sale of lithium battery materials and cobalt materials in China and internationally.

Undervalued average dividend payer.