- China

- /

- Electrical

- /

- SHSE:603016

Exploring Wuxi New Hongtai Electrical TechnologyLtd Plus 2 Other Small Cap Gems With Robust Metrics

Reviewed by Simply Wall St

In the midst of a volatile global market landscape, characterized by U.S. job growth falling short of estimates and tariff uncertainties impacting investor sentiment, small-cap stocks have shown resilience despite broader index declines. As economic indicators like the ISM Manufacturing PMI signal potential recovery in manufacturing, identifying small-cap companies with robust financial metrics becomes crucial for investors seeking opportunities beyond the mainstream.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Darya-Varia Laboratoria | NA | 1.44% | -11.65% | ★★★★★★ |

| Anpec Electronics | 3.15% | 3.67% | 9.94% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Prima Andalan Mandiri | 0.94% | 20.24% | 15.28% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Central Finance | 1.16% | 10.03% | 16.10% | ★★★★★☆ |

| Vinacomin - Power Holding | 42.01% | -0.84% | 34.75% | ★★★★★☆ |

| Li Ming Development Construction | 236.64% | 31.54% | 34.00% | ★★★★☆☆ |

| Bhakti Multi Artha | 45.21% | 32.37% | -16.43% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Wuxi New Hongtai Electrical TechnologyLtd (SHSE:603016)

Simply Wall St Value Rating: ★★★★★☆

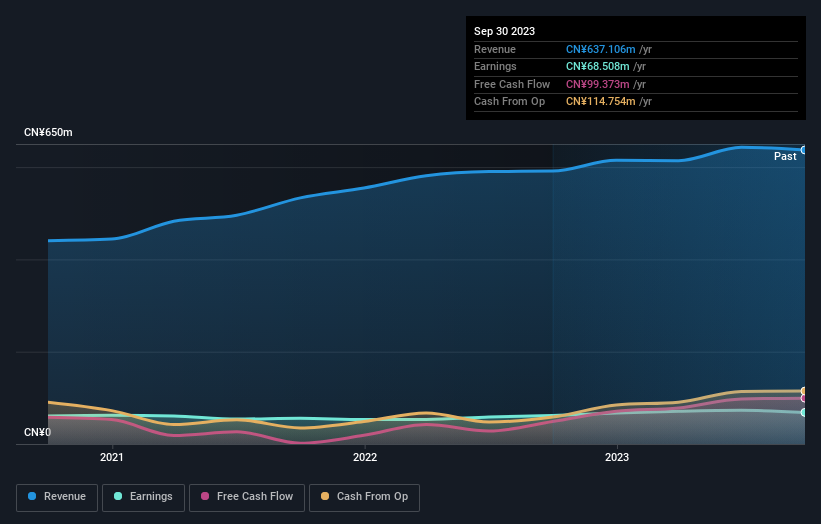

Overview: Wuxi New Hongtai Electrical Technology Co., Ltd focuses on the research, development, production, and sale of components for circuit breakers, low-voltage circuit breakers, and knife-melt switches in China with a market capitalization of CN¥5.34 billion.

Operations: Wuxi New Hongtai Electrical Technology Co., Ltd generates revenue primarily through its Transmission and Distribution and Control Equipment Manufacturing segment, which reported CN¥637.11 million. The company's market capitalization stands at CN¥5.34 billion.

Wuxi New Hongtai Electrical Technology, a promising player in the electrical sector, has seen its earnings grow by 10.8% over the past year, outpacing the industry's 1.1%. The company operates with more cash than total debt, reflecting a robust balance sheet despite a slight increase in its debt-to-equity ratio to 0.3% over five years. Trading at about 11.5% below estimated fair value suggests potential undervaluation, though recent share price volatility could be unsettling for some investors. An upcoming extraordinary shareholders meeting on December 23 may provide further insights into strategic directions and future prospects.

TKD Science and TechnologyLtd (SHSE:603738)

Simply Wall St Value Rating: ★★★★★★

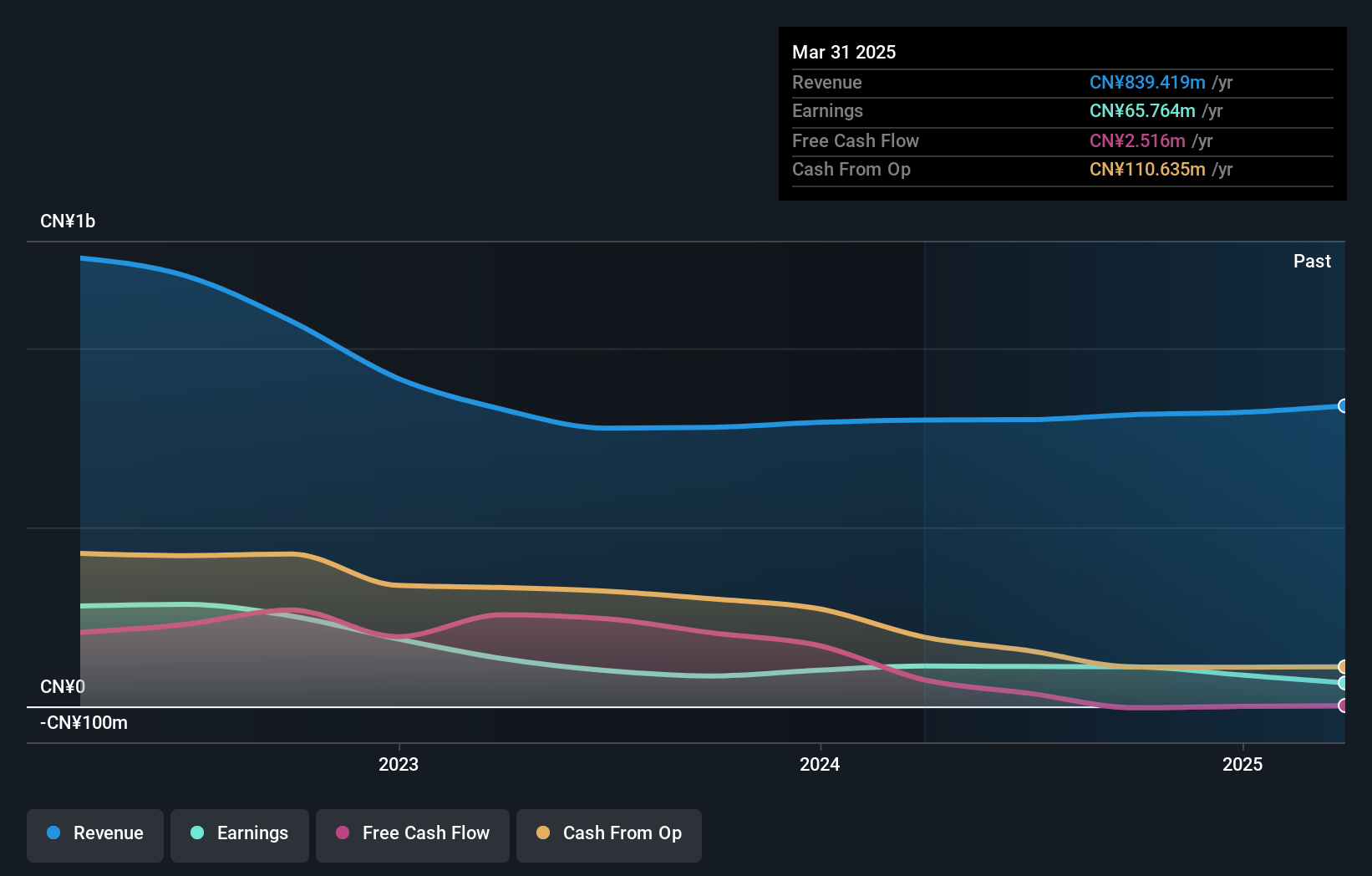

Overview: TKD Science and Technology Co., Ltd. engages in the research, development, production, and sale of quartz frequency control components and production equipment primarily in China, with a market capitalization of approximately CN¥6.11 billion.

Operations: TKD Science and Technology Ltd generates revenue through the sale of quartz frequency control components and production equipment. The company's net profit margin has shown fluctuations, reflecting changes in operational efficiency and cost management.

TKD Science and Technology Ltd. appears to be an intriguing prospect with its debt-free status, a significant improvement from five years ago when its debt to equity ratio was 24.4%. The company experienced a robust earnings growth of 30.1% over the past year, outpacing the Electrical industry average of 1.1%. However, it's important to note that recent financial results were impacted by a one-off gain of CN¥44 million. Despite not being free cash flow positive, TKD repurchased 1,387,500 shares for CN¥21.22 million recently, indicating confidence in its valuation and potential future performance.

Nishi-Nippon Financial Holdings (TSE:7189)

Simply Wall St Value Rating: ★★★★☆☆

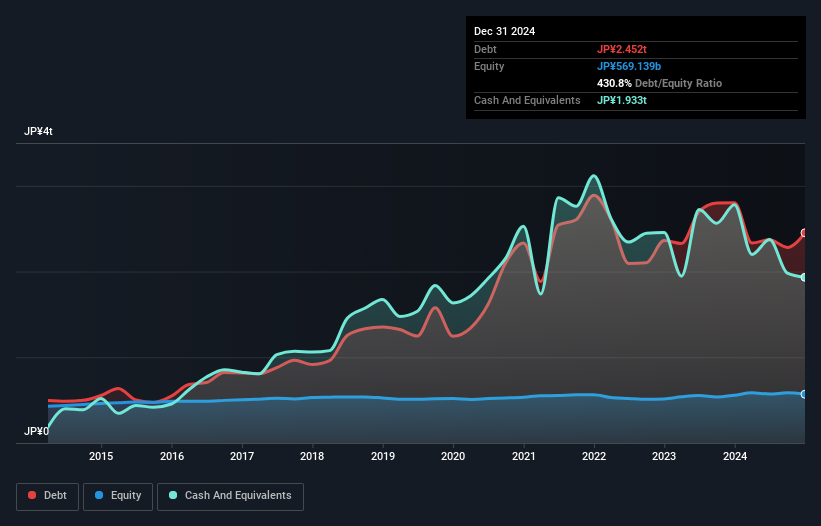

Overview: Nishi-Nippon Financial Holdings, Inc. manages and operates banks and other companies offering financial and non-financial solutions across Japan, Hong Kong, China, and Singapore with a market cap of ¥287.21 billion.

Operations: Nishi-Nippon Financial Holdings generates revenue primarily through its banking operations and financial services across multiple regions, including Japan, Hong Kong, China, and Singapore. The company focuses on managing costs to optimize profitability. It has shown a notable trend in its net profit margin over recent periods.

Nishi-Nippon Financial Holdings stands out with its robust earnings growth of 37% over the past year, surpassing the industry's 18.8%. While trading at a notable 38% below estimated fair value, it leverages primarily low-risk funding sources, with customer deposits forming 80% of liabilities. The bank's total assets are ¥13.8 trillion and equity is ¥569 billion, supporting a net interest margin of 0.8%. Despite an appropriate bad loan ratio of 1.5%, its allowance for bad loans seems insufficient at this level. Recently, the company repurchased over one million shares for ¥2 billion to enhance shareholder value.

- Navigate through the intricacies of Nishi-Nippon Financial Holdings with our comprehensive health report here.

Understand Nishi-Nippon Financial Holdings' track record by examining our Past report.

Next Steps

- Get an in-depth perspective on all 4695 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wuxi New Hongtai Electrical TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603016

Wuxi New Hongtai Electrical TechnologyLtd

Engages in the research, development, production, and sale of components of circuit breakers, low-voltage circuit breakers, and knife-melt switches in China.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives