- China

- /

- Electrical

- /

- SHSE:603728

Shanghai Moons' Electric (SHSE:603728) shareholders notch a 38% CAGR over 5 years, yet earnings have been shrinking

For many, the main point of investing in the stock market is to achieve spectacular returns. While not every stock performs well, when investors win, they can win big. To wit, the Shanghai Moons' Electric Co., Ltd. (SHSE:603728) share price has soared 400% over five years. This just goes to show the value creation that some businesses can achieve. It's also good to see the share price up 42% over the last quarter.

Since it's been a strong week for Shanghai Moons' Electric shareholders, let's have a look at trend of the longer term fundamentals.

Check out our latest analysis for Shanghai Moons' Electric

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During five years of share price growth, Shanghai Moons' Electric actually saw its EPS drop 7.6% per year.

Essentially, it doesn't seem likely that investors are focused on EPS. Because earnings per share don't seem to match up with the share price, we'll take a look at other metrics instead.

We doubt the modest 0.07% dividend yield is attracting many buyers to the stock. In contrast revenue growth of 5.6% per year is probably viewed as evidence that Shanghai Moons' Electric is growing, a real positive. It's quite possible that management are prioritizing revenue growth over EPS growth at the moment.

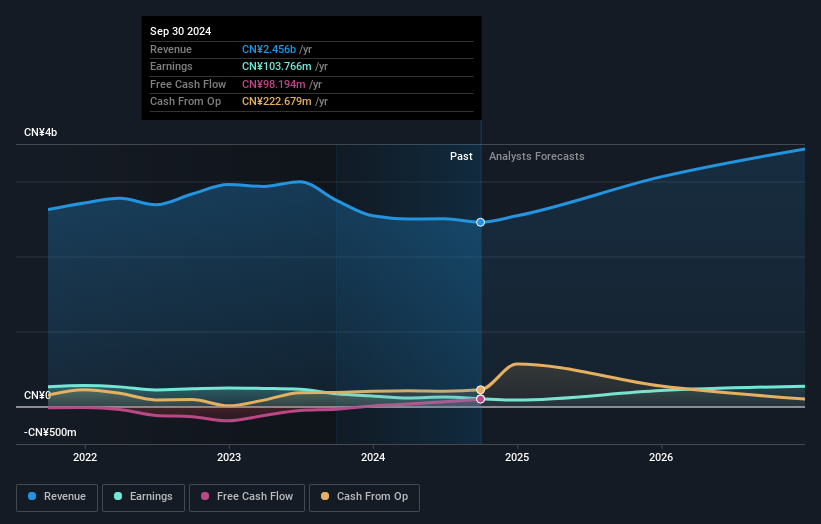

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Shanghai Moons' Electric the TSR over the last 5 years was 406%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

It's nice to see that Shanghai Moons' Electric shareholders have received a total shareholder return of 10.0% over the last year. Of course, that includes the dividend. However, that falls short of the 38% TSR per annum it has made for shareholders, each year, over five years. The pessimistic view would be that be that the stock has its best days behind it, but on the other hand the price might simply be moderating while the business itself continues to execute. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 2 warning signs for Shanghai Moons' Electric you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

If you're looking to trade Shanghai Moons' Electric, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603728

Shanghai Moons' Electric

Engages in the research and development, production, operation, and sale of motion control, LED intelligent lighting control, and industrial equipment in the Asia Pacific, the Americas, and Europe.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives