- China

- /

- Electrical

- /

- SHSE:603685

Zhejiang Chenfeng Technology Co., Ltd.'s (SHSE:603685) Revenues Are Not Doing Enough For Some Investors

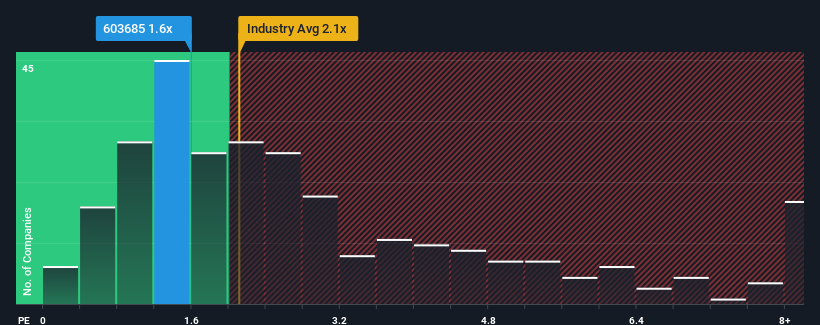

Zhejiang Chenfeng Technology Co., Ltd.'s (SHSE:603685) price-to-sales (or "P/S") ratio of 1.6x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Electrical industry in China have P/S ratios greater than 2.1x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Zhejiang Chenfeng Technology

How Has Zhejiang Chenfeng Technology Performed Recently?

Zhejiang Chenfeng Technology has been doing a good job lately as it's been growing revenue at a solid pace. Perhaps the market is expecting this acceptable revenue performance to take a dive, which has kept the P/S suppressed. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

Although there are no analyst estimates available for Zhejiang Chenfeng Technology, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Zhejiang Chenfeng Technology's Revenue Growth Trending?

In order to justify its P/S ratio, Zhejiang Chenfeng Technology would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered an exceptional 15% gain to the company's top line. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 13% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 23% shows it's an unpleasant look.

In light of this, it's understandable that Zhejiang Chenfeng Technology's P/S would sit below the majority of other companies. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

The Final Word

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Zhejiang Chenfeng Technology confirms that the company's shrinking revenue over the past medium-term is a key factor in its low price-to-sales ratio, given the industry is projected to grow. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises either. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Having said that, be aware Zhejiang Chenfeng Technology is showing 3 warning signs in our investment analysis, and 2 of those are concerning.

If these risks are making you reconsider your opinion on Zhejiang Chenfeng Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Chenfeng Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603685

Zhejiang Chenfeng Technology

Manufactures and sells lighting products in China.

Low and slightly overvalued.