Zhejiang XCC Group Co.,Ltd's (SHSE:603667) P/E Is Still On The Mark Following 32% Share Price Bounce

Zhejiang XCC Group Co.,Ltd (SHSE:603667) shareholders would be excited to see that the share price has had a great month, posting a 32% gain and recovering from prior weakness. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 4.1% in the last twelve months.

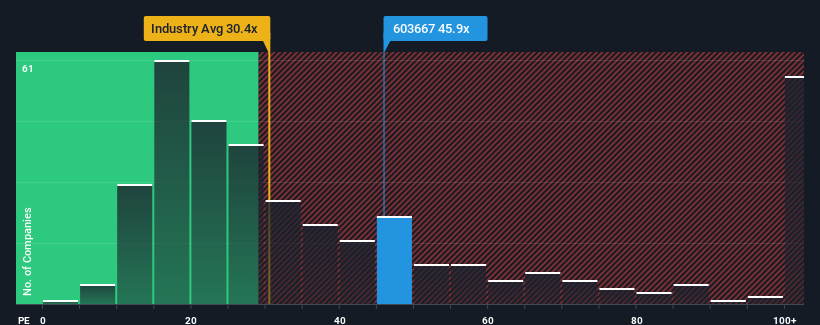

Following the firm bounce in price, given around half the companies in China have price-to-earnings ratios (or "P/E's") below 31x, you may consider Zhejiang XCC GroupLtd as a stock to potentially avoid with its 45.9x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

Zhejiang XCC GroupLtd has been struggling lately as its earnings have declined faster than most other companies. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. If not, then existing shareholders may be very nervous about the viability of the share price.

View our latest analysis for Zhejiang XCC GroupLtd

Does Growth Match The High P/E?

Zhejiang XCC GroupLtd's P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

Retrospectively, the last year delivered a frustrating 20% decrease to the company's bottom line. The last three years don't look nice either as the company has shrunk EPS by 11% in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the sole analyst covering the company suggest earnings should grow by 113% over the next year. That's shaping up to be materially higher than the 37% growth forecast for the broader market.

In light of this, it's understandable that Zhejiang XCC GroupLtd's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Zhejiang XCC GroupLtd's P/E?

Zhejiang XCC GroupLtd's P/E is getting right up there since its shares have risen strongly. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Zhejiang XCC GroupLtd's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Zhejiang XCC GroupLtd that you should be aware of.

Of course, you might also be able to find a better stock than Zhejiang XCC GroupLtd. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang XCC GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603667

Zhejiang XCC GroupLtd

Engages in the research, development, manufacture, and sale of bearings in the United States, Japan, Korea, Brazil, and internationally.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives